Wells Fargo 2009 Annual Report Download - page 181

Download and view the complete annual report

Please find page 181 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

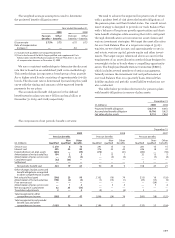

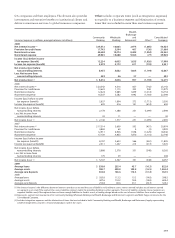

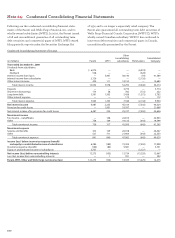

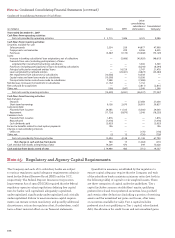

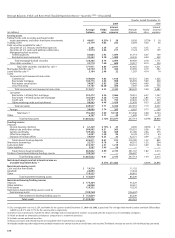

Wealth,

Brokerage

Community Wholesale and Consolidated

(income/expense in millions, average balances in billions) Banking Banking Retirement Other(3) Company

2009

Net interest income (1) $34,372 10,063 2,974 (1,085) 46,324

Provision for credit losses 17,743 3,594 467 (136) 21,668

Noninterest income 24,650 10,274 8,492 (1,054) 42,362

Noninterest expense 29,045 10,688 9,364 (77) 49,020

Income (loss) before income

tax expense (benefit) 12,234 6,055 1,635 (1,926) 17,998

Income tax expense (benefit) 3,279 2,173 611 (732) 5,331

Net income (loss) before

noncontrolling interests 8,955 3,882 1,024 (1,194) 12,667

Less: Net income from

noncontrolling interests 339 26 27 — 392

Net income (loss) (2) $ 8,616 3,856 997 (1,194) 12,275

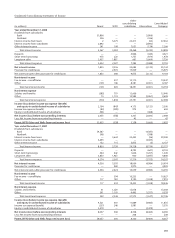

2008

Net interest income (1) $ 20,542 4,516 827 (742) 25,143

Provision for credit losses 13,622 1,115 302 940 15,979

Noninterest income 12,424 3,685 1,839 (1,214) 16,734

Noninterest expense 16,507 5,282 1,992 (1,183) 22,598

Income (loss) before income

tax expense (benefit) 2,837 1,804 372 (1,713) 3,300

Income tax expense (benefit) 659 416 141 (614) 602

Net income (loss) before

noncontrolling interests 2,178 1,388 231 (1,099) 2,698

Less: Net income from

noncontrolling interests 32 11 — — 43

Net income (loss) (2) $ 2,146 1,377 231 (1,099) 2,655

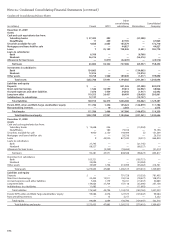

2007

Net interest income (1) $ 17,314 3,609 502 (451) 20,974

Provision for credit losses 4,869 69 4 (3) 4,939

Noninterest income 12,911 4,926 1,938 (1,229) 18,546

Noninterest expense 17,159 4,833 1,870 (1,116) 22,746

Income (loss) before income

tax expense (benefit) 8,197 3,633 566 (561) 11,835

Income tax expense (benefit) 2,311 1,257 215 (213) 3,570

Net income (loss) before

noncontrolling interests 5,886 2,376 351 (348) 8,265

Less: Net income from

noncontrolling interests 179 29 — — 208

Net income (loss) (2) $ 5,707 2,347 351 (348) 8,057

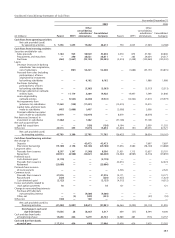

2009

Average loans $ 538.0 255.4 45.7 (16.3) 822.8

Average assets 788.7 380.8 109.4 (16.5) 1,262.4

Average core deposits 533.0 146.6 114.3 (31.4) 762.5

2008

Average loans $ 285.6 112.3 15.2 (14.6) 398.5

Average assets 447.6 153.2 18.4 (14.8) 604.4

Average core deposits 252.8 69.6 23.1 (20.3) 325.2

(1) Net interest income is the difference between interest earned on assets and the cost of liabilities to fund those assets. Interest earned includes actual interest earned

on segment assets and, if the segment has excess liabilities, interest credits for providing funding to other segments. The cost of liabilities includes interest expense on

segment liabilities and, if the segment does not have enough liabilities to fund its assets, a funding charge based on the cost of excess liabilities from another segment.

(2) Represents segment net income (loss) for Community Banking; Wholesale Banking; and Wealth, Brokerage and Retirement segments and Wells Fargo net income for the

Consolidated Company.

(3) Includes integration expenses and the elimination of items that are included in both Community Banking and Wealth, Brokerage and Retirement, largely representing

wealth management customers serviced and products sold in the stores.

U.S. companies and their employees. The division also provides

investments and executive benefits to institutional clients and

delivers reinsurance services to global insurance companies.

Other includes corporate items (such as integration expenses)

not specific to a business segment and elimination of certain

items that are included in more than one business segment.