Wells Fargo 2009 Annual Report Download - page 139

Download and view the complete annual report

Please find page 139 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

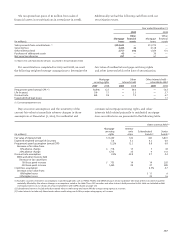

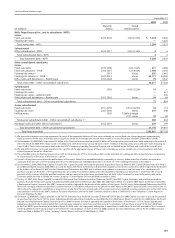

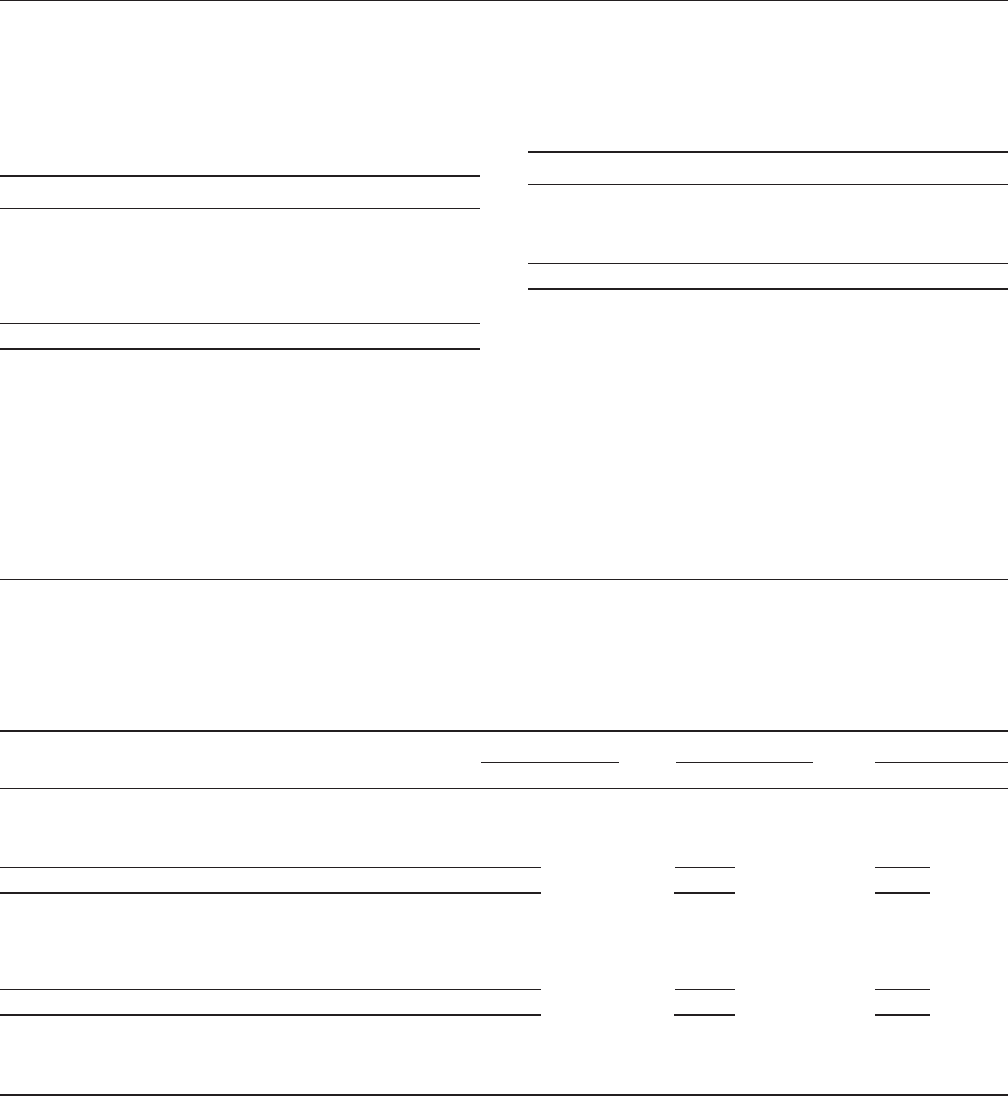

Note 12: Short-Term Borrowings

2009 2008 2007

(in millions) Amount Rate Amount Rate Amount Rate

As of December 31,

Commercial paper and other short-term borrowings $12,950 0.39% $ 45,871 0.93% $30,427 4.45%

Federal funds purchased and securities sold

under agreements to repurchase 26,016 0.08 62,203 1.12 22,828 2.94

Total $38,966 0.18 $108,074 1.04 $53,255 3.80

Year ended December 31,

Average daily balance

Commercial paper and other short-term borrowings $27,793 0.43 $ 43,792 2.43 $ 8,765 4.96

Federal funds purchased and securities sold

under agreements to repurchase 24,179 0.46 22,034 1.88 17,089 4.74

Total $51,972 0.44 $65,826 2.25 $25,854 4.81

Maximum month-end balance

Commercial paper and other short-term borrowings (1) $62,871 N/A $ 76,009 N/A $30,427 N/A

Federal funds purchased and securities sold

under agreements to repurchase (2) 30,608 N/A 62,203 N/A 23,527 N/A

N/A – Not applicable.

(1) Highest month-end balance in each of the last three years was February 2009, August 2008 and December 2007.

(2) Highest month-end balance in each of the last three years was February 2009, December 2008 and September 2007.

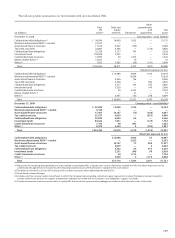

(in millions) December 31, 2009

Three months or less $10,146

After three months through six months 5,092

After six months through twelve months 8,592

After twelve months 19,907

Total $43,737

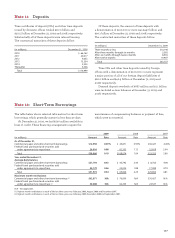

Time certificates of deposit (CDs) and other time deposits

issued by domestic offices totaled $117.0 billion and

$210.5 billion at December 31, 2009 and 2008, respectively.

Substantially all of these deposits were interest bearing.

The contractual maturities of these deposits follow.

Note 11: Deposits

Of these deposits, the amount of time deposits with

a denomination of $100,000 or more was $43.7 billion and

$90.1 billion at December 31, 2009 and 2008, respectively.

The contractual maturities of these deposits follow.

(in millions) December 31, 2009

2010 $ 66,162

2011 20,617

2012 9,635

2013 15,354

2014 2,225

Thereafter 3,006

Total $116,999

Time CDs and other time deposits issued by foreign

offices with a denomination of $100,000 or more represent

a major portion of all of our foreign deposit liabilities of

$60.0 billion and $40.9 billion at December 31, 2009 and

2008, respectively.

Demand deposit overdrafts of $667 million and $1.1 billion

were included as loan balances at December 31, 2009 and

2008, respectively.

The table below shows selected information for short-term

borrowings, which generally mature in less than 30 days.

At December 31, 2009, we had $500 million available in

lines of credit. These financing arrangements require the

maintenance of compensating balances or payment of fees,

which were not material.