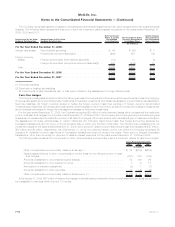

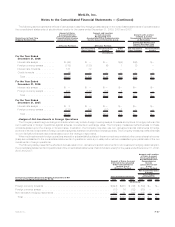

MetLife 2009 Annual Report Download - page 132

Download and view the complete annual report

Please find page 132 of the 2009 MetLife annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Other Limited Partnership Interests

The carrying value of other limited partnership interests (which primarily represent ownership interests in pooled investment funds that

principally make private equity investments in companies in the United States and overseas) was $5.5 billion and $6.0 billion at December 31,

2009 and 2008, respectively. Included within other limited partnership interests were $1.0 billion and $1.3 billion, at December 31, 2009 and

2008, respectively, of investments in hedge funds. Impairments of other limited partnership interests, principally cost method other limited

partnership interests, were $354 million, $105 million and $4 million for the years ended December 31, 2009, 2008 and 2007, respectively.

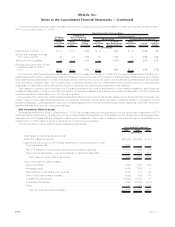

Other Invested Assets

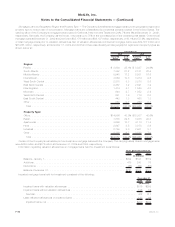

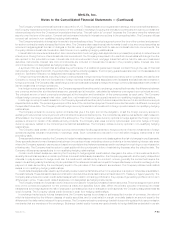

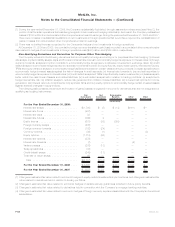

The following table presents the carrying value of the Company’s other invested assets by type at:

Carrying

Value %of

Total Carrying

Value %of

Total

2009 2008

December 31,

(In millions)

Freestandingderivativeswithpositivefairvalues ..................... $ 6,133 48.2% $12,306 71.3%

Leveragedleases,netofnon-recoursedebt........................ 2,227 17.5 2,146 12.4

Jointventureinvestments.................................... 977 7.7 751 4.4

MSRs................................................. 878 6.9 191 1.1

Taxcreditpartnerships...................................... 719 5.7 503 2.9

Fundswithheld........................................... 505 4.0 62 0.4

Fundingagreements ....................................... 409 3.2 394 2.3

Other................................................. 861 6.8 895 5.2

Total . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $12,709 100.0% $17,248 100.0%

See Note 4 for information regarding the freestanding derivatives with positive estimated fair values. See the following section for the

composition of leveraged leases and information on MSRs. Joint venture investments are accounted for on the equity method and represent

the Company’s investment in insurance underwriting joint ventures in Japan, Chile and China. Tax credit partnerships are established for the

purpose of investing in low-income housing and other social causes, where the primary return on investment is in the form of tax credits, and

are accounted for under the equity method or under the effective yield method. Funds withheld represent amounts contractually withheld by

ceding companies in accordance with reinsurance agreements. Funding agreements represent arrangements where the Company has long-

term interest bearing amounts on deposit with third parties and are generally stated at amortized cost.

Leveraged Leases

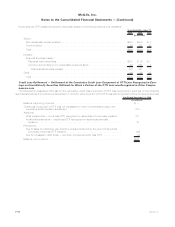

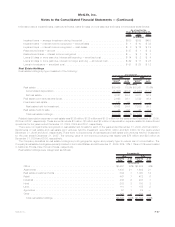

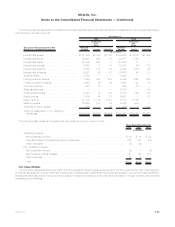

Investment in leveraged leases, included in other invested assets, consisted of the following:

2009 2008

December 31,

(In millions)

Rentalreceivables,net .................................................. $1,698 $1,486

Estimatedresidualvalues................................................. 1,921 1,913

Subtotal .......................................................... 3,619 3,399

Unearnedincome...................................................... (1,392) (1,253)

Investmentinleveragedleases............................................ $2,227 $2,146

The Company’s deferred income tax liability related to leveraged leases was $1.3 billion and $1.2 billion at December 31, 2009 and 2008,

respectively. The rental receivables set forth above are generally due in periodic installments. The payment periods range from one to

15 years, but in certain circumstances are as long as 30 years.

The components of net income from investment in leveraged leases are as follows:

2009 2008 2007

Years Ended December 31,

(In millions)

Income from investment in leveraged leases (included in net investment income) . . . . . . . . . . $114 $116 $ 68

Less:Incometaxexpenseonleveragedleases................................ (40) (40) (24)

Netincomefrominvestmentinleveragedleases............................... $ 74 $ 76 $44

F-48 MetLife, Inc.

MetLife, Inc.

Notes to the Consolidated Financial Statements — (Continued)