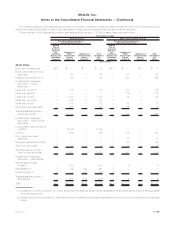

MetLife 2009 Annual Report Download - page 191

Download and view the complete annual report

Please find page 191 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

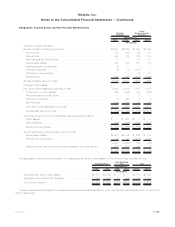

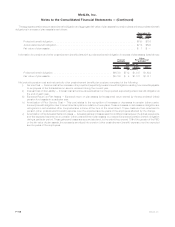

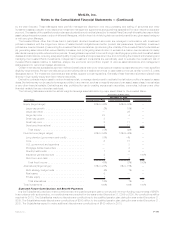

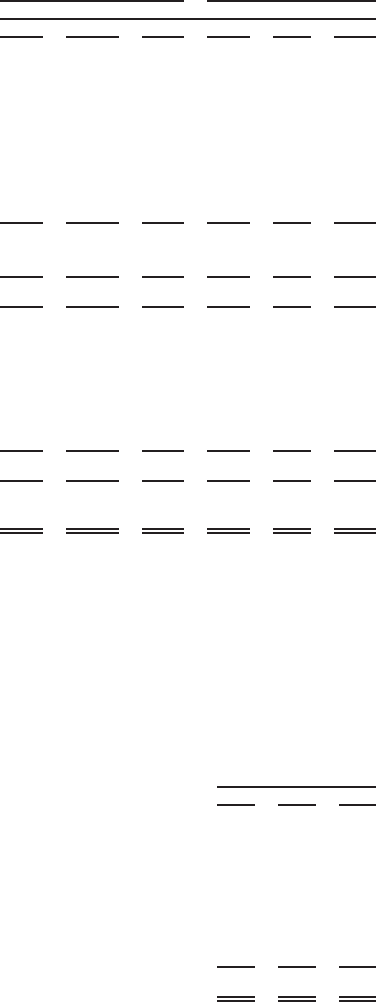

The components of net periodic benefit cost and other changes in plan assets and benefit obligations recognized in other comprehensive

income (loss) were as follows:

2009 2008 2007 2009 2008 2007

Years Ended December 31,

Pension

Benefits

Other

Postretirement

Benefits

(In millions)

Net Periodic Benefit Cost

Servicecost................................... $170 $ 164 $162 $ 22 $ 21 $ 27

Interestcost................................... 395 379 351 125 103 103

Settlementandcurtailmentcost...................... 17 — — — — —

Expectedreturnonplanassets ...................... (439) (517) (505) (72) (86) (86)

Amortizationofnetactuarial(gains)losses ............... 227 24 68 42 (1) —

Amortizationofpriorservicecost(credit) ................ 10 15 17 (36) (37) (36)

Netperiodicbenefitcost ......................... 380 65 93 81 — 8

Net periodic benefit cost of subsidiary held-for-sale . . . . . . . . — 1 5 — — 1

380 66 98 81 — 9

Other Changes in Plan Assets and Benefit Obligations

Recognized in Other Comprehensive Income (Loss)

Netactuarial(gains)losses ......................... 310 1,561 (432) 283 259 (440)

Priorservicecost(credit) .......................... (10) (19) 40 (167) 36 —

Amortizationofnetactuarial(gains)losses ............... (227) (24) (68) (42) 1 —

Amortizationofpriorservicecost(credit) ................ (10) (15) (17) 36 37 36

Total recognized in other comprehensive income (loss) . . . . . . 63 1,503 (477) 110 333 (404)

Total recognized in net periodic benefit cost and other

comprehensive income (loss) . . . . . . . . . . . . . . . . . . . . . $ 443 $1,569 $(379) $ 191 $333 $(395)

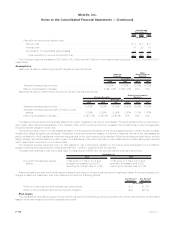

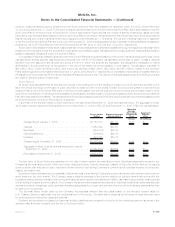

Included within other comprehensive income (loss) are other changes in plan assets and benefit obligations associated with pension

benefits of $63 million and other postretirement benefits of $110 million for an aggregate reduction in other comprehensive income (loss) of

$173 million before income tax and $102 million, net of income tax and noncontrolling interests.

The estimated net actuarial losses and prior service cost for the pension plans that will be amortized from accumulated other compre-

hensive income (loss) into net periodic benefit cost over the next year are $203 million and $7 million, respectively.

The estimated net actuarial losses and prior service credit for the defined benefit other postretirement benefit plans that will be amortized

from accumulated other comprehensive income (loss) into net periodic benefit cost over the next year are $38 million and ($83) million,

respectively.

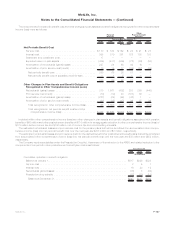

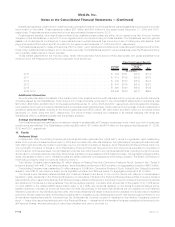

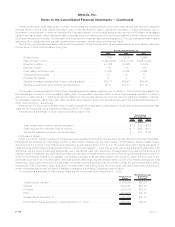

The Company receives subsidies under the Prescription Drug Act. A summary of the reduction to the APBO and related reduction to the

components of net periodic other postretirement benefit plan cost is as follows:

2009 2008 2007

December 31,

(In millions)

Cumulative reduction in benefit obligation:

BalanceatJanuary1,................................................ $317 $299 $328

Servicecost...................................................... 2 5 7

Interestcost...................................................... 16 20 19

Netactuarialgains(losses) ............................................ (76) 3 (42)

Prescriptiondrugsubsidy ............................................. (12) (10) (13)

BalanceatDecember31,............................................ $247 $317 $299

F-107MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)