Wells Fargo 2009 Annual Report Download - page 178

Download and view the complete annual report

Please find page 178 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

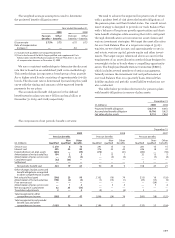

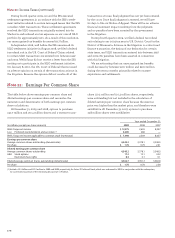

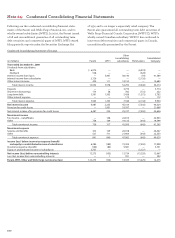

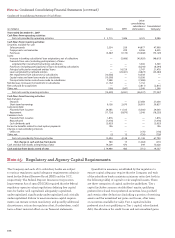

Year ended December 31,

(in millions, except per share amounts) 2009 2008 2007

Wells Fargo net income $ 12,275 2,655 8,057

Less: Preferred stock dividends and accretion (1) 4,285 286 —

Wells Fargo net income applicable to common stock (numerator) $ 7,990 2,369 8,057

Earnings per common share

Average common shares outstanding (denominator) 4,545.2 3,378.1 3,348.5

Per share $1.76 0.70 2.41

Diluted earnings per common share

Average common shares outstanding 4,545.2 3,378.1 3,348.5

Add: Stock options 17.2 13.1 34.2

Restricted share rights 0.3 0.1 0.1

Diluted average common shares outstanding (denominator) 4,562.7 3,391.3 3,382.8

Per share $1.75 0.70 2.38

(1) Includes $3.5 billion and $219 million in 2009 and 2008, respectively, for Series D Preferred Stock, which was redeemed in 2009. In conjunction with the redemption,

we accelerated accretion of the remaining discount of $1.9 billion.

The table below shows earnings per common share and

diluted earnings per common share and reconciles the

numerator and denominator of both earnings per common

share calculations.

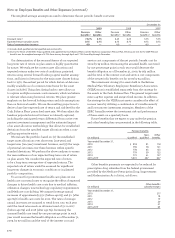

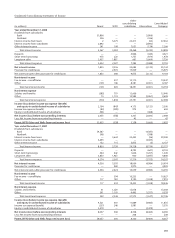

At December 31, 2009 and 2008, options to purchase

242.7 million and 172.4 million shares and a warrant to pur-

Note 21: Earnings Per Common Share

chase 110.3 million and 110.3 million shares, respectively,

were outstanding but not included in the calculation of

diluted earnings per common share because the exercise

price was higher than the market price, and therefore were

antidilutive. At December 31, 2007, options to purchase

13.8 million shares were antidilutive.

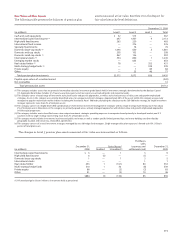

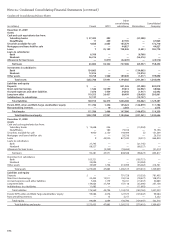

During fourth quarter 2009, we and the IRS executed

settlement agreements in accordance with the IRS’s settle-

ment initiative related to certain leveraged leases that the IRS

considers SILO transactions. These settlement agreements

resolved the SILO transactions originally entered into by

Wachovia and reduced our tax exposure on our overall SILO

portfolio by approximately 90%. As a result of this resolution,

our unrecognized tax benefits decreased $2.7 billion.

In September 2006, well before the IRS announced its

SILO settlement initiative in August 2008, we filed a federal

tax refund suit in the U.S. Court of Federal Claims related

to certain SILO transactions we entered into between 1997

and 2002. Wells Fargo did not receive a letter from the IRS

inviting us to participate in the SILO settlement initiative.

On January 8, 2010, the U.S. Court of Federal Claims issued

an adverse opinion on certain of the transactions at issue in

the litigation. Because the opinion did not resolve all of the

transactions at issue, final judgment has not yet been entered

by the court. Once final judgment is entered, we will have

60 days to file our Notice of Appeal. There will be no adverse

financial statement impact resulting from the judgment,

and no penalties have been asserted by the government

in the litigation.

During fourth quarter 2009, we filed a federal tax refund

suit relating to our 2003 tax year in U.S. District Court for the

District of Minnesota. At issue in the litigation is a structured

finance transaction, the timing of our deduction for certain

state taxes, and SILO transactions entered into between 1997

and 2003. No penalties have been asserted in connection

with this litigation.

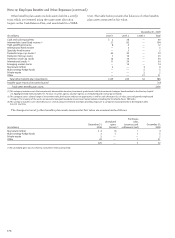

We are estimating that our unrecognized tax benefits

could decrease by between $100 million and $300 million

during the next 12 months primarily related to statute

expirations and settlements.

Note 20: Income Taxes (continued)