Wells Fargo 2009 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

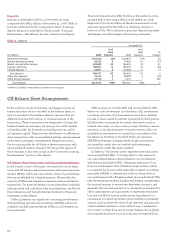

increased delinquencies and heightened investor repurchase

demands on prior years loan sales within the current

environment. To the extent that economic conditions and the

housing market do not recover or future investor repurchase

demand and appeals success rates differ from past experience,

we could continue to have increased demands and increased

loss severity on repurchases, causing future additions to the

repurchase reserve. For additional information about mort-

gage loan repurchases, see the “Risk Management – Credit

Risk Management Process – Reserve for Mortgage Loan

Repurchase Losses” section in this Report. Net write-downs

for mortgage loans while they were in the warehouse/pipeline

totaled $164 million during 2009 and $584 million during

2008, due to the deterioration in the overall credit market

and related secondary market liquidity challenges. Similar

losses on the warehouse/pipeline could be possible in the

future if housing market values do not recover.

Income from trading activities was $2.7 billion in 2009,

up from $275 million a year ago. This increase was driven

by $1.8 billion in investment banking activities in our fixed

income, financial products, equities and municipal businesses

in large part due to Wachovia’s investment banking business.

The majority of the remaining 2009 trading gains were

driven by various hedging activities of interest rate and credit

exposures using cash and derivative trading instruments.

Net losses on debt securities available for sale were

$127 million in 2009, compared with net gains of $1.0 billion a

year ago. Net gains from equity investments were $185 million

in 2009, compared with net losses of $757 million in 2008,

which included a $334 million gain from our ownership

interest in Visa, which completed its initial public offering in

March 2008. Net gains and losses on debt and equity securities

totaled $58 million, after OTTI write-downs of $1.7 billion, in

2009 and $280 million, after OTTI write-downs of $2.0 billion,

in 2008. The 2008 OTTI write-downs included $646 million for

securities of Fannie Mae, Freddie Mac and Lehman Brothers.

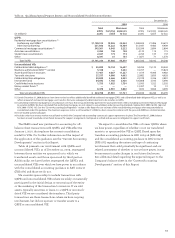

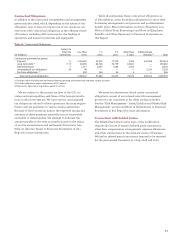

Noninterest Expense

The increase in noninterest expense to $49.0 billion in 2009

from a year ago was predominantly due to the acquisition of

Wachovia, increased staffing and other costs related to problem

loan modifications and workouts, special deposit assessments

and operating losses. The acquisition of Wachovia resulted in

an expanded geographic platform and capabilities in businesses

such as retail brokerage, asset management and investment

banking. As part of our integration investment to enhance

both the short- and long-term benefits to our customers, we

added sales and service team members to align Wachovia’s

banking stores and other distribution channels with Wells Fargo’s

model. Commission and incentive compensation expense

increased proportionately more than salaries due to higher

2009 revenues generated by businesses with revenue-based

compensation, including the retail securities brokerage business

acquired from Wachovia and our mortgage business.

Noninterest expense included $895 million of Wachovia

merger-related integration expense for 2009. Employee bene-

fit expense in 2009 reflected actions related to freezing the

Wells Fargo and Wachovia Cash Balance pension plans, which

lowered pension cost by approximately $500 million for 2009,

and reflected $150 million of additional expense for a 401(k)

profit sharing contribution to all eligible team members.

See Note 19 (Employee Benefits and Other Expenses) to

Financial Statements in this Report for additional information.

Salaries and employee benefits also reflected increased

staffing levels to handle the higher volume of mortgage loan

modifications, which continued to increase throughout 2009,

driven by both federal and our own proprietary loan modifica-

tion programs to help customers stay in their homes. FDIC

and other deposit assessments, which included additional

assessments related to the FDIC Transaction Account

Guarantee Program in 2009, were $1.8 billion in 2009, including

a mid-year 2009 FDIC special assessment of $565 million.

See the “Risk Management – Liquidity and Funding” section

in this Report for additional information. Operating losses

included a $261 million reserve for an auction rate securities

(ARS) settlement. See Note 8 (Securitizations and Variable

Interest Entities) to Financial Statements in this Report for

more information.

Income Tax Expense

Our effective income tax rate was 30.3% in 2009, up from

18.5% in 2008. The increase is primarily attributable to higher

pre-tax earnings and increased tax expense (with a comparable

increase in interest income) associated with purchase accounting

for leveraged leases, partially offset by higher levels of tax

exempt income, tax credits and the impact of changes in our

liability for uncertain tax positions. We recognized a net tax

benefit of approximately $150 million and $200 million during

the fourth quarter and year-ended December 31, 2009, respectively,

primarily related to changes in our uncertain tax positions,

due to federal and state income tax settlements.

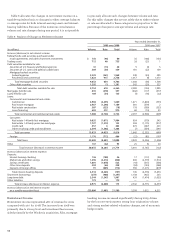

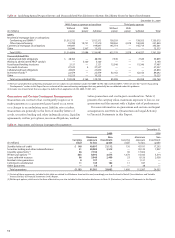

Table 8: Noninterest Expense

Year endedDecember 31,

(in millions) 2009 2008 2007

Salaries $13,757 8,260 7,762

Commission and incentive compensation 8,021 2,676 3,284

Employee benefits 4,689 2,004 2,322

Equipment 2,506 1,357 1,294

Net occupancy 3,127 1,619 1,545

Core deposit and other intangibles 2,577 186 158

FDIC and other deposit assessments 1,849 120 34

Outside professional services 1,982 847 899

Contract services 1,088 407 448

Foreclosed assets 1,071 414 256

Outside data processing 1,027 480 482

Postage, stationery and supplies 933 556 565

Operating losses 875 142 437

Insurance 845 725 416

Telecommunications 610 321 321

Travel and entertainment 575 447 474

Advertising and promotion 572 378 412

Operating leases 227 389 561

All other 2,689 1,270 1,076

Total $49,020 22,598 22,746