MetLife 2009 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

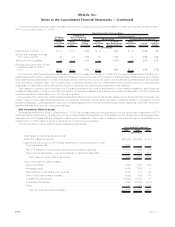

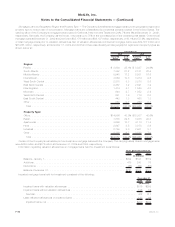

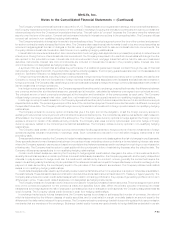

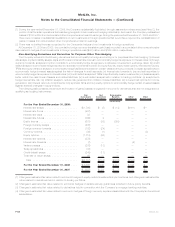

Mortgage Servicing Rights

The following table presents the carrying value and changes in capitalized MSRs, which are included in other invested assets:

2009 2008

Years Ended December 31,

(In millions)

Estimatedfairvalue,January1,.......................................... $191 $ —

AcquisitionofMSRs ................................................. 117 350

OriginationofMSRs ................................................. 511 —

Reductionsduetoloanpayments ........................................ (113) (10)

Reductionsduetosales............................................... — —

Changes in estimated fair value due to:

Changesinvaluationmodelinputsorassumptions ............................ 172 (149)

Otherchangesinestimatedfairvalue..................................... — —

Estimatedfairvalue,December31, ....................................... $878 $191

The Company recognizes the rights to service residential mortgage loans as MSRs. MSRs are either acquired or are generated from the

sale of originated residential mortgage loans where the servicing rights are retained by the Company. MSRs are carried at estimated fair value

and changes in estimated fair value, primarily due to changes in valuation inputs and assumptions and to the collection of expected cash

flows, are reported in other revenues in the period in which the change occurs. See also Note 5 for further information about how the

estimated fair value of MSRs is determined and other related information.

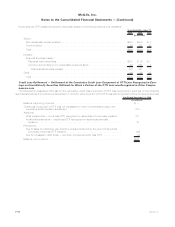

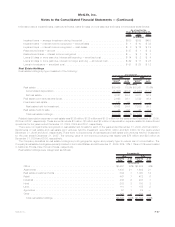

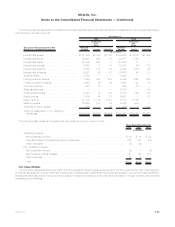

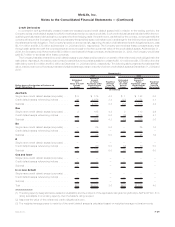

Variable Interest Entities

The Company invests in certain entities that are VIEs, as a passive investor holding a limited partnership interest, or as a sponsor or debt

holder. The following table presents the total assets and total liabilities relating to VIEs for which the Company has concluded that it is the

primary beneficiary and which are consolidated in the Company’s financial statements at December 31, 2009 and 2008. Generally, creditors

or beneficial interest holders of VIEs where the Company is the primary beneficiary have no recourse to the general credit of the Company, as

the Company’s obligation to the VIEs is limited to the amount of its committed investment.

Total

Assets Total

Liabilities Total

Assets Tot al

Liabilities

2009 2008

December 31,

(In millions)

MRSCcollateralfinancingarrangement(1)........................ $3,230 $— $2,361 $—

Otherlimitedpartnershipinterests............................. 367 72 20 3

Otherinvestedassets .................................... 27 1 10 3

Realestatejointventures .................................. 22 17 26 15

Total................................................ $3,646 $90 $2,417 $21

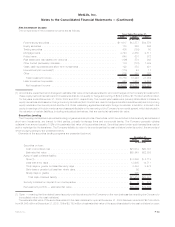

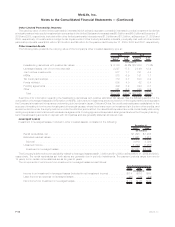

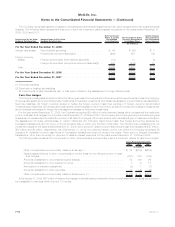

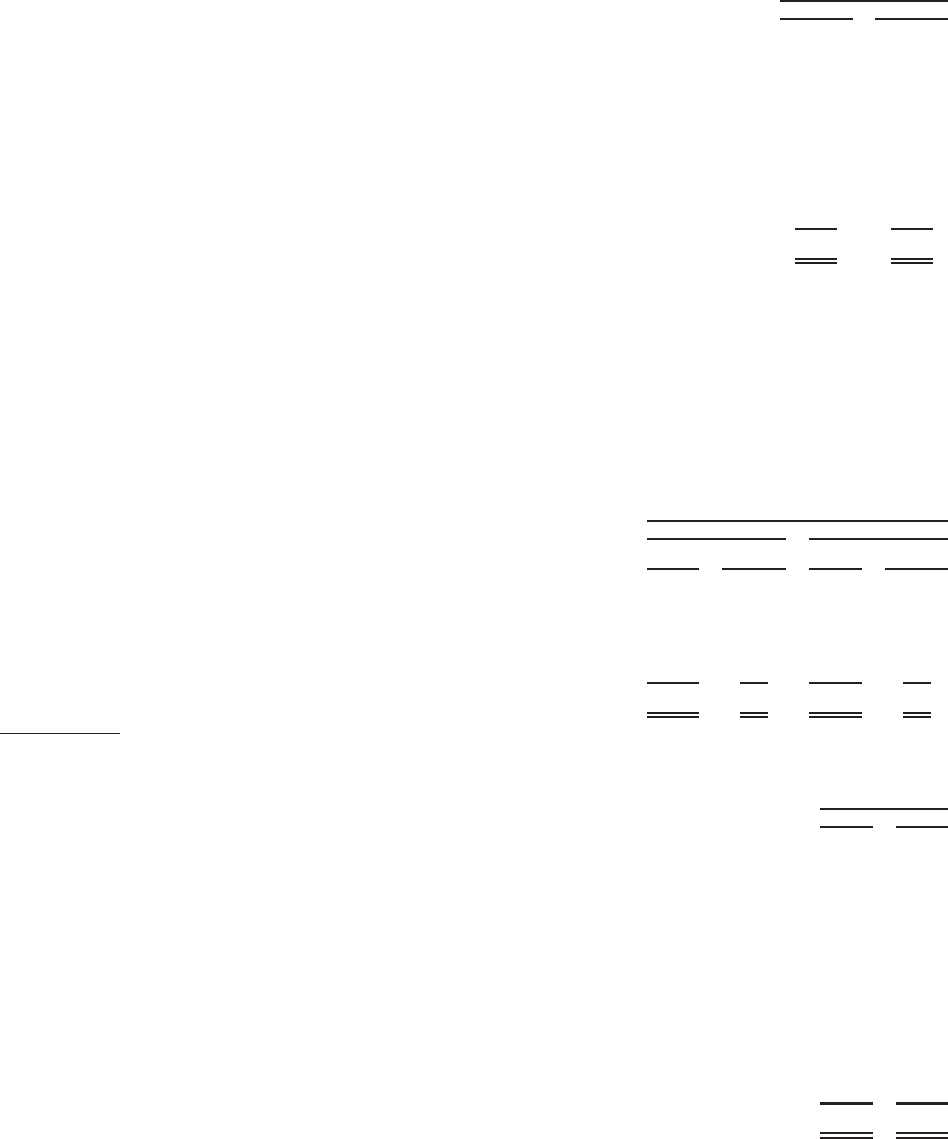

(1) See Note 12 for a description of the MetLife Reinsurance Company of South Carolina (“MRSC”) collateral financing arrangement. At

December 31, 2009 and 2008, these assets are presented at estimated fair value and consist of the following:

2009 2008

December 31,

(In millions)

Fixed maturity securities available-for-sale:

U.S.corporatesecurities ................................................ $1,049 $ 948

ABS.............................................................. 963 409

RMBS............................................................. 672 561

CMBS ............................................................ 348 98

Foreigncorporatesecurities .............................................. 80 95

U.S.Treasury,agencyandgovernmentguaranteedsecurities......................... 33 —

Stateandpoliticalsubdivisionsecurities ...................................... 21 21

Foreigngovernmentsecurities............................................. 5 5

Cash and cash equivalents (including cash held in trust of less than $1 million and $60 million,

respectively) ........................................................ 59 224

Total............................................................... $3,230 $2,361

F-49MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)