Wells Fargo 2009 Annual Report Download - page 156

Download and view the complete annual report

Please find page 156 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

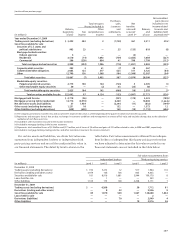

including certain public equity and non-public securities

and certain investments in private equity funds, are recorded

at fair value with realized and unrealized gains and losses

included in gains and losses on equity investments in the

income statement, and are included in other assets in the

balance sheet. Public equity investments are valued using

quoted market prices and discounts are only applied when

there are trading restrictions that are an attribute of the

investment. Investments in non-public securities are recorded

at our estimate of fair value using metrics such as security

prices of comparable public companies, acquisition prices

for similar companies and original investment purchase price

multiples, while also incorporating a portfolio company’s

financial performance and specific factors. For investments

in private equity funds, we use the NAV provided by the fund

sponsor as an appropriate measure of fair value. In some

cases, such NAVs require adjustments based on certain

unobservable inputs.

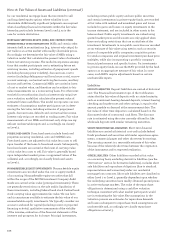

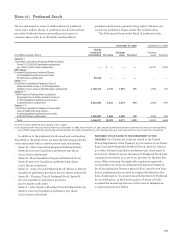

Liabilities

DEPOSIT LIABILITIES Deposit liabilities are carried at historical

cost. The Financial Instruments topic of the Codification

states that the fair value of deposits with no stated maturity,

such as noninterest-bearing demand deposits, interest-bearing

checking, and market rate and other savings, is equal to the

amount payable on demand at the measurement date. The

fair value of other time deposits is calculated based on the

discounted value of contractual cash flows. The discount

rate is estimated using the rates currently offered for like

wholesale deposits with similar remaining maturities.

SHORT-TERM FINANCIAL LIABILITIES Short-term financial

liabilities are carried at historical cost and include federal

funds purchased and securities sold under repurchase agree-

ments, commercial paper and other short-term borrowings.

The carrying amount is a reasonable estimate of fair value

because of the relatively short time between the origination

of the instrument and its expected realization.

OTHER LIABILITIES Other liabilities recorded at fair value

on a recurring basis, excluding derivative liabilities (see the

“Derivatives” section for derivative liabilities), includes short

sale liabilities and repurchase obligations (due to standard

representations and warranties) under our residential

mortgage loan contracts. Short sale liabilities are classified as

either Level 1 or Level 2, generally dependent upon whether

the underlying securities have readily obtained quoted prices

in active exchange markets. The value of the repurchase

obligations is determined using a cash flow valuation

technique consistent with what market participants would

use in estimating the fair value. Key assumptions in the

valuation process are estimates for repurchase demands

and losses subsequent to repurchase. Such assumptions are

unobservable and, accordingly, we classify repurchase

obligations as Level 3.

for our residential mortgage loans that we intend to sell

and long dated equity options where volatility is not

observable. Additionally, significant judgments are required

when classifying financial instruments within the fair value

hierarchy, particularly between Level 2 and 3, as is the

case for certain derivatives.

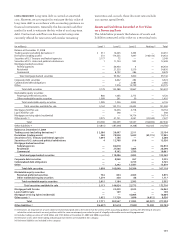

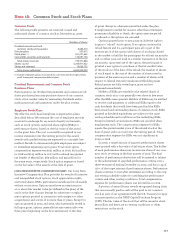

MORTGAGE SERVICING RIGHTS (MSRS) AND CERTAIN OTHER

INTERESTS HELD IN SECURITIZATIONS MSRs and certain other

interests held in securitizations (e.g., interest-only strips) do

not trade in an active market with readily observable prices.

Accordingly, we determine the fair value of MSRs using a

valuation model that calculates the present value of estimated

future net servicing income. The model incorporates assump-

tions that market participants use in estimating future net

servicing income, including estimates of prepayment speeds

(including housing price volatility), discount rate, cost to

service (including delinquency and foreclosure costs), escrow

account earnings, contractual servicing fee income, ancillary

income and late fees. Commercial MSRs are carried at lower

of cost or market value, and therefore can be subject to fair

value measurements on a nonrecurring basis. For other inter-

ests held in securitizations (such as interest-only strips) we

use a valuation model that calculates the present value of

estimated future cash flows. The model incorporates our own

estimates of assumptions market participants use in deter-

mining the fair value, including estimates of prepayment

speeds, discount rates, defaults and contractual fee income.

Interest-only strips are recorded as trading assets. Fair value

measurements of our MSRs and interest-only strips use sig-

nificant unobservable inputs and, accordingly, we classify

as Level 3.

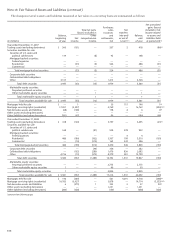

FORECLOSED ASSETS Foreclosed assets include foreclosed

properties securing residential, auto and GNMA loans.

Foreclosed assets are adjusted to fair value less costs to sell

upon transfer of the loans to foreclosed assets. Subsequently,

foreclosed assets are carried at the lower of carrying value

or fair value less costs to sell. Fair value is generally based

upon independent market prices or appraised values of the

collateral and, accordingly, we classify foreclosed assets

as Level 2.

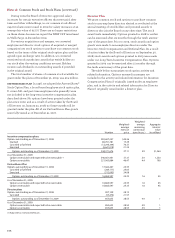

NONMARKETABLE EQUITY INVESTMENTS Nonmarketable equity

investments are recorded under the cost or equity method

of accounting. Nonmarketable equity securities that fall

within the scope of the AICPA Investment Company Audit

Guide are carried at fair value (principal investments). There

are generally restrictions on the sale and/or liquidation of

these investments, including federal bank stock. Federal bank

stock carrying value approximates fair value. We use facts

and circumstances available to estimate the fair value of our

nonmarketable equity investments. We typically consider our

access to and need for capital (including recent or projected

financing activity), qualitative assessments of the viability

of the investee, evaluation of the financial statements of the

investee and prospects for its future. Principal investments,

Note 16: Fair Values of Assets and Liabilities (continued)