Wells Fargo 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

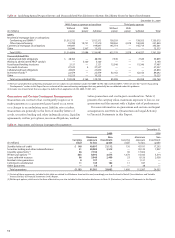

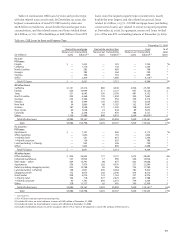

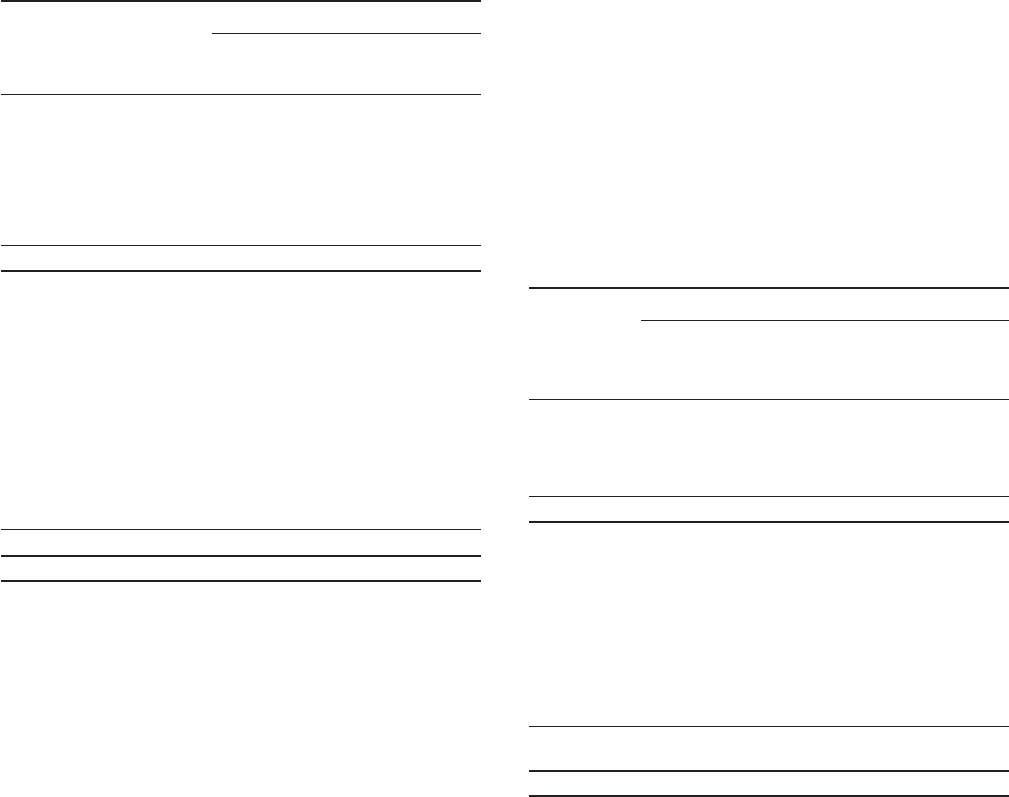

COMMERCIAL LOANS AND LEASE FINANCING For purposes of

portfolio risk management, we aggregate commercial loans

and lease financing according to market segmentation and

standard industry codes. Table 21 summarizes commercial

loans and lease financing by industry with the related

nonaccrual totals. This portfolio has experienced less credit

deterioration than our CRE portfolio as evidenced by its

lower nonaccrual rate of 2.6% compared with 5.2% for the CRE

portfolios. We believe this portfolio is well underwritten and

is diverse in its risk with relatively even concentrations across

several industries.

REAL ESTATE - FAMILY FIRST MORTGAGE LOANS As part of the

Wachovia acquisition, we acquired residential first and home

equity loans that are very similar to the Wells Fargo core

originated portfolio. We also acquired the Pick-a-Pay portfolio,

which is composed primarily of option payment adjustable-rate

mortgage and fixed-rate mortgage products. Under purchase

accounting for the Wachovia acquisition, we made purchase

accounting adjustments to the Pick-a-Pay loans considered

to be impaired under accounting guidance for PCI loans.

See the “Risk Management – Pick-a-Pay Portfolio” section

in this Report for additional detail.

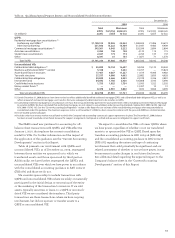

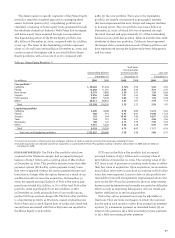

Table 22: Real Estate 1-4 Family Mortgage Loans by State

December 31, 2009

Real estate Real estate Total real

1-4 family 1-4 family estate 1-4 % of

first junior lien family total

(in millions) mortgage mortgage mortgage loans

PCI loans:

California $ 25,265 82 25,347 3%

Florida 4,288 67 4,355 1

New Jersey 1,196 34 1,230 *

Other (1) 7,637 148 7,785 1

Total PCI loans $ 38,386 331 38,717 5%

All other loans:

California $ 52,229 29,731 81,960 11%

Florida 19,284 9,210 28,494 4

New Jersey 9,230 6,801 16,031 2

Virginia 5,915 4,995 10,910 1

New York 6,769 4,071 10,840 1

Pennsylvania 6,396 4,343 10,739 1

North Carolina 6,464 4,043 10,507 1

Georgia 5,003 3,816 8,819 1

Texas 6,900 1,769 8,669 1

Other (2) 72,960 34,598 107,558 14

Total all

other loans $191,150 103,377 294,527 37%

Total $229,536 103,708 333,244 42%

* Less than 1%.

(1) Consists of 47 states; no state had loans in excess of $975 million.

(2) Consists of 41 states; no state had loans in excess of $7.8 billion.

Includes $15.2 billion in GNMA pool buyouts.

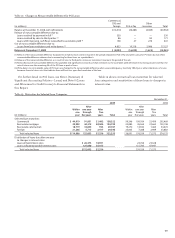

Table 21: Commercial Loans and Lease Financing by Industry

December 31, 2009

% of

Nonaccrual Outstanding total

(in millions) loans balance(1) loans

PCI loans:

Real estate investment trust $ — 351 *%

Media — 314 *

Investors — 140 *

Residential construction — 122 *

Insurance — 118 *

Leisure — 110 *

Other — 756(2) *

Total PCI loans $ — 1,911 *%

All other loans:

Financial institutions $ 496 11,111 1%

Oil and gas 202 8,464 1

Healthcare 88 8,397 1

Cyclical retailers 77 8,316 1

Industrial equipment 71 8,188 1

Food and beverage 119 7,524 1

Real estate – other 99 6,722 1

Business services 167 6,570 1

Transportation 31 6,469 1

Public administration 17 5,785 1

Technology 15 5,752 1

Utilities 72 5,489 1

Other 3,114 81,864(3) 10

Total all other loans $4,568 170,651 22%

Total $4,568 172,562 22%

* Less than 1%.

(1) For PCI loans amounts represent carrying value.

(2) No other single category had loans in excess of $87 million.

(3) No other single category had loans in excess of $5.3 billion. The next largest

categories included investors, hotel/restaurant, media, securities firms,

non-residential construction, leisure, trucking, dairy, gaming and contractors.

The concentrations of real estate 1-4 family mortgage

loans by state are presented in Table 22. Our real estate 1-4

family mortgage loans to borrowers in the state of California

represented approximately 14% of total loans at both

December 31, 2009 and 2008, mostly within the larger

metropolitan areas, with no single area consisting of more

than 3% of total loans. Of this amount, 3% of total loans were

PCI loans from Wachovia. Changes in real estate values and

underlying economic or market conditions for these areas are

monitored continuously within the credit risk management

process. Beginning in 2007, the residential real estate markets

began to experience significant declines in property values

and several markets in California, specifically in Southern

California and the Central Valley, experienced declines that

turned out to be more significant than the national decline.

Some of our real estate 1-4 family mortgage loans, including

first mortgage and home equity products, include an interest-

only feature as part of the loan terms. At December 31, 2009,

these loans were approximately 15% of total loans, compared

with 11% at the end of 2008. Most of these loans are considered

to be prime or near prime. We have manageable adjustable-

rate mortgage (ARM) reset risk across our Wells Fargo

originated and owned mortgage loan portfolios.