MetLife 2009 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

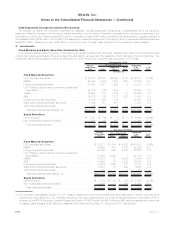

(2) At time of acquisition, the Company classifies perpetual securities that have attributes of both debt and equity as fixed maturity securities if

the security has a punitive interest rate step-up feature, as it believes in most instances this feature will compel the issuer to redeem the

security at the specified call date. Perpetual securities that do not have a punitive interest rate step-up feature are classified as equity

securities within non-redeemable preferred stock. Many of such securities have been issued by non-U.S. financial institutions that are

accorded Tier 1 and Upper Tier 2 capital treatment by their respective regulatory bodies and are commonly referred to as “perpetual hybrid

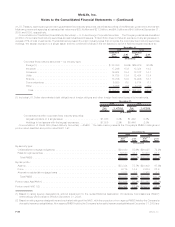

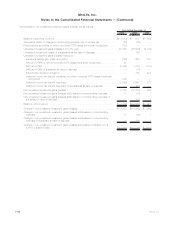

securities.” The following table presents the perpetual hybrid securities held by the Company at:

Consolidated Balance Sheets Sector Table Primary Issuers

Estimated

Fair

Value

Estimated

Fair

Value

Classification

2009 2008

December 31,

(In millions)

Equity securities Non-redeemable preferred stock Non-U.S. financial institutions $ 988 $1,224

Equity securities Non-redeemable preferred stock U.S. financial institutions $ 349 $ 288

Fixed maturity securities Foreign corporate securities Non-U.S. financial institutions $2,626 $2,110

Fixed maturity securities U.S. corporate securities U.S. financial institutions $ 91 $ 46

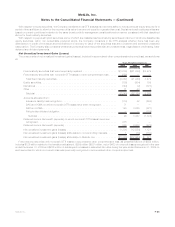

(3) The Company held $2.5 billion and $2.1 billion at estimated fair value of redeemable preferred stock which have stated maturity dates at

December 31, 2009 and 2008, respectively. These securities, commonly referred to as “capital securities”, are primarily issued by U.S.

financial institutions, have cumulative interest deferral features and are included in the U.S. corporate securities sector within fixed

maturity securities.

(4) Equity securities primarily consist of investments in common and preferred stocks, including certain perpetual hybrid securities and

mutual fund interests. Privately-held equity securities represented $1.0 billion and $1.1 billion at estimated fair value at December 31,

2009 and 2008, respectively.

The Company held foreign currency derivatives with notional amounts of $9.1 billion to hedge the exchange rate risk associated with

foreign denominated fixed maturity securities at both December 31, 2009 and December 31, 2008.

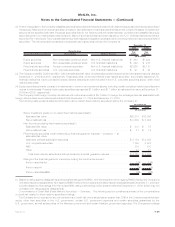

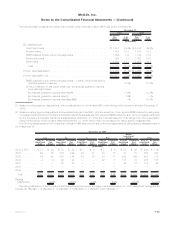

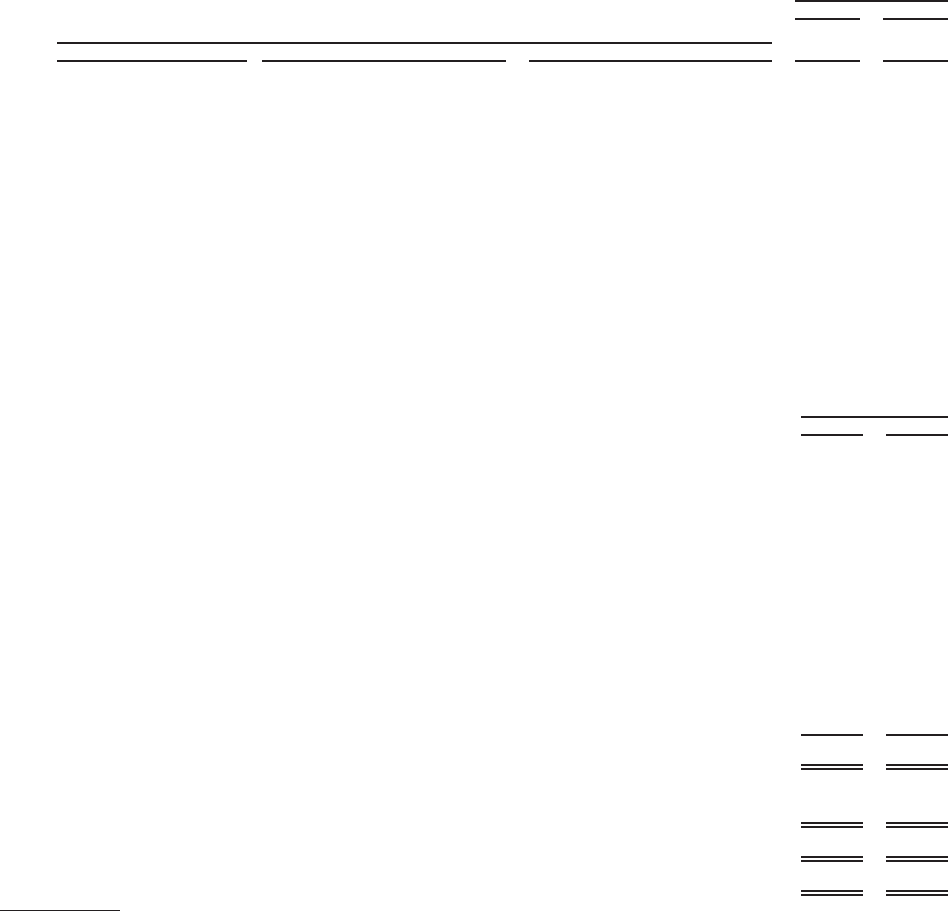

The following table presents selected information about certain fixed maturity securities held by the Company at:

2009 2008

December 31,

(In millions)

Below investment grade or non-rated fixed maturity securities(1):

Estimatedfairvalue .................................................. $20,201 $12,365

Netunrealizedloss .................................................. $ 2,609 $ 5,094

Non-income producing fixed maturity securities(1):

Estimatedfairvalue .................................................. $ 312 $ 75

Netunrealizedloss .................................................. $ 31 $ 19

Fixed maturity securities credit enhanced by financial guarantor insurers — by sector — at

estimated fair value:

Stateandpoliticalsubdivisionsecurities..................................... $ 2,154 $ 2,005

U.S.corporatesecurities............................................... 1,750 2,007

ABS ............................................................ 803 833

Other ........................................................... 43 51

Total fixed maturity securities credit enhanced by financial guarantor insurers . . . . . . . . . . . $ 4,750 $ 4,896

Ratings of the financial guarantor insurers providing the credit enhancement:

PortionratedAa/AA.................................................. 18% 15%

PortionratedA ..................................................... 2% —%

PortionratedBaa/BBB ................................................ 36% 68%

(1) Based on rating agency designations and equivalent ratings of the NAIC, with the exception of non-agency RMBS held by the Company’s

domestic insurance subsidiaries. Non-agency RMBS held by the Company’s domestic insurance subsidiaries at December 31, 2009 are

included based on final ratings from the revised NAIC rating methodology which became effective December 31, 2009 (which may not

correspond to rating agency designations).

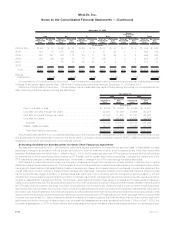

Concentrations of Credit Risk (Fixed Maturity Securities) — Summary. The following section contains a summary of the concentrations

of credit risk related to fixed maturity securities holdings.

The Company is not exposed to any concentrations of credit risk of any single issuer greater than 10% of the Company’s stockholders’

equity, other than securities of the U.S. government, certain U.S. government agencies and certain securities guaranteed by the

U.S. government, as well as securities of the Mexican government and certain Mexican government agencies. The Company’s holdings

F-29MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)