Wells Fargo 2009 Annual Report Download - page 112

Download and view the complete annual report

Please find page 112 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

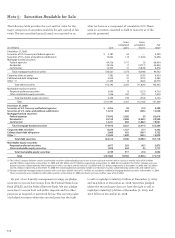

Note 2: Business Combinations (continued)

Employee Contract Facilities

(in millions) termination termination related Total

Balance, December 31, 2008 $ 57 13 129 199

Purchase accounting adjustments (1) 596 61 354 1,011

Cash payments/utilization (298) (16) (139) (453)

Balance, December 31, 2009 $ 355 58 344 757

(1) Certain purchase accounting adjustments have been refined during 2009 as additional information became available.

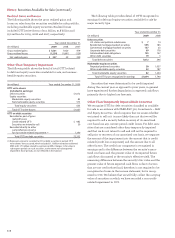

(in millions) Date Assets

2009

Capital TempFunds, Fort Lauderdale, Florida March 2 $74

Other (1) Various 39

$ 113

2008

Flatiron Credit Company, Inc., Denver, Colorado April 30 $ 332

Transcap Associates, Inc., Chicago, Illinois June 27 22

United Bancorporation of Wyoming, Inc., Jackson, Wyoming (2) July 1 2,110

Farmers State Bank of Fort Morgan Colorado, Fort Morgan, Colorado December 6 186

Century Bancshares, Inc., Dallas, Texas December 31 1,604

Wells Fargo Merchant Services, LLC (3) December 31 1,251

Other (4) Various 52

$ 5,557

2007

Placer Sierra Bancshares, Sacramento, California June 1 $ 2,644

Certain assets of The CIT Group/Equipment Financing, Inc., Tempe, Arizona June 29 2,888

Greater Bay Bancorp, East Palo Alto, California October 1 8,204

Certain Illinois branches of National City Bank, Cleveland, Ohio December 7 61

Other (5) Various 61

$13,858

(1) Consists of eight acquisitions of insurance brokerage businesses.

(2) Consists of five affiliated banks of United Bancorporation of Wyoming, Inc., located in Wyoming and Idaho, and certain assets and liabilities of

United Bancorporation of Wyoming, Inc.

(3) Represents a step acquisition resulting from the increase in Wells Fargo’s ownership from a 47.5% interest to a 60% interest in the

Wells Fargo Merchant Services, LLC joint venture.

(4) Consists of 12 acquisitions of insurance brokerage businesses.

(5) Consists of six acquisitions of insurance brokerage and third party health care payment processing businesses.

We regularly explore opportunities to acquire financial

services companies and businesses. Generally, we do not

make a public announcement about an acquisition opportunity

until a definitive agreement has been signed.

In addition to the 2008 Wachovia acquisition, business

combinations completed in 2009, 2008 and 2007 are

presented below.

For information on additional consideration related to

acquisitions, which is considered to be a guarantee, see

Note 14 in this Report.

The increase in goodwill includes the recognition of

additional types of costs associated with involuntary employee

termination, contract terminations and closing duplicate

facilities and have been allocated to the purchase price.

These costs were recorded throughout 2009 as part of the

further integration of Wachovia’s employees, locations and

operations as management finalized integration plans. The

following table summarizes exit reserves associated with the

Wachovia acquisition.