MetLife 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

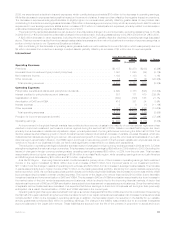

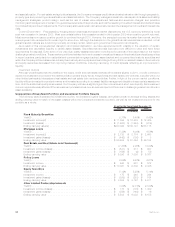

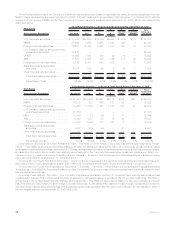

2009 2008 2007

At and for the Years Ended December 31,

(In millions)

Cash and Short-Term Investments

Yield(1).................................................. 0.44% 1.62% 4.91%

Investmentincome .......................................... $ 94 $ 307 $ 424

Investmentgains ........................................... $ 6 $ 3 $ 3

Endingcarryingvalue ........................................ $ 18,486 $ 38,085 $ 12,505

Other Invested Assets(4), (5), (6), (7)

Investmentincome .......................................... $ 339 $ 279 $ 526

Investmentgains(losses)...................................... $ (4,994) $ 4,363 $ (474)

Endingcarryingvalue ........................................ $ 12,709 $ 17,248 $ 8,076

Total Investments

Grossinvestmentincomeyield(1)................................. 4.90% 5.68% 6.88%

Investmentfeesandexpensesyield............................... (0.14) (0.16) (0.16)

Net Investment Income Yield ................................. 4.76% 5.52% 6.72%

Grossinvestmentincome...................................... $ 15,522 $ 16,660 $ 18,755

Investmentfeesandexpenses .................................. (433) (460) (427)

Net Investment Income(4) ................................... $ 15,089 $ 16,200 $ 18,328

Ending Carrying Value ...................................... $337,679 $322,518 $328,009

Grossinvestmentgains....................................... $ 1,549 $ 2,579 $ 1,386

Grossinvestmentlosses(6)..................................... (1,842) (2,084) (1,710)

Writedowns(6) ............................................. (2,845) (2,042) (140)

Subtotal................................................. $ (3,138) $ (1,547) $ (464)

Derivativesnotqualifyingforhedgeaccounting(4),(6),(7)................. (4,866) 3,422 (380)

Investment Gains (Losses)(4) ................................. $ (8,004) $ 1,875 $ (844)

Investmentgains(losses)incometaxbenefit(provision) .................. 2,876 (733) 280

Investment Gains (Losses), Net of Income Tax..................... $ (5,128) $ 1,142 $ (564)

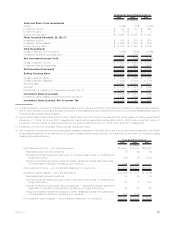

(1) Yields are based on average of quarterly average asset carrying values, excluding recognized and unrealized investment gains (losses),

and for yield calculation purposes, average of quarterly ending assets exclude collateral received from counterparties associated with the

Company’s securities lending program.

(2) Fixed maturity securities include $2,384 million, $946 million and $779 million at estimated fair value related to trading securities at

December 31, 2009, 2008 and 2007, respectively. Fixed maturity securities include $400 million, ($193) million and $50 million of

investment income related to trading securities for the years ended December 31, 2009, 2008 and 2007, respectively.

(3) Investment income from mortgage loans includes prepayment fees.

(4) Net investment income and net investment gains (losses) presented in this yield table vary from the amounts presented in the GAAP

consolidated statement of operations due to certain reclassifications made between net investment income and net investment gains

(losses) as presented below.

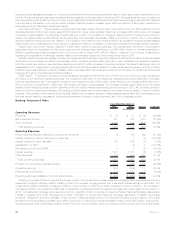

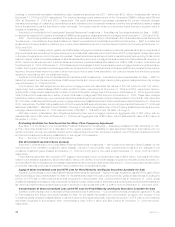

2009 2008 2007

Years Ended December 31,

(In millions)

Netinvestmentincome—peryieldtableabove.......................... $15,089 $16,200 $18,328

Realestatediscontinuedoperations................................ (7) (9) (18)

Scheduled periodic settlement payments on derivative instruments not qualifying for

hedgeaccounting .......................................... (88) (5) (253)

Hedged embedded derivatives related to certain variable annuities with guarantees

ofconsolidatedentitiesandoperatingjointventures .................... (156) 105 —

Net investment income — per consolidated statement of operations . . . . . . . . . . . . . $14,838 $16,291 $18,057

Investmentgains(losses)—peryieldtableabove ........................ $(8,004) $ 1,875 $ (844)

Realestatediscontinuedoperations................................ (8) (8) (13)

Scheduled periodic settlement payments on derivative instruments not qualifying for

hedgeaccounting .......................................... 88 5 253

Interest credited to policyholder account balances — scheduled periodic settlement

payments on derivative instruments not qualifying for hedge accounting . . . . . . . (4) 45 26

Hedged embedded derivatives related to certain variable annuities with guarantees

ofconsolidatedentitiesandoperatingjointventures .................... 156 (105) —

Net investment gains (losses) — per consolidated statement of operations . . . . . . . . $ (7,772) $ 1,812 $ (578)

33MetLife, Inc.