Wells Fargo 2009 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

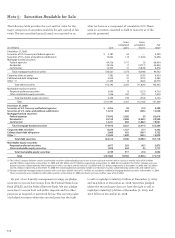

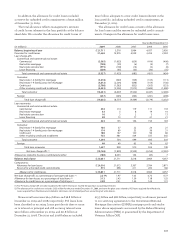

Non-agency residential MBS –

non-investment grade (1)

Year ended December 31, 2009

Expected remaining life of loan losses (2):

Range (3) 0-58%

Credit impairment distribution (4):

0-10% range 56

10-20% range 27

20-30% range 12

Greater than 30% 5

Weighted average (5) 11

Current subordination levels (6):

Range (3) 0-44

Weighted average (5) 8

Prepayment speed (annual CPR (7)):

Range (3) 5-25

Weighted average (5) 11

(1) Total credit impairment losses were $591 million, of which 96% were recorded

on non-investment grade securities for the year ended December 31, 2009.

This does not include OTTI recorded on those securities that we intend to sell.

(2) Represents future expected credit losses on underlying pool of loans

expressed as a percentage of total current outstanding loan balance.

(3) Represents the range of inputs/assumptions based upon the individual

securities within each category.

(4) Represents distribution of credit impairment losses recognized in earnings

categorized based on range of expected remaining life of loan losses.

For example, 56% of credit impairment losses recognized in earnings for the

year ended December 31, 2009, had expected remaining life of loan loss

assumptions of 0 to 10%.

(5) Calculated by weighting the relevant input/assumption for each individual

security by current outstanding amortized cost basis of the security.

(6) Represents current level of credit protection (subordination) for the securities,

expressed as a percentage of total current underlying loan balance.

(7) Constant prepayment rate.

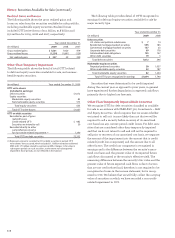

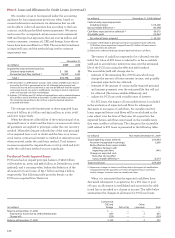

(in millions) Year ended December 31, 2009

Balance, beginning of year $ 471

Additions (1):

Initial credit impairments 625

Subsequent credit impairments 357

Reductions:

For securities sold (255)

Due to change in intent to sell

or requirement to sell (1)

For increases in expected cash flows (10)

Balance, end of year $1,187

(1) Excludes $30 million of OTTI on debt securities we intend to sell.

For asset-backed securities (e.g., residential MBS), we esti -

mated expected future cash flows of the security by estimating

the expected future cash flows of the underlying collateral

and applying those collateral cash flows, together with any

credit enhancements such as subordinated interests owned

by third parties, to the security. The expected future cash

flows of the underlying collateral are determined using the

remaining contractual cash flows adjusted for future expected

credit losses (which considers current delinquencies and non-

performing assets, future expected default rates and collateral

value by vintage and geographic region) and prepayments.

The expected cash flows of the security are then discounted

at the interest rate used to recognize interest income on the

security to arrive at a present value amount. The table below

presents a summary of the significant inputs considered in

determining the measurement of the credit loss component

recognized in earnings for residential MBS.

The table below presents a roll-forward of the credit loss

component recognized in earnings (referred to as “credit-

impaired” debt securities). The credit loss component of the

amortized cost represents the difference between the present

value of expected future cash flows and the amortized cost

basis of the security prior to considering credit losses. The

beginning balance represents the credit loss component for

debt securities for which OTTI occurred prior to January 1,

2009. OTTI recognized in earnings in 2009 for credit-impaired

debt securities is presented as additions in two components

based upon whether the current period is the first time the

debt security was credit-impaired (initial credit impairment)

or is not the first time the debt security was credit impaired

(subsequent credit impairments). The credit loss component is

reduced if we sell, intend to sell or believe we will be required

to sell previously credit-impaired debt securities. Additionally,

the credit loss component is reduced if we receive or expect

to receive cash flows in excess of what we previously expected

to receive over the remaining life of the credit-impaired

debt security, the security matures or is fully written down.

Changes in the credit loss component of credit-impaired

debt securities were: