MetLife 2009 Annual Report Download - page 61

Download and view the complete annual report

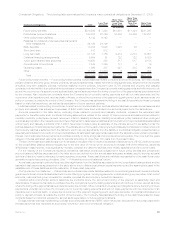

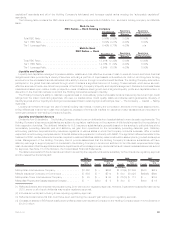

Please find page 61 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.mortgage-backed securities. We continuously monitor and adjust our liquidity and capital plans for the Holding Company and its subsidiaries

in light of changing needs and opportunities.

The Company

Liquidity

Liquidity refers to a company’s ability to generate adequate amounts of cash to meet its needs. Liquidity needs are determined from a

rolling 6-month forecast by portfolio and are monitored daily. Asset mix and maturities are adjusted based on the forecast. Cash flow testing

and stress testing provide additional perspectives on liquidity, which include various scenarios of the potential risk of early contractholder and

policyholder withdrawal. We believe that the Company has ample liquidity and capital resources to meet business requirements under current

market conditions and unlikely but reasonably possible stress scenarios under current market conditions. The Company includes provisions

limiting withdrawal rights on many of its products, including general account institutional pension products (generally group annuities,

including funding agreements, and certain deposit fund liabilities) sold to employee benefit plan sponsors. Certain of these provisions prevent

the customer from making withdrawals prior to the maturity date of the product.

In the event of significant cash requirements beyond anticipated liquidity needs, the Company has various alternatives available

depending on market conditions and the amount and timing of the liquidity need. These options include cash flows from operations, the

sale of liquid assets, global funding sources and various credit facilities.

Under certain stressful market and economic conditions, liquidity may deteriorate broadly which could negatively impact the Company. If

the Company requires significant amounts of cash on short notice in excess of anticipated cash requirements, the Company may have

difficulty selling investment assets in a timely manner, be forced to sell them for less than the Company otherwise would have been able to

realize, or both. In addition, in the event of such forced sale, accounting rules require the recognition of a loss for certain securities in an

unrealized loss position and may require the impairment of other securities based upon the Company’s ability to hold such securities, which

may negatively impact the Company’s financial condition. A disruption in the financial markets could limit the Company’s access to, or cost of,

liquidity.

In extreme circumstances, all general account assets — other than those which may have been pledged to a specific purpose — within a

statutory legal entity are available to fund obligations of the general account within that legal entity.

Capital

Capital reflects the financial strength of the Company and its ability to generate strong cash flows at the operating companies, borrow

funds at competitive rates and raise additional capital to meet operating and growth needs.

While the Company raised new capital from its debt issuances during the difficult market conditions prevailing since the second half of

2008 (see “— The Company — Liquidity and Capital Sources — Debt Issuances and Other Borrowings”), the increase in credit spreads

experienced since then has resulted in an increase in the cost of such new capital. As a result of reductions in interest rates, the Company’s

interest expense and dividends on floating rate securities have been lower; however, the increase in the Company’s credit spreads since the

second half of 2008 has caused the Company’s credit facility fees to increase.

The Company manages its capital structure to maintain a level of capital needed for “AA” financial strength ratings. However, we believe

that the rating agencies have recently heightened the level of scrutiny that they apply to life insurance companies and are considering several

other factors, in addition to the level of capital, in assigning financial strength ratings. The rating agencies may also adjust upward the capital

and other requirements employed in their models for maintenance of certain ratings levels.

Statutory Capital and Dividends. Our insurance subsidiaries have statutory surplus well above levels to meet current regulatory

requirements.

RBC requirements are used as minimum capital requirements by the NAIC and the state insurance departments to identify companies that

merit regulatory action. RBC is based on a formula calculated by applying factors to various asset, premium and statutory reserve items. The

formula takes into account the risk characteristics of the insurer, including asset risk, insurance risk, interest rate risk and business risk and is

calculated on an annual basis. The formula is used as an early warning regulatory tool to identify possible inadequately capitalized insurers for

purposes of initiating regulatory action, and not as a means to rank insurers generally. These rules apply to each of the Holding Company’s

domestic insurance subsidiaries. State insurance laws provide insurance regulators the authority to require various actions by, or take various

actions against, insurers whose total adjusted capital does not meet or exceed certain RBC levels. At the date of the most recent annual

statutory financial statements filed with insurance regulators, the total adjusted capital of each of these subsidiaries was in excess of each of

those RBC levels.

The amount of dividends that our insurance subsidiaries can pay to the Holding Company or other parent entities is constrained by the

amount of surplus we hold to maintain our ratings and provide an additional margin for risk protection and invest in our businesses. We

proactively take actions to maintain capital consistent with these ratings objectives, which may include adjusting dividend amounts and

deploying financial resources from internal or external sources of capital. Certain of these activities may require regulatory approval.

Rating Agencies. Rating agencies assign insurer financial strength ratings to the Company’s domestic life insurance subsidiaries and

credit ratings to the Holding Company and certain of its subsidiaries. The level and composition of our regulatory capital at the subsidiary level

and equity capital of the Company are among the many factors considered in determining the Company’s insurer financial strength and credit

ratings. Each agency has its own capital adequacy evaluation methodology, and assessments are generally based on a combination of

factors. We believe that the rating agencies have recently heightened the level of scrutiny that they apply to insurance companies, and that

they may increase the frequency and scope of their credit reviews, may request additional information from the companies that they rate, and

may adjust upward the capital and other requirements employed in the rating agency models for maintenance of certain ratings levels.

The Company’s financial strength ratings for its domestic life insurance companies are “AA-/Aa3/AA-/A+” for S&P, Moody’s, Fitch, and

A.M. Best, respectively. The Company’s long-term senior debt credit ratings are “A-/A3/A-/a-” for S&P, Moody’s, Fitch, and A.M. Best,

respectively. The Company’s ratings outlooks are “CreditWatch negative/stable/stable/Under Review with negative implications” for S&P,

Moody’s, Fitch, and A.M. Best, respectively. For further discussion, see “Business — Company Ratings.”

A downgrade in the credit or financial strength (i.e., claims-paying) ratings of the Company or its subsidiaries would likely impact the cost

and availability of financing for the Company and its subsidiaries and result in additional collateral requirements or other required payments

55MetLife, Inc.