Wells Fargo 2009 Annual Report Download - page 93

Download and view the complete annual report

Please find page 93 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196

|

|

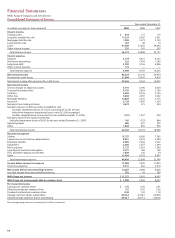

Wells Fargo & Company and Subsidiaries

Consolidated Balance Sheet

December 31,

(in millions, except shares) 2009 2008

Assets

Cash and due from banks $ 27,080 23,763

Federal funds sold, securities purchased under

resale agreements and other short-term investments 40,885 49,433

Trading assets 43,039 54,884

Securities available for sale 172,710 151,569

Mortgages held for sale (includes $36,962 and $18,754 carried at fair value) 39,094 20,088

Loans held for sale (includes $149 and $398 carried at fair value) 5,733 6,228

Loans 782,770 864,830

Allowance for loan losses (24,516) (21,013)

Net loans 758,254 843,817

Mortgage servicing rights:

Measured at fair value (residential MSRs) 16,004 14,714

Amortized 1,119 1,446

Premises and equipment, net 10,736 11,269

Goodwill 24,812 22,627

Other assets 104,180 109,801

Total assets $1,243,646 1,309,639

Liabilities

Noninterest-bearing deposits $ 181,356 150,837

Interest-bearing deposits 642,662 630,565

Total deposits 824,018 781,402

Short-term borrowings 38,966 108,074

Accrued expenses and other liabilities 62,442 50,689

Long-term debt 203,861 267,158

Total liabilities 1,129,287 1,207,323

Equity

Wells Fargo stockholders’ equity:

Preferred stock 8,485 31,332

Common stock – $12/3par value, authorized 6,000,000,000 shares;

issued 5,245,971,422 shares and 4,363,921,429 shares 8,743 7,273

Additional paid-in capital 52,878 36,026

Retained earnings 41,563 36,543

Cumulative other comprehensive income (loss) 3,009 (6,869)

Treasury stock – 67,346,829 shares and 135,290,540 shares (2,450) (4,666)

Unearned ESOP shares (442) (555)

Total Wells Fargo stockholders’ equity 111,786 99,084

Noncontrolling interests 2,573 3,232

Total equity 114,359 102,316

Total liabilities and equity $1,243,646 1,309,639

The accompanying notes are an integral part of these statements.