MetLife 2009 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

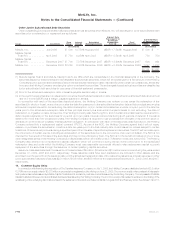

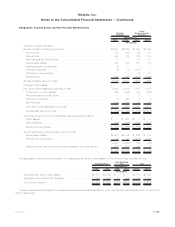

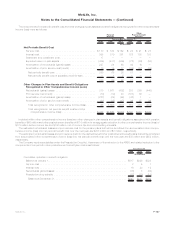

Commitments

Leases

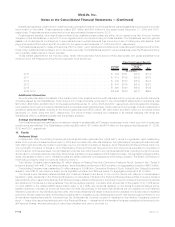

In accordance with industry practice, certain of the Company’s income from lease agreements with retail tenants are contingent upon the

level of the tenants’ revenues. Additionally, the Company, as lessee, has entered into various lease and sublease agreements for office

space, information technology and other equipment. Future minimum rental and sublease income, and minimum gross rental payments

relating to these lease agreements are as follows:

Rental

Income Sublease

Income

Gross

Rental

Payments

(In millions)

2010 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $415 $15 $287

2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $357 $17 $237

2012 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $288 $16 $190

2013 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $253 $15 $169

2014 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $221 $ 9 $119

Thereafter.................................................... $723 $44 $994

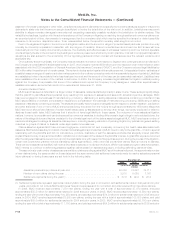

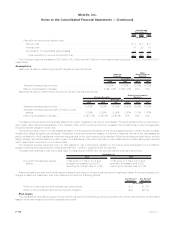

During 2008, the Company moved certain of its operations in New York from Long Island City to New York City. As a result of this movement

of operations and current market conditions, which precluded the Company’s immediate and complete sublet of all unused space in both

Long Island City and New York City, the Company incurred a lease impairment charge of $38 million which is included within other expenses in

Banking, Corporate & Other. The impairment charge was determined based upon the present value of the gross rental payments less

sublease income discounted at a risk-adjusted rate over the remaining lease terms which range from 15-20 years. The Company has made

assumptions with respect to the timing and amount of future sublease income in the determination of this impairment charge. During 2009,

pending sublease deals were impacted by the further decline of market conditions, which resulted in an additional lease impairment charge of

$52 million. See Note 19 for discussion of $28 million of such charges related to restructuring. Additional impairment charges could be

incurred should market conditions deteriorate further or last for a period significantly longer than anticipated.

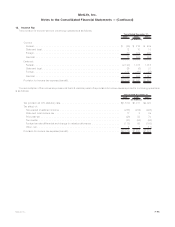

Commitments to Fund Partnership Investments

The Company makes commitments to fund partnership investments in the normal course of business. The amounts of these unfunded

commitments were $4.1 billion and $4.5 billion at December 31, 2009 and 2008, respectively. The Company anticipates that these amounts

will be invested in partnerships over the next five years.

Mortgage Loan Commitments

The Company has issued interest rate lock commitments on certain residential mortgage loan applications totaling $2.7 billion and

$8.0 billion at December 31, 2009 and 2008, respectively. The Company intends to sell the majority of these originated residential mortgage

loans. Interest rate lock commitments to fund mortgage loans that will be held-for-sale are considered derivatives and their estimated fair

value and notional amounts are included within interest rate forwards in Note 4.

The Company also commits to lend funds under certain other mortgage loan commitments that will be held-for-investment. The amounts

of these mortgage loan commitments were $2.2 billion and $2.7 billion at December 31, 2009 and 2008, respectively.

Commitments to Fund Bank Credit Facilities, Bridge Loans and Private Corporate Bond Investments

The Company commits to lend funds under bank credit facilities, bridge loans and private corporate bond investments. The amounts of

these unfunded commitments were $1.3 billion and $1.0 billion at December 31, 2009 and 2008, respectively.

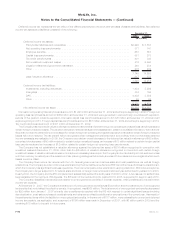

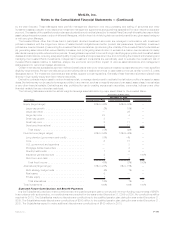

Guarantees

In the normal course of its business, the Company has provided certain indemnities, guarantees and commitments to third parties

pursuant to which it may be required to make payments now or in the future. In the context of acquisition, disposition, investment and other

transactions, the Company has provided indemnities and guarantees, including those related to tax, environmental and other specific

liabilities and other indemnities and guarantees that are triggered by, among other things, breaches of representations, warranties or

covenants provided by the Company. In addition, in the normal course of business, the Company provides indemnifications to counterparties

in contracts with triggers similar to the foregoing, as well as for certain other liabilities, such as third-party lawsuits. These obligations are often

subject to time limitations that vary in duration, including contractual limitations and those that arise by operation of law, such as applicable

statutes of limitation. In some cases, the maximum potential obligation under the indemnities and guarantees is subject to a contractual

limitation ranging from less than $1 million to $800 million, with a cumulative maximum of $1.6 billion, while in other cases such limitations are

not specified or applicable. Since certain of these obligations are not subject to limitations, the Company does not believe that it is possible to

determine the maximum potential amount that could become due under these guarantees in the future. Management believes that it is unlikely

the Company will have to make any material payments under these indemnities, guarantees, or commitments.

In addition, the Company indemnifies its directors and officers as provided in its charters and by-laws. Also, the Company indemnifies its

agents for liabilities incurred as a result of their representation of the Company’s interests. Since these indemnities are generally not subject to

limitation with respect to duration or amount, the Company does not believe that it is possible to determine the maximum potential amount that

could become due under these indemnities in the future.

F-103MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)