MetLife 2009 Annual Report Download - page 62

Download and view the complete annual report

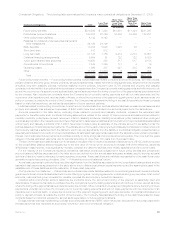

Please find page 62 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.under certain agreements, which are eligible to be satisfied in cash or by posting securities held by the subsidiaries subject to the

agreements.

Liquidity and Capital Sources

Cash Flows from Operations. The Company’s principal cash inflows from its insurance activities come from insurance premiums, annuity

considerations and deposit funds. A primary liquidity concern with respect to these cash inflows is the risk of early contractholder and

policyholder withdrawal. See “— The Company — Liquidity and Capital Uses — Contractual Obligations.”

Cash Flows from Investments. The Company’s principal cash inflows from its investment activities come from repayments of principal,

proceeds from maturities, sales of invested assets and net investment income. The primary liquidity concerns with respect to these cash

inflows are the risk of default by debtors and market volatility. The Company closely monitors and manages these risks through its credit risk

management process.

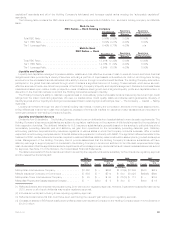

Liquid Assets. An integral part of the Company’s liquidity management is the amount of liquid assets it holds. Liquid assets include cash,

cash equivalents, short-term investments and publicly-traded securities, excluding: (i) cash collateral received under the Company’s

securities lending program that has been reinvested in cash, cash equivalents, short-term investments and publicly-traded securities;

(ii) cash collateral received from counterparties in connection with derivative instruments; (iii) cash, cash equivalents, short-term investments

and securities on deposit with regulatory agencies; and (iv) securities held in trust in support of collateral financing arrangements and pledged

in support of debt and funding agreements. At December 31, 2009 and 2008, the Company had $139.2 billion and $141.7 billion in liquid

assets, respectively. For further discussion of invested assets on deposit with regulatory agencies, held in trust in support of collateral

financing arrangements and pledged in support of debt and funding agreements, see “— Investments — Invested Assets on Deposit, Held in

Trust and Pledged as Collateral.”

Global Funding Sources. Liquidity is also provided by a variety of short-term instruments, including repurchase agreements and

commercial paper. Capital is provided by a variety of instruments, including medium- and long-term debt, junior subordinated debt securities,

capital securities and equity securities. The diversity of the Company’s funding sources, including funding that may be available through

certain economic stabilization programs established by various government institutions, enhances flexibility, limits dependence on any one

source of funds and generally lowers the cost of funds. The Company’s global funding sources include:

• The Holding Company and MetLife Funding, Inc. (“MetLife Funding”) each have commercial paper programs supported by our

$2.85 billion general corporate credit facility. MetLife Funding, a subsidiary of MLIC, serves as a centralized finance unit for the

Company. Pursuant to a support agreement, MLIC has agreed to cause MetLife Funding to have a tangible net worth of at least one

dollar. At both December 31, 2009 and 2008, MetLife Funding had a tangible net worth of $12 million. MetLife Funding raises cash from

various funding sources and uses the proceeds to extend loans, through MetLife Credit Corp., another subsidiary of MLIC, to the

Holding Company, MLIC and other affiliates. MetLife Funding manages its funding sources to enhance the financial flexibility and

liquidity of MLIC and other affiliated companies. At December 31, 2009 and 2008, MetLife Funding had total outstanding liabilities for its

commercial paper program, including accrued interest payable, of $319 million and $414 million, respectively.

• The Federal Reserve Bank of New York’s Commercial Paper Funding Facility (“CPFF”) was initiated in 2008 to improve liquidity in short-

term funding markets by increasing the availability of term commercial paper funding to issuers and by providing greater assurance to

both issuers and investors that firms will be able to rollover their maturing commercial paper. MetLife Short Term Funding LLC, the issuer

of commercial paper under a program supported by funding agreements issued by MLIC and MICC, was accepted in October 2008 for

the CPFF and could issue a maximum amount of $3.8 billion under the CPFF. At December 31, 2009, MetLife Short Term Funding LLC

had no drawdown under its CPFF capacity, compared to $1.65 billion at December 31, 2008. MetLife Funding was accepted in

November 2008 for the CPFF and could issue a maximum amount of $1.0 billion under the CPFF. No drawdown by MetLife Funding had

taken place under this facility at both December 31, 2009 and 2008. The CPFF program expired on February 1, 2010.

• MetLife Bank is a depository institution that is approved to use the Federal Reserve Bank of New York Discount Window borrowing

privileges and participate in the Federal Reserve Bank of New York Term Auction Facility. To utilize these facilities, MetLife Bank has

pledged qualifying loans and investment securities to the Federal Reserve Bank of New York as collateral. At December 31, 2009,

MetLife Bank had no liability for advances from the Federal Reserve Bank of New York under these facilities. At December 31, 2008

MetLife Bank’s liability for advances from the Federal Reserve Bank of New York under these facilities was $950 million, which is

included in short-term debt. See Note 11 of the Notes to the Consolidated Financial Statements.

• As a member of the FHLB of NY, MetLife Bank has entered into repurchase agreements with FHLB of NY on both short- and long-term

bases, with a total liability for repurchase agreements with the FHLB of NY of $2.4 billion and $1.8 billion at December 31, 2009 and

2008, respectively. See Note 11 of the Notes to the Consolidated Financial Statements.

• The Holding Company and MetLife Bank elected to continue to participate in the debt guarantee component of the FDIC’s Temporary

Liquidity Guarantee Program (the “FDIC Program”). On March 26, 2009, the Holding Company issued $397 million of floating-rate senior

notes due June 2012 under the FDIC Program, representing all of MetLife, Inc.’s capacity under the FDIC Program. MetLife Bank let its

capacity to issue up to $178 million of guaranteed debt under the FDIC Program expire unused when the program ended on October 31,

2009.

• In addition, the Company had obligations under funding agreements with the FHLB of NY of $13.7 billion and $15.2 billion at

December 31, 2009 and 2008, respectively, for MLIC and with the FHLB of Boston of $326 million and $526 million at December 31,

2009 and 2008, respectively, for MICC. The FHLB of Boston had also advanced $300 million to MICC at December 31, 2008, which was

included in short-term debt. There were no such advances at December 31, 2009. See Note 8 of the Notes to the Consolidated

Financial Statements.

At December 31, 2009 and 2008, the Company had outstanding $912 million and $2.7 billion in short-term debt, respectively, and

$13.2 billion and $9.7 billion in long-term debt, respectively. At December 31, 2009 and 2008, the Company had outstanding $5.3 billion and

$5.2 billion in collateral financing arrangements, respectively, and $3.2 billion and $3.8 billion in junior subordinated debt, respectively. Short-

term and long-term debt includes the above-mentioned MetLife Bank funding from the Federal Reserve Bank of New York and the FHLB of NY,

as well as the above-mentioned advances from the FHLB of Boston.

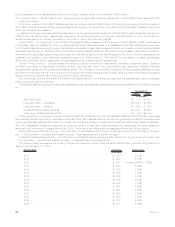

Debt Issuances and Other Borrowings. In July 2009, the Holding Company issued $500 million of junior subordinated debt securities

with a final maturity of August 2069. Interest is payable semi-annually at a fixed rate of 10.75% up to, but not including, August 1, 2039, the

56 MetLife, Inc.