MetLife 2009 Annual Report Download - page 165

Download and view the complete annual report

Please find page 165 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

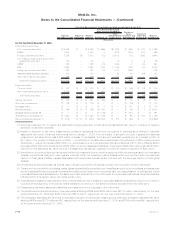

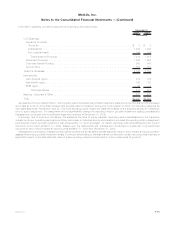

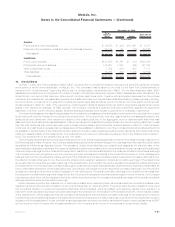

The Company’s proportional interest in separate accounts is included in the consolidated balance sheets as follows:

2009 2008

December 31,

(In millions)

Fixedmaturitysecurities...................................................... $11 $21

Equitysecurities........................................................... $57 $19

Cashandcashequivalents.................................................... $ 2 $ 3

For the years ended December 31, 2009, 2008 and 2007, there were no investment gains (losses) on transfers of assets from the general

account to the separate accounts.

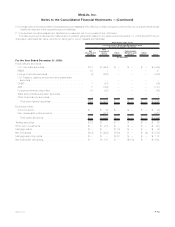

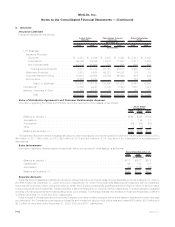

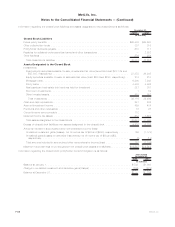

Obligations Under Funding Agreements

The Company issues fixed and floating rate funding agreements, which are denominated in either U.S. Dollars or foreign currencies, to

certain SPEs that have issued debt securities for which payment of interest and principal is secured by such funding agreements. During the

years ended December 31, 2009, 2008 and 2007, the Company issued $4.3 billion, $5.8 billion and $5.2 billion, respectively, and repaid

$7.7 billion, $8.3 billion and $4.3 billion, respectively, of such funding agreements. At December 31, 2009 and 2008, funding agreements

outstanding, which are included in policyholder account balances, were $19.3 billion and $21.6 billion, respectively. During the years ended

December 31, 2009, 2008 and 2007, interest credited on the funding agreements, which are included in interest credited to policyholder

account balances, was $0.6 billion, $1.0 billion and $1.1 billion, respectively.

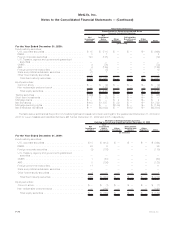

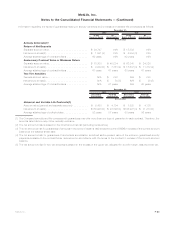

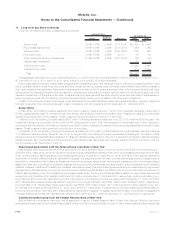

MetLife Insurance Company of Connecticut (“MICC”) is a member of the FHLB of Boston and holds $70 million of common stock of the

FHLB of Boston at both December 31, 2009 and 2008, which is included in equity securities. MICC has also entered into funding agreements

with the FHLB of Boston whereby MICC has issued such funding agreements in exchange for cash and for which the FHLB of Boston has

been granted a blanket lien on certain MICC assets, including RMBS, to collateralize MICC’s obligations under the funding agreements. MICC

maintains control over these pledged assets, and may use, commingle, encumber or dispose of any portion of the collateral as long as there is

no event of default and the remaining qualified collateral is sufficient to satisfy the collateral maintenance level. Upon any event of default by

MICC, the FHLB of Boston’s recovery on the collateral is limited to the amount of MICC’s liability to the FHLB of Boston. The amount of MICC’s

liability for funding agreements with the FHLB of Boston was $326 million and $526 million at December 31, 2009 and 2008, respectively,

which is included in policyholder account balances. In addition, at December 31, 2008, MICC had advances of $300 million from the FHLB of

Boston with original maturities of less than one year and therefore, such advances are included in short-term debt. There were no such

advances at December 31, 2009. These advances and the advances on these funding agreements are collateralized by mortgage-backed

securities with estimated fair values of $419 million and $1,284 million at December 31, 2009 and 2008, respectively. During the years ended

December 31, 2009, 2008 and 2007, interest credited on the funding agreements, which are included in interest credited to policyholder

account balances, was $6 million, $15 million and $34 million, respectively.

MLIC is a member of the FHLB of NY and holds $742 million and $830 million of common stock of the FHLB of NY at December 31, 2009

and 2008, respectively, which is included in equity securities. MLIC has also entered into funding agreements with the FHLB of NY whereby

MLIC has issued such funding agreements in exchange for cash and for which the FHLB of NY has been granted a lien on certain MLIC assets,

including RMBS to collateralize MLIC’s obligations under the funding agreements. MLIC maintains control over these pledged assets, and

may use, commingle, encumber or dispose of any portion of the collateral as long as there is no event of default and the remaining qualified

collateral is sufficient to satisfy the collateral maintenance level. Upon any event of default by MLIC, the FHLB of NY’s recovery on the collateral

is limited to the amount of MLIC’s liability to the FHLB of NY. The amount of the Company’s liability for funding agreements with the FHLB of NY

was $13.7 billion and $15.2 billion at December 31, 2009 and 2008, respectively, which is included in policyholder account balances. The

advances on these agreements are collateralized by mortgage-backed securities with estimated fair values of $15.1 billion and $17.8 billion

at December 31, 2009 and 2008, respectively. During the years ended December 31, 2009, 2008 and 2007, interest credited on the funding

agreements, which are included in interest credited to policyholder account balances, was $333 million, $229 million and $94 million,

respectively.

The temporary contingent increase in MLIC’s borrowing capacity that was in effect on December 31, 2008 expired December 31, 2009.

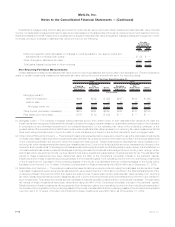

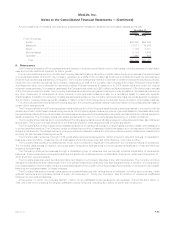

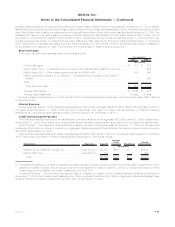

MLIC has issued funding agreements to certain SPEs that have issued debt securities for which payment of interest and principal is

secured by such funding agreements, and such debt securities are also guaranteed as to payment of interest and principal by the Farmer

MAC, a federally chartered instrumentality of the United States. The obligations under these funding agreements are secured by a pledge of

certain eligible agricultural real estate mortgage loans and may, under certain circumstances, be secured by other qualified collateral. The

amount of the Company’s liability for funding agreements issued to such trusts was $2.5 billion at both December 31, 2009 and 2008, which

is included in policyholder account balances. The obligations under these funding agreements are collateralized by designated agricultural

real estate mortgage loans with estimated fair values of $2.9 billion at both December 31, 2009 and 2008. During the years ended

December 31, 2009, 2008 and 2007, interest credited on the funding agreements, which are included in interest credited to policyholder

account balances, was $132 million, $132 million and $117 million, respectively.

F-81MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)