Wells Fargo 2009 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

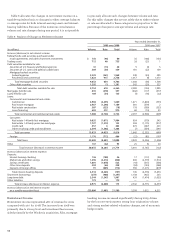

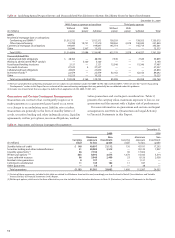

During 2009, we continued to grow core deposits even

though loan demand remained soft. Deposits increased

$42.6 billion in 2009 from a year ago, with $35.3 billion of the

increase in core deposits. Growth in deposits was due to the

increase in the U.S. money supply, a preference on the part

of consumers and businesses to maintain liquidity, and the

Company’s successful efforts to attract and retain deposits

from new and existing customers. Loans decreased $82.1 billion

from a year ago, before considering the impact of the $3.5 billion

increase in the allowance for loan losses. Commercial loan

demand was soft during 2009 as businesses reduced investing

in inventory, plant and equipment. Likewise, retail customer

borrowing declined as consumers limited their spending.

Excess deposits were therefore invested in liquid assets,

particularly in the latter half of 2009. Our rate mix of core

deposits improved with noninterest-bearing, interest-bearing

checking, and market rate and other lower cost savings deposits

increasing to 83% of total core deposits at December 31, 2009,

from 71% a year ago.

See the following sections for more discussion and details

about the major components of our balance sheet. Capital is

discussed in the “Capital Management” section of this Report.

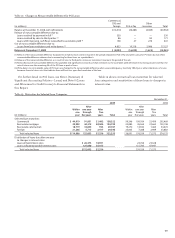

Securities Available for Sale

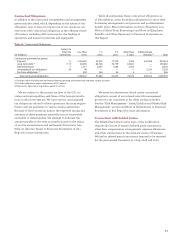

Securities available for sale consist of both debt and marketable

equity securities. We hold debt securities available for sale

primarily for liquidity, interest rate risk management and

long-term yield enhancement. Accordingly, this portfolio

consists primarily of very liquid, high-quality federal agency

debt and privately issued MBS. We held $167.1 billion of debt

securities available for sale, with net unrealized gains of

$4.8 billion, at December 31, 2009, compared with $145.4 billion,

with net unrealized losses of $9.8 billion a year ago. We also

held $5.6 billion of marketable equity securities available for

sale, with net unrealized gains of $843 million, at December 31,

2009, compared with $6.1 billion, with net unrealized losses

of $160 million a year ago. The total net unrealized gains on

securities available for sale were $5.6 billion at December 31,

2009, up from net unrealized losses of $9.9 billion at December 31,

2008, due to general decline in long-term yields and narrowing

of credit spreads. With the application of purchase accounting

at December 31, 2008, for the Wachovia portfolio, the net

unrealized losses in cumulative other comprehensive income

(OCI), a component of common equity, related entirely to

the legacy Wells Fargo portfolio at that date.

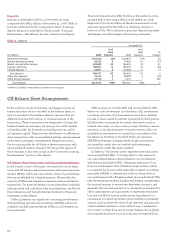

We analyze securities for OTTI on a quarterly basis, or

more often if a potential loss-triggering event occurs. Of the

$1.7 billion OTTI write-downs in 2009, $1.0 billion related to

debt securities and $655 million to equity securities. For a dis-

cussion of our OTTI accounting policies and underlying con-

siderations and analysis see Note 1 (Summary of Significant

Accounting Policies – Accounting Standards Adopted in 2009

– FASB ASC 320-10 and – Securities) and Note 5 (Securities

Available for Sale) to Financial Statements in this Report.

At December 31, 2009, we had approximately $8 billion of

investments in securities, primarily municipal bonds, which

are guaranteed against loss by bond insurers. These securities

are almost exclusively investment grade and were generally

underwritten in accordance with our own investment standards

prior to the determination to purchase, without relying on the

bond insurer’s guarantee in making the investment decision.

These securities will continue to be monitored as part of our

on-going impairment analysis of our securities available for

sale, but are expected to perform, even if the rating agencies

reduce the credit rating of the bond insurers.

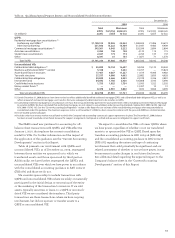

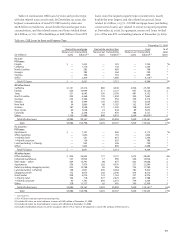

The weighted-average expected maturity of debt securities

available for sale was 5.6 years at December 31, 2009. Since

73% of this portfolio is MBS, the expected remaining maturity

may differ from contractual maturity because borrowers

generally have the right to prepay obligations before the

underlying mortgages mature. The estimated effect of a

200 basis point increase or decrease in interest rates on the

fair value and the expected remaining maturity of the MBS

available for sale are shown in Table 10.

See Note 5 (Securities Available for Sale) to Financial

Statements in this Report for securities available for sale by

security type.

Balance Sheet Analysis

Table 10: Mortgage-Backed Securities

Net Expected

Fair unrealized remaining

(in billions) value gain (loss) maturity

At December 31, 2009 $122.4 2.5 4.0

At December 31, 2009,

assuming a 200 basis point:

Increase in interest rates 113.0 (6.9) 5.4

Decrease in interest rates 128.8 8.9 2.6