MetLife 2009 Annual Report Download - page 125

Download and view the complete annual report

Please find page 125 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

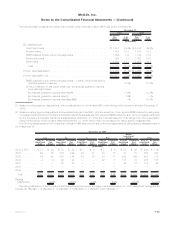

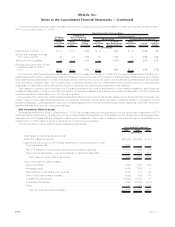

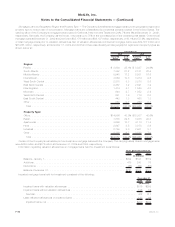

Proceeds from sales or disposals of fixed maturity and equity securities and the components of fixed maturity and equity securities net

investment gains (losses) are as follows:

2009 2008 2007 2009 2008 2007 2009 2008 2007

Years Ended December 31, Years Ended December 31, Years Ended December 31,

Fixed Maturity Securities Equity Securities Total

(In millions)

Proceeds . . . . . . . . . . . . . . . . . . . $38,972 $62,495 $78,001 $ 950 $2,107 $1,112 $39,922 $64,602 $79,113

Gross investment gains . . . . . . . . . . 947 858 554 134 440 226 1,081 1,298 780

Gross investment losses . . . . . . . . . (1,110) (1,515) (1,091) (133) (263) (43) (1,243) (1,778) (1,134)

Total OTTI losses recognized in

earnings:

Credit-related . . . . . . . . . . . . . . . (1,137) (1,138) (58) — — — (1,137) (1,138) (58)

Other(1) . . . . . . . . . . . . . . . . . . (363) (158) (20) (400) (430) (19) (763) (588) (39)

Total OTTI losses recognized in

earnings . . . . . . . . . . . . . . . . . (1,500) (1,296) (78) (400) (430) (19) (1,900) (1,726) (97)

Net investment gains (losses) . . . . . . $ (1,663) $ (1,953) $ (615) $(399) $ (253) $ 164 $ (2,062) $ (2,206) $ (451)

(1) Other OTTI losses recognized in earnings include impairments on equity securities, impairments on perpetual hybrid securities classified

within fixed maturity securities where the primary reason for the impairment was the severity and/or the duration of an unrealized loss

position and fixed maturity securities where there is an intent to sell or it is more likely than not that the Company will be required to sell the

security before recovery of the decline in estimated fair value.

The Company periodically disposes of fixed maturity and equity securities at a loss. Generally, such losses are insignificant in amount or in

relation to the cost basis of the investment, are attributable to declines in estimated fair value occurring in the period of the disposition or are

as a result of management’s decision to sell securities based on current conditions, or the Company’s need to shift the portfolio to maintain its

portfolio management objectives. Investment gains and losses on sales of securities are determined on a specific identification basis.

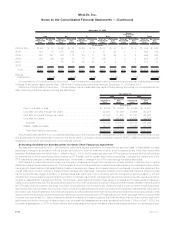

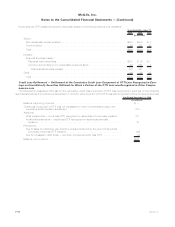

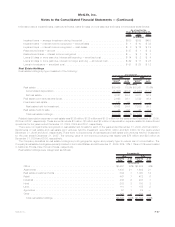

Fixed maturity security OTTI losses recognized in earnings relates to the following sectors and industries:

2009 2008 2007

Years Ended December 31,

(In millions)

U.S. and foreign corporate securities:

Finance....................................................... $ 459 $ 673 $18

Communications................................................. 235 134 —

Consumer ..................................................... 211 107 —

Utility ........................................................ 89 5 1

Industrial ...................................................... 30 26 18

Other ........................................................ 26 185 28

TotalU.S.andforeigncorporatesecurities............................... 1,050 1,130 65

RMBS........................................................ 193 — —

ABS ......................................................... 168 99 13

CMBS........................................................ 88 65 —

Foreigngovernmentsecurities ........................................ 1 2 —

Total ....................................................... $1,500 $1,296 $78

F-41MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)