Wells Fargo 2009 Annual Report Download - page 124

Download and view the complete annual report

Please find page 124 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

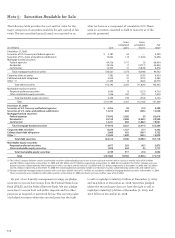

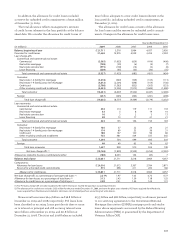

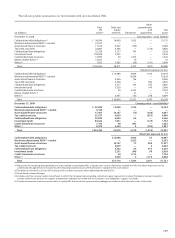

We consider a loan to be impaired under the accounting

guidance for loan impairment provisions when, based on

current information and events, we determine that we will

not be able to collect all amounts due according to the loan

contract, including scheduled interest payments. We assess

and account for as impaired certain nonaccrual commercial,

CRE and foreign loan exposures that are over $5 million and

certain consumer, commercial, CRE and foreign loans whose

terms have been modified in a TDR. The recorded investment

in impaired loans and the methodology used to measure

impairment was:

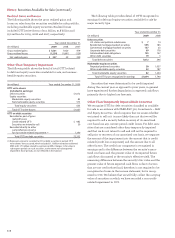

The excess of cash flows expected to be collected over the

initial fair value of PCI loans is referred to as the accretable

yield and is accreted into interest income over the estimated

life of the PCI loans using the effective yield method.

The accretable yield will change due to:

• estimate of the remaining life of PCI loans which may

change the amount of future interest income, and possibly

principal, expected to be collected;

• estimate of the amount of contractually required principal

and interest payments over the estimated life that will not

be collected (the nonaccretable difference); and

• indices for PCI loans with variable rates of interest.

For PCI loans, the impact of loan modifications is included

in the evaluation of expected cash flows for subsequent

decreases or increases of cash flows. For variable rate PCI

loans, expected future cash flows will be recalculated as the

rates adjust over the lives of the loans. At acquisition, the

expected future cash flows were based on the variable rates

that were in effect at that time. The change in the accretable

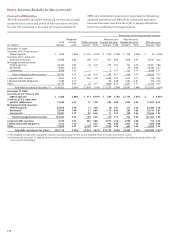

yield related to PCI loans is presented in the following table.

When it is estimated that the expected cash flows have

decreased subsequent to acquisition for a PCI loan or pool

of loans, an allowance is established and a provision for addi-

tional loss is recorded as a charge to income. The table below

summarizes the changes in allowance for PCI loan losses.

December 31,

(in millions) 2009 2008

Impairment measurement based on:

Collateral value method $ 561 88

Discounted cash flow method (1) 15,217 3,552

Total (2) $15,778 3,640

(1) The December 31, 2009, balance includes $501 million of GNMA loans that are

insured by the FHA or guaranteed by the VA. Although both principal and

interest are insured, the insured interest rate may be different than the original

contractual interest rate prior to modification, resulting in interest impairment

under a discounted cash flow methodology.

(2) Includes $15.0 billion and $3.5 billion of impaired loans with a related allowance

of $2.8 billion and $816 million at December 31, 2009 and 2008, respectively.

The remaining impaired loans do not have a specific impaired allowance

associated with them.

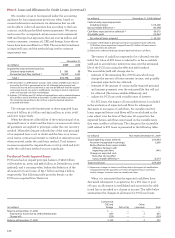

(in millions) December 31, 2008 (refined)

Contractually required payments

including interest $115,008

Nonaccretable difference (1) (45,398)

Cash flows expected to be collected (2) 69,610

Accretable yield (10,447)

Fair value of loans acquired $ 59,163

(1) Includes $40.9 billion in principal cash flows not expected to be collected,

$2.0 billion of pre-acquisition charge-offs and $2.5 billion of future interest

not expected to be collected.

(2) Represents undiscounted expected principal and interest cash flows.

The average recorded investment in these impaired loans

was $10.6 billion, $2.0 billion and $313 million, in 2009, 2008

and 2007, respectively.

When the ultimate collectibility of the total principal of an

impaired loan is in doubt and the loan is on nonaccrual status,

all payments are applied to principal, under the cost recovery

method. When the ultimate collectibility of the total principal

of an impaired loan is not in doubt and the loan is on nonac-

crual status, contractual interest is credited to interest income

when received, under the cash basis method. Total interest

income recognized for impaired loans in 2009, 2008 and 2007

under the cash basis method was not significant.

Purchased Credit-Impaired Loans

PCI loans had an unpaid principal balance of $83.6 billion

at December 31, 2009, and $98.2 billion at December 31, 2008

(refined), and a carrying value, before the deduction of the

allowance for loan losses, of $51.7 billion and $59.2 billion,

respectively. The following table provides details on the

PCI loans acquired from Wachovia.

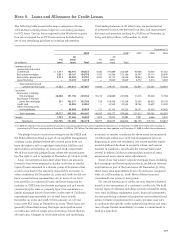

Note 6: Loans and Allowance for Credit Losses (continued)

(in millions) Year ended December 31, 2009

Total, beginning of year (refined) $(10,447)

Accretion (recognized in earnings) 2,606

Reclassification from nonaccretable

difference for loans with

improving cash flows (441)

Changes in expected cash

flows that do not affect

nonaccretable difference (1) (6,277)

Total, end of year $(14,559)

(1) Represents changes in interest cash flows due to the impact of modifications

incorporated into the quarterly assessment of expected future cash flows

and/or changes in interest rates on variable rate loans.

Commercial,

CRE and Other

(in millions) foreign Pick-a-Pay consumer Total

Balance at December 31, 2008 $ ————

Provision for losses due to credit deterioration 850 — 3 853

Charge-offs (520) — — (520)

Balance at December 31, 2009 $ 330 — 3 333