Wells Fargo 2009 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

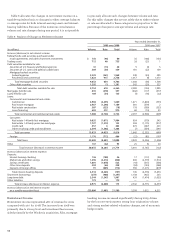

Earnings Performance

The earnings performance in 2009 was impacted by the

acquisition of Wachovia on December 31, 2008, which signifi-

cantly increased both asset size and the earnings potential of

the Company. Net income for 2009 was $12.3 billion ($1.75

diluted per share) with $8.0 billion applicable to common

stock, compared with net income of $2.7 billion ($0.70 diluted

per share) with $2.4 billion applicable to common stock for 2008.

Our 2009 earnings were influenced by factors including:

•a low mortgage rate environment combined with synergies

from the addition of complementary Wachovia business

lines, which resulted in a more even split in revenue

between net interest income and noninterest income, pri-

marily mortgage banking and trust and investment fees;

•the integration of Wachovia, which increased our expenses

to align staffing models with those of Wells Fargo in our

service and product distribution channels, as well as to

align or enhance our various systems, business line

support and other infrastructures;

•consumer and commercial borrower financial distress,

which increased credit losses and foreclosed asset

preservation costs, as well as increased staffing expenses

to manage loan modification programs, loan collection,

and various other loss mitigation activities; and

•significant distress in the financial services industry,

which caused, among other items, increased Federal

Deposit Insurance Corporation (FDIC) and other

deposit assessments.

Revenue, the sum of net interest income and noninterest

income, grew to $88.7 billion in 2009 from $41.9 billion in 2008,

primarily due to the acquisition of Wachovia. In 2009, net

interest income of $46.3 billion represented 52% of revenue,

compared with $25.1 billion (60%) in 2008. Noninterest income

of $42.4 billion in 2009 represented 48% of revenue, up from

$16.7 billion (40%) in 2008. The increase in noninterest income

as a percentage of revenue was due to a higher percentage of

trust and investment fees (11% in 2009, up from 7% in 2008)

with the addition of Wells Fargo Advisors (formerly Wachovia

Securities) retail brokerage business, legacy Wachovia wealth

management and retirement, and reinsurance businesses, and

to very strong mortgage banking results (14% in 2009, up

from 6% in 2008, predominantly from legacy Wells Fargo).

Noninterest expense as a percentage of revenue was 55%

in 2009 and 54% in 2008, with amortization of core deposits

(3% of revenue in 2009 and less than 1% in 2008) and additional

FDIC and other deposit assessments (2% of revenue in 2009

and less than 1% in 2008) in 2009 driving the slightly weaker

ratio. Noninterest expense for 2009 also included $895 million

of Wachovia merger-related integration expense.

Table 3 presents the components of revenue and noninterest

expense as a percentage of revenue for year-over-year results,

comparing the combined Wells Fargo and Wachovia results

for 2009 with legacy Wells Fargo results for 2008.

Net Interest Income

Net interest income is the interest earned on debt securities,

loans (including yield-related loan fees) and other interest-

earning assets minus the interest paid for deposits, short-term

borrowings and long-term debt. The net interest margin is the

average yield on earning assets minus the average interest

rate paid for deposits and our other sources of funding. Net

interest income and the net interest margin are presented on

a taxable-equivalent basis in Table 5 to consistently reflect

income from taxable and tax-exempt loans and securities

based on a 35% federal statutory tax rate.

Net interest income on a taxable-equivalent basis

increased to $47.0 billion in 2009, from $25.4 billion in 2008,

and the net interest margin was 4.28% in 2009, down 55 basis

points from 4.83% in 2008. These changes are primarily due to

the impact of acquiring Wachovia. Although the addition of

Wachovia increased earning assets and net interest income, it

decreased the net interest margin since Wachovia’s net inter-

est margin was much lower than that of legacy Wells Fargo.

Table 4 presents the components of earning assets and

funding sources as a percentage of earning assets to provide

a more meaningful analysis of year-over-year average bal-

ances, comparing the combined Wells Fargo and Wachovia

balances for 2009 with legacy Wells Fargo balances for 2008.

The mix of earning assets and their yields are important

drivers of net interest income. During 2009, there were slight

shifts in our earning asset mix from loans to more liquid

assets. Due to weaker loan demand in 2009 and the impact

of liquidating certain loan portfolios, average loans for 2009

decreased to 75% of average earning assets from 76% for 2008,

average mortgage-backed securities (MBS) dropped to 12% in

2009, from 13% in 2008, and average short-term investments

and trading account assets increased to 2% in 2009 from 1% a

year ago.

As a result of PCI loan accounting, certain credit-related

ratios of the Company, including the growth rate in nonper-

forming assets (NPAs) since December 31, 2008, may not be

directly comparable with periods prior to the merger or with

credit-related ratios of other financial institutions. In particular:

• Wachovia’s high risk loans were written down pursuant

to PCI accounting at the time of merger. Therefore, the

allowance for credit losses is lower than otherwise would

have been required without PCI loan accounting; and

• Because we virtually eliminated Wachovia’s nonaccrual

loans at December 31, 2008, quarterly growth in our nonac-

crual loans during 2009 was higher than it would have been

without PCI loan accounting. Similarly, our net charge-offs

rate was lower than it otherwise would have been.

For further detail on the merger see the “Balance Sheet

Analysis – Loan Portfolio” section and Note 2 (Business

Combinations) to Financial Statements in this Report.