Wells Fargo 2009 Annual Report Download - page 79

Download and view the complete annual report

Please find page 79 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

When an active market for a financial instrument does not

exist, the use of management estimates that incorporate

current market participant expectations of future cash flows,

adjusted for an appropriate risk premium, is acceptable.

In connection with the first quarter 2009 adoption of the

new fair value measurement guidance included in FASB ASC

820, Fair Value Measurements and Disclosures, we developed

policies and procedures to determine when markets for our

financial assets and liabilities are inactive if the level and vol-

ume of activity has declined significantly relative to normal

conditions. If markets are determined to be inactive, it may be

appropriate to adjust price quotes received. The methodology

we use to adjust the quotes generally involves weighting the

price quotes and results of internal pricing techniques, such

as the net present value of future expected cash flows (with

observable inputs, where available) discounted at a rate of

return market participants require to arrive at the fair value.

The more active and orderly markets for particular security

classes are determined to be, the more weighting we assign to

price quotes. The less active and orderly markets are deter-

mined to be, the less weighting we assign to price quotes.

We may use independent pricing services and brokers to

obtain fair values based on quoted prices. We determine the

most appropriate and relevant pricing service for each security

class and generally obtain one quoted price for each security.

For certain securities, we may use internal traders to obtain

quoted prices. Quoted prices are subject to our internal price

verification procedures. We validate prices received using a

variety of methods, including, but not limited to, comparison

to pricing services, corroboration of pricing by reference to

other independent market data such as secondary broker

quotes and relevant benchmark indices, and review of pricing

by Company personnel familiar with market liquidity and

other market-related conditions. We believe the determina-

tion of fair value for our securities is consistent with the

accounting guidance on fair value measurements.

Significant judgment may be required to determine

whether certain assets measured at fair value are included in

Level 2 or Level 3. When making this judgment, we consider

all available information, including observable market data,

indications of market liquidity and orderliness, and our

understanding of the valuation techniques and significant

inputs used. For securities in inactive markets, we use a pre-

determined percentage to evaluate the impact of fair value

adjustments derived from weighting both external and inter-

nal indications of value to determine if the instrument is

classified as Level 2 or Level 3. Otherwise, the classification

of Level 2 or Level 3 is based upon the specific facts and

circumstances of each instrument or instrument category

and judgments are made regarding the significance of the

Level 3 inputs to the instruments’ fair value measurement in

its entirety. If Level 3 inputs are considered significant, the

instrument is classified as Level 3.

Our financial assets valued using Level 3 measurements

consisted of certain asset-backed securities, including those

collateralized by auto leases or loans and cash reserves, pri-

vate collateralized mortgage obligations (CMOs), collateral-

ized debt obligations (CDOs), collateralized loan obligations

(CLOs), auction-rate securities, certain derivative contracts

such as credit default swaps related to CMO, CDO and CLO

exposures and certain MHFS and MSRs.

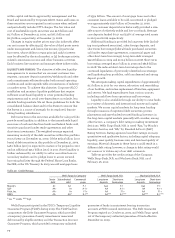

Approximately 22% of total assets ($277.4 billion) at

December 31, 2009, and 19% of total assets ($247.5 billion) at

December 31, 2008, consisted of financial instruments recorded

at fair value on a recurring basis. The fair value of assets

measured using significant Level 3 inputs (before derivative

netting adjustments) represented approximately 19% of these

financial instruments (4% of total assets) at December 31, 2009,

and approximately 22% (4% of total assets) at December 31, 2008.

The fair value of the remaining assets was measured using

valuation methodologies involving market-based or market-

derived information, collectively Level 1 and 2 measurements.

Approximately 2% of total liabilities ($22.8 billion) at

December 31, 2009, and 2% ($18.8 billion) at December 31,

2008, consisted of financial instruments recorded at fair value

on a recurring basis. The fair value of liabilities measured

using Level 3 inputs (before derivative netting adjustments)

was $7.9 billion and $9.3 billion at December 31, 2009 and

2008, respectively.

See Note 16 (Fair Values of Assets and Liabilities) to

Financial Statements in this Report for a complete discussion

on our use of fair valuation of financial instruments, our

related measurement techniques and its impact to our

financial statements.

Pension Accounting

We account for our defined benefit pension plans using an

actuarial model. The funded status of our pension and postre-

tirement benefit plans is recognized in our balance sheet.

In 2008, we began measuring our plan assets and benefit

obligations using a year-end measurement date.

On April 28, 2009, the Board approved amendments to freeze

the benefits earned under the Wells Fargo qualified and sup-

plemental Cash Balance Plans and the Wachovia Corporation

Pension Plan, and to merge the Pension Plan into the qualified

Cash Balance Plan. These actions became effective on July 1, 2009.

We use four key variables to calculate our annual pension

cost: size and characteristics of the employee population,

actuarial assumptions, expected long-term rate of return on

plan assets, and discount rate. We describe below the effect

of each of these variables on our pension expense.

SIZE AND CHARACTERISTICS OF THE EMPLOYEE POPULATION

Pension expense is directly related to the number of employees

covered by the plans, and other factors including salary, age

and years of employment. As of July 1, 2009, pension expense

will no longer be dependent on salaries earned and service

cost will no longer be recognized for the plans that were

frozen in 2009. In 2009, pension expense for the qualified and

unqualified Cash Balance plans was about $317 million, which

includes one-time curtailment gains of $59 million resulting

from the freezing of these plans. In 2010, pension expense

for these plans is estimated to be a credit of approximately

$44 million; the decrease in pension expense in 2010 is

primarily due to no longer incurring service cost.