Wells Fargo 2009 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

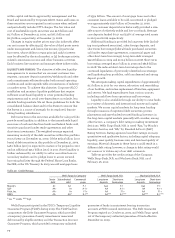

Table 32: Estimated Impact of Initial 2010 Application of

ASU 2009-16 (FAS 166) and ASU 2009-17 (FAS 167)

by Structure Type

Incremental Incremental Retained

(in billions, except GAAP risk-weighted earnings

retained earnings in millions) assets assets impact(2)

Residential mortgage loans –

nonconforming (1) $13 5 240

Commercial paper conduit 5 3 (4)

Other 2 2 27

Total $20 10 263

(1) Represents certain of our residential mortgage loans that are not guaranteed

by GSEs (“nonconforming”).

(2) Represents cumulative effect (after tax) of adopting ASU 2009-17 (FAS 167)

recorded to retained earnings on January 1, 2010.

The following accounting pronouncements were issued by

the FASB, but are not yet effective:

• ASU 2010-6, Improving Disclosures about Fair Value

Measurements;

• ASU 2009-16, Accounting for Transfers of Financial Assets

(FAS 166, Accounting for Transfers of Financial Assets –

an amendment of FASB Statement No. 140); and

• ASU 2009-17, Improvements to Financial Reporting

by Enterprises Involved with Variable Interest Entities

(FAS 167, Amendments to FASB Interpretation No. 46(R)).

Information about these pronouncements is further

described in more detail below.

ASU 2010-6 changes the disclosure requirements for fair

value measurements. Companies are now required to disclose

significant transfers in and out of Levels 1 and 2 of the fair

value hierarchy, whereas existing rules only require the dis-

closure of transfers in and out of Level 3. Additionally, in the

rollforward of Level 3 activity, companies should present

information on purchases, sales, issuances, and settlements

on a gross basis rather than on a net basis as is currently

allowed. The Update also clarifies that fair value measure-

ment disclosures should be presented for each class of assets

and liabilities. A class is typically a subset of a line item in the

statement of financial position. Companies should also pro-

vide information about the valuation techniques and inputs

used to measure fair value for both recurring and nonrecur-

ring instruments classified as either Level 2 or Level 3. ASU

2010-6 is effective for us in first quarter 2010 with prospective

application, except for the new requirement related to the

Level 3 rollforward. Gross presentation in the Level 3 rollfor-

ward is effective for us in first quarter 2011 with prospective

application. Our adoption of the Update will not affect our

consolidated financial results since it amends only the disclo-

sure requirements for fair value measurements.

ASU 2009-16 (FAS 166) modifies certain guidance contained

in FASB ASC 860, Transfers and Servicing. This pronouncement

eliminates the concept of QSPEs and provides additional

criteria transferors must use to evaluate transfers of financial

assets. To determine if a transfer is to be accounted for as

a sale, the transferor must assess whether it and all of the

entities included in its consolidated financial statements have

surrendered control of the assets. A transferor must consider

all arrangements or agreements made or contemplated at the

time of transfer before reaching a conclusion on whether

control has been relinquished. The new guidance addresses

situations in which a portion of a financial asset is transferred.

In such instances the transfer can only be accounted for as

a sale when the transferred portion is considered to be a

participating interest. The Update also requires that any

assets or liabilities retained from a transfer accounted for as a

sale be initially recognized at fair value. This pronouncement

is effective for us as of January 1, 2010, with adoption applied

prospectively for transfers that occur on and after the

effective date.

ASU 2009-17 (FAS 167) amends several key consolidation

provisions related to VIEs, which are included in FASB ASC

810, Consolidation. First, the scope of the new guidance

includes entities that are currently designated as QSPEs.

Second, companies are to use a different approach to identify

the VIEs for which they are deemed to be the primary

beneficiary and are required to consolidate. Under existing

rules, the primary beneficiary is the entity that absorbs the

majority of a VIE’s losses and receives the majority of the

VIE’s returns. The new guidance identifies a VIE’s primary

beneficiary as the entity that has the power to direct the

VIE’s significant activities, and has an obligation to absorb

losses or the right to receive benefits that could be potentially

significant to the VIE. Third, companies will be required to

continually reassess whether they are the primary beneficiary

of a VIE. Existing rules only require companies to reconsider

primary beneficiary conclusions when certain triggering

events have occurred. The Update is effective for us as of

January 1, 2010, and applies to all existing QSPEs and VIEs,

and VIEs created after the effective date.

We have performed an analysis of these accounting

pronouncements with respect to QSPE and VIE structures

currently applicable to us. Application of these new accounting

pronouncements will result in the January 1, 2010, consolida-

tion of certain QSPEs and VIEs that were not included in our

consolidated financial statements at December 31, 2009. Tables

32 and 33 present the estimated impacts to our financial state-

ments of those newly consolidated QSPEs and VIE structures.

Implementation of ASU 2009-17 (FAS 167) has been

deferred for certain investment funds and accordingly,

will not be consolidated under ASU 2009-17 (FAS 167).

Current Accounting Developments