MetLife 2009 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

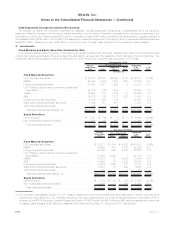

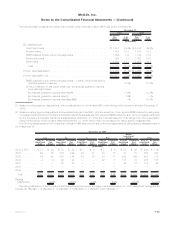

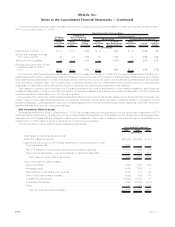

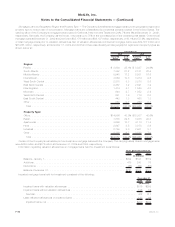

Continuous Gross Unrealized Loss and OTTI Loss for Fixed Maturity and Equity Securities Available-for-Sale by

Sector

The following tables present the estimated fair value and gross unrealized loss of the Company’s fixed maturity and equity securities in an

unrealized loss position, aggregated by sector and by length of time that the securities have been in a continuous unrealized loss position.

The unrealized loss amounts presented below at December 31, 2009 include the noncredit component of OTTI loss. Fixed maturity securities

on which a noncredit OTTI loss has been recognized in accumulated other comprehensive loss are categorized by length of time as being

“less than 12 months” or “equal to or greater than 12 months” in a continuous unrealized loss position based on the point in time that the

estimated fair value initially declined to below the amortized cost basis and not the period of time since the unrealized loss was deemed a

noncredit OTTI loss.

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Less than 12 Months Equal to or Greater

than 12 Months Total

December 31, 2009

(In millions, except number of securities)

Fixed Maturity Securities:

U.S. corporate securities . . . . . . . . . . . . . . . . . . . . . . . . . $ 8,641 $ 395 $18,004 $2,314 $26,645 $ 2,709

RMBS...................................... 5,623 119 10,268 2,438 15,891 2,557

Foreign corporate securities . . . . . . . . . . . . . . . . . . . . . . . . 3,786 139 7,282 1,096 11,068 1,235

U.S. Treasury, agency and government guaranteed securities . . 15,051 990 51 20 15,102 1,010

CMBS...................................... 2,052 29 5,435 1,095 7,487 1,124

ABS....................................... 1,259 143 5,875 1,156 7,134 1,299

Foreigngovernmentsecurities ...................... 2,318 55 507 84 2,825 139

State and political subdivision securities . . . . . . . . . . . . . . . . 2,086 94 1,843 317 3,929 411

Otherfixedmaturitysecurities ...................... 6 2 — — 6 2

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . . $40,822 $1,966 $49,265 $8,520 $90,087 $10,486

Equity Securities:

Commonstock................................ 56 7 14 1 70 8

Non-redeemable preferred stock . . . . . . . . . . . . . . . . . . . . 66 41 930 226 996 267

Totalequitysecurities .......................... $ 122 $ 48 $ 944 $ 227 $ 1,066 $ 275

Total number of securities in an unrealized loss position . . . . . . 2,210 3,333

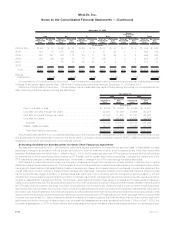

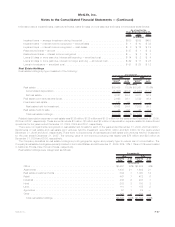

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Estimated

Fair

Value

Gross

Unrealized

Loss

Less than 12 Months Equal to or Greater

than 12 Months Total

December 31, 2008

(In millions, except number of securities)

Fixed Maturity Securities:

U.S.corporatesecurities......................... $30,076 $ 4,479 $18,011 $ 5,423 $ 48,087 $ 9,902

RMBS ..................................... 10,032 2,711 4,572 2,009 14,604 4,720

Foreign corporate securities . . . . . . . . . . . . . . . . . . . . . . . 15,634 3,157 6,609 2,527 22,243 5,684

U.S. Treasury, agency and government guaranteed

securities.................................. 106 1 — — 106 1

CMBS..................................... 9,259 1,665 3,093 1,788 12,352 3,453

ABS ...................................... 6,412 1,325 3,777 2,414 10,189 3,739

Foreigngovernmentsecurities ..................... 2,030 316 403 61 2,433 377

State and political subdivision securities . . . . . . . . . . . . . . . 2,035 405 948 537 2,983 942

Otherfixedmaturitysecurities...................... 20 3 2 — 22 3

Total fixed maturity securities . . . . . . . . . . . . . . . . . . . . . $75,604 $14,062 $37,415 $14,759 $113,019 $28,821

Equity securities ............................. $ 727 $ 306 $ 978 $ 672 $ 1,705 $ 978

Total number of securities in an unrealized loss position . . . . . 9,066 3,539

F-37MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)