Wells Fargo 2009 Annual Report Download - page 123

Download and view the complete annual report

Please find page 123 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

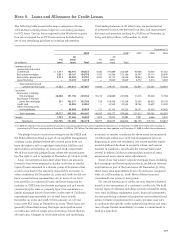

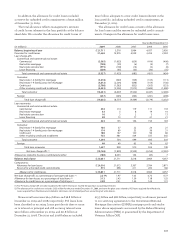

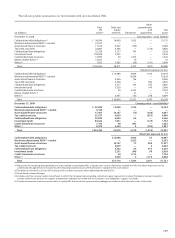

In addition, the allowance for credit losses included

a reserve for unfunded credit commitments of $515 million

at December 31, 2009.

The total allowance reflects management’s estimate

of credit losses inherent in the loan portfolio at the balance

sheet date. We consider the allowance for credit losses of

$25.0 billion adequate to cover credit losses inherent in the

loan portfolio, including unfunded credit commitments, at

December 31, 2009.

The allowance for credit losses consists of the allowance

for loan losses and the reserve for unfunded credit commit-

ments. Changes in the allowance for credit losses were:

Year ended December 31,

(in millions) 2009 2008 2007 2006 2005

Balance, beginning of year $ 21,711 5,518 3,964 4,057 3,950

Provision for credit losses 21,668 15,979 4,939 2,204 2,383

Loan charge-offs:

Commercial and commercial real estate:

Commercial (3,365) (1,653) (629) (414) (406)

Real estate mortgage (758) (29) (6) (5) (7)

Real estate construction (975) (178) (14) (2) (6)

Lease financing (229) (65) (33) (30) (35)

Total commercial and commercial real estate (5,327) (1,925) (682) (451) (454)

Consumer:

Real estate 1-4 family first mortgage (3,318) (540) (109) (103) (111)

Real estate 1-4 family junior lien mortgage (4,812) (2,204) (648) (154) (136)

Credit card (2,708) (1,563) (832) (505) (553)

Other revolving credit and installment (3,423) (2,300) (1,913) (1,685) (1,480)

Total consumer (14,261) (6,607) (3,502) (2,447) (2,280)

Foreign (237) (245) (265) (281) (298)

Total loan charge-offs (19,825) (8,777) (4,449) (3,179) (3,032)

Loan recoveries:

Commercial and commercial real estate:

Commercial 254 114 119 111 133

Real estate mortgage 33 5 8 19 16

Real estate construction 16 32313

Lease financing 20 13 17 21 21

Total commercial and commercial real estate 323 135 146 154 183

Consumer:

Real estate 1-4 family first mortgage 185 37 22 26 21

Real estate 1-4 family junior lien mortgage 174 89 53 36 31

Credit card 180 147 120 96 86

Other revolving credit and installment 755 481 504 537 365

Total consumer 1,294 754 699 695 503

Foreign 40 49 65 76 63

Total loan recoveries 1,657 938 910 925 749

Net loan charge-offs (1) (18,168) (7,839) (3,539) (2,254) (2,283)

Allowances related to business combinations/other (180) 8,053 154 (43) 7

Balance, end of year $ 25,031 21,711 5,518 3,964 4,057

Components:

Allowance for loan losses $ 24,516 21,013 5,307 3,764 3,871

Reserve for unfunded credit commitments 515 698 211 200 186

Allowance for credit losses $ 25,031 21,711 5,518 3,964 4,057

Net loan charge-offs as a percentage of average total loans (1) 2.21% 1.97 1.03 0.73 0.77

Allowance for loan losses as a percentage of total loans (2) 3.13 2.43 1.39 1.18 1.25

Allowance for credit losses as a percentage of total loans (2) 3.20 2.51 1.44 1.24 1.31

(1) For PCI loans, charge-offs are only recorded to the extent that losses exceed the purchase accounting estimates.

(2) The allowance for credit losses includes $333 million for the year ended December 31, 2009, and none for prior years related to PCI loans acquired from Wachovia.

Loans acquired from Wachovia are included in total loans, net of related purchase accounting net write-downs.

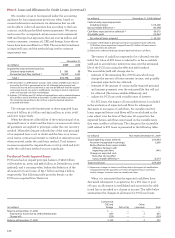

Nonaccrual loans were $24.4 billion and $6.8 billion at

December 31, 2009 and 2008, respectively. PCI loans have

been classified as accruing. Loans past due 90 days or more

as to interest or principal and still accruing interest were

$22.2 billion at December 31, 2009, and $11.8 billion at

December 31, 2008. The 2009 and 2008 balances included

$15.3 billion and $8.2 billion, respectively, in advances pursuant

to our servicing agreements to the Government National

Mortgage Association (GNMA) mortgage pools and similar

loans whose repayments are insured by the Federal Housing

Administration (FHA) or guaranteed by the Department of

Veterans Affairs (VA).