MetLife 2009 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Effective January 1, 2007, the Company adopted new guidance on income taxes. This guidance clarifies the accounting for uncertainty in

income tax recognized in a company’s financial statements. It requires companies to determine whether it is “more likely than not” that a tax

position will be sustained upon examination by the appropriate taxing authorities before any part of the benefit can be recorded in the financial

statements. It also provides guidance on the recognition, measurement and classification of income tax uncertainties, along with any related

interest and penalties. Previously recorded income tax benefits that no longer meet this standard are required to be charged to earnings in the

period that such determination is made. As a result of the implementation, the Company recognized a $35 million increase in the liability for

unrecognized tax benefits and a $9 million decrease in the interest liability for unrecognized tax benefits, as well as a $17 million increase in

the liability for unrecognized tax benefits and a $5 million increase in the interest liability for unrecognized tax benefits which are included in

liabilities of subsidiaries held-for-sale. The corresponding reduction to the January 1, 2007 balance of retained earnings was $37 million, net

of $11 million of noncontrolling interests.

Effective January 1, 2007, the Company adopted new guidance on accounting by insurance enterprises for DAC on internal replacements

of insurance and investment contracts other than those specifically described in guidance relating to accounting and reporting by insurance

enterprises for long-duration contracts and for realized gains and losses from the sale of investments. As a result of the adoption of the new

guidance, if an internal replacement modification substantially changes a contract, then the DAC is written off immediately through income

and any new deferrable costs associated with the new replacement are deferred. If a contract modification does not substantially change the

contract, the DAC amortization on the original contract will continue and any acquisition costs associated with the related modification are

immediately expensed. The adoption of this guidance resulted in a reduction to DAC and VOBA on January 1, 2007 and an acceleration of the

amortization period relating primarily to the Company’s group life and health insurance contracts that contain certain rate reset provisions.

Prior to the adoption, DAC on such contracts was amortized over the expected renewable life of the contract. Upon adoption, DAC on such

contracts is to be amortized over the rate reset period. The impact as of January 1, 2007 was a cumulative effect adjustment of $292 million,

net of income tax of $161 million, which was recorded as a reduction to retained earnings.

The following new pronouncements had no material impact on the Company’s consolidated financial statements:

• Effective January 1, 2009, the Company adopted guidance on determining whether an instrument (or embedded feature) is indexed to

an entity’s own stock. This guidance provides a framework for evaluating the terms of a particular instrument and whether such terms

qualify the instrument as being indexed to an entity’s own stock.

• Effective January 1, 2008, the Company adopted new guidance on written loan commitments recorded at fair value through earnings. It

provides guidance on (i) incorporating expected net future cash flows when related to the associated servicing of a loan when

measuring fair value; and (ii) broadening the SEC staff’s view that internally-developed intangible assets should not be recorded as part

ofthefairvalueofaderivativeloancommitmentortowrittenloancommitmentsthatareaccountedforatfairvaluethroughearnings.

Internally-developed intangible assets are not considered a component of the related instruments.

• Effective January 1, 2008, the Company prospectively adopted new guidance on the sale of real estate when the agreement includes a

buy-sell clause. This guidance addresses whether the existence of a buy-sell arrangement would preclude partial sales treatment when

real estate is sold to a jointly owned entity and concludes that the existence of a buy-sell clause does not necessarily preclude partial

sale treatment under current guidance.

Future Adoption of New Accounting Pronouncements

In January 2010, the FASB issued new guidance that requires new disclosures about significant transfers in and/or out of Levels 1 and 2 of

the fair value hierarchy and activity in Level 3 (Accounting Standards Update (“ASU”) 2010-06, Fair Value Measurements and Disclosures

(Topic 820): Improving Disclosures about Fair Value Measurements). In addition, this guidance provides clarification of existing disclosure

requirements about (a) level of disaggregation and (b) inputs and valuation techniques. The update is effective for the first quarter of 2010. The

Company is currently evaluating the impact of this guidance on its consolidated financial statements.

In June 2009, the FASB issued additional guidance related to financial instrument transfers (ASU 2009-16, Transfers and Servicing (Topic

860): Accounting for Transfers of Financial Assets) and evaluation of VIEs for consolidation (ASU 2009-17, Consolidations (Topic 810):

Improvements to Financial Reporting by Enterprises Involved with Variable Interest Entities). The guidance is effective for the first quarter of

2010:

• The financial instrument transfer guidance eliminates the concept of a “QSPE,” eliminates the guaranteed mortgage securitization

exception, changes the criteria for achieving sale accounting when transferring a financial asset and changes the initial recognition of

retained beneficial interests. The guidance also requires additional disclosures about transfers of financial assets, including securitized

transactions, as well as a company’s continuing involvement in transferred financial assets. The Company does not expect the adoption

of the new guidance to have a material impact on the Company’s consolidated financial statements.

• The consolidation guidance relating to VIEs changes the determination of the primary beneficiary of a VIE from a quantitative model to a

qualitative model. Under the new qualitative model, the primary beneficiary must have both the ability to direct the activities of the VIE

and the obligation to absorb either losses or gains that could be significant to the VIE. The guidance also changes when reassessment is

needed, as well as requires enhanced disclosures, including the effects of a company’s involvement with VIEs on its financial

statements. The Company does not expect the adoption of the new guidance to have a material impact on the Company’s consolidated

financial statements.

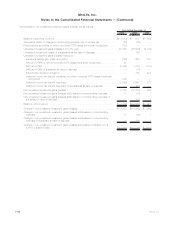

2. Acquisitions and Dispositions

2009 Disposition

On March 2, 2009, the Company sold Cova Corporation (“Cova”), the parent company of Texas Life Insurance Company (“Texas Life”) to a

third-party for $130 million in cash consideration, excluding $1 million of transaction costs. The net assets sold were $101 million, resulting in

a gain on disposal of $28 million, net of income tax. The Company also reclassified $4 million, net of income tax, of the 2009 operations of

F-26 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)