Wells Fargo 2009 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

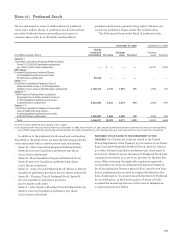

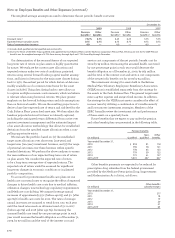

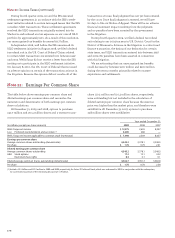

December 31,

2009 2008 2007

Pension Other Pension Other Pension Other

benefits(1) benefits benefits(1) benefits benefits (1) benefits

Discount rate (2) 7.42% 6.75 6.25 6.25 5.75 5.75

Expected return on plan assets 8.75 8.75 8.75 8.75 8.75 8.75

Rate of compensation increase 4.0 — 4.0 — 4.0 —

(1) Includes both qualified and nonqualified pension benefits.

(2) Due to the freeze of the Wells Fargo qualified and supplemental Cash Balance Plans and the Wachovia Corporation Pension Plan, the discount rate for the 2009 Pension

benefits was the weighted average of 6.75% from January through April and 7.75% from May through December.

The weighted-average assumptions used to determine the net periodic benefit cost were:

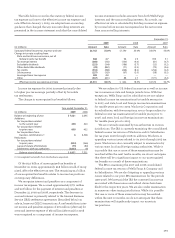

Our determination of the reasonableness of our expected

long-term rate of return on plan assets is highly quantitative

by nature. We evaluate the current asset allocations and

expected returns under two sets of conditions: projected

returns using several forward-looking capital market assump-

tions, and historical returns for the main asset classes dating

back to 1970, the earliest period for which historical data was

readily available as of a common time frame for the asset

classes included. Using data dating back to 1970 allows us

to capture multiple economic environments, which we believe

is relevant when using historical returns. We place greater

emphasis on the forward looking return and risk assumptions

than on historical results. We use the resulting projections to

derive a base line expected rate of return and risk level for the

Cash Balance Plans’ prescribed asset mix. We then adjust the

baseline projected returns for items not already captured,

including the anticipated return differential from active over

passive investment management and the estimated impact

of an asset allocation methodology that allows for established

deviations from the specified target allocations when a com-

pelling opportunity exists.

We evaluate the portfolio based on: (1) the established

target asset allocations over short term (one-year) and

longer term (ten-year) investment horizons, and (2) the range

of potential outcomes over these horizons within specific

standard deviations. We perform the above analyses to assess

the reasonableness of our expected long-term rate of return

on plan assets. We consider the expected rate of return

to be a long-term average view of expected returns. The

expected rate of return would be assessed for significant

long-term changes in economic conditions or in planned

portfolio composition.

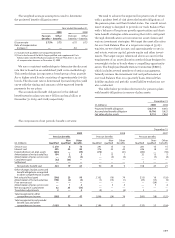

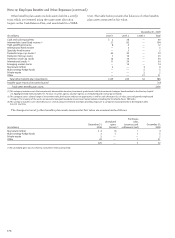

To account for postretirement health care plans we use

health care cost trend rates to recognize the effect of expected

changes in future health care costs due to medical inflation,

utilization changes, new technology, regulatory requirements

and Medicare cost shifting. We assumed average annual

increases of approximately 9.5% (before age 65) and 9% (after

age 65) for health care costs for 2010. The rates of average

annual increases are assumed to trend down 0.5% each year

until the trend rates reach an ultimate trend of 5% in 2017

(before age 65) and 2016 (after age 65). Increasing the

assumed health care trend by one percentage point in each

year would increase the benefit obligation as of December 31,

2009, by $71 million and the total of the interest cost and

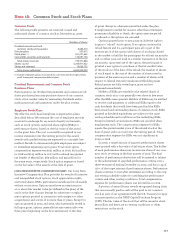

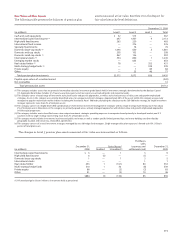

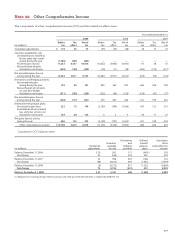

Pension benefits

Non- Other

(in millions) Qualified qualified benefits

Year ended December 31,

2010 $ 818 81 118

2011 796 78 121

2012 778 65 123

2013 779 59 125

2014 772 61 127

2015-2019 3,610 267 627

Other benefits

(in millions) subsidy receipts

Year ended December 31,

2010 $17

2011 18

2012 19

2013 20

2014 21

2015-2019 65

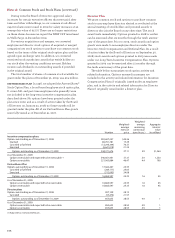

Note 19: Employee Benefits and Other Expenses (continued)

service cost components of the net periodic benefit cost for

2009 by $5 million. Decreasing the assumed health care trend

by one percentage point in each year would decrease the

benefit obligation as of December 31, 2009, by $63 million

and the total of the interest cost and service cost components

of the net periodic benefit cost for 2009 by $4 million.

The investment strategy for assets held in the Retiree

Medical Plan Voluntary Employees’ Beneficiary Association

(VEBA) trust is established separately from the strategy for

the assets in the Cash Balance Plan. The general target asset

mix is 45-65% equities and 35-55% fixed income. In addition,

the strategy for the VEBA trust assets considers the effect of

income taxes by utilizing a combination of variable annuity

and low turnover investment strategies. Members of the

EBRC formally review the investment risk and performance

of these assets on a quarterly basis.

Future benefits that we expect to pay under the pension

and other benefit plans are presented in the following table.

Other benefits payments are expected to be reduced by

prescription drug subsidies from the federal government

provided by the Medicare Prescription Drug, Improvement

and Modernization Act of 2003, as follows: