Wells Fargo 2009 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

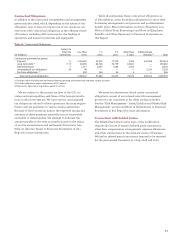

While commercial and CRE nonaccrual loans were up in

2009, the dollar amount of the increase declined between

quarters and the rate of growth slowed considerably through-

out the year. Commercial and CRE nonaccrual loans increased

$8.6 billion, or 295%, from December 31, 2008. Similarly, the

growth rate in consumer nonaccrual loans also slowed in

2009. Wells Fargo’s consumer nonaccrual loans increased

$8.9 billion, or 233%, from December 31, 2008. Wachovia’s

Pick-a-Pay portfolio represents the largest portion of con-

sumer nonaccrual loans and was up $3.3 billion in 2009.

Total consumer TDRs amounted to $8.3 billion at December 31,

2009, compared with $1.6 billion at December 31, 2008. Of the

TDRs, $2.1 billion at December 31, 2009, and $409 million at

December 31, 2008, were classified as nonaccrual. Consumer

loans that enter into a TDR before they reach nonaccrual status

(normally 120 days past due) remain in accrual status as long

as they continue to perform according to the terms of the

TDR. We strive to identify troubled loans and work with the

customer to modify to more affordable terms before their loan

reaches nonaccrual status. Accordingly, during 2009 most

consumer loans were in accrual status at the time of TDR and

therefore most of our consumer TDR loans are in accrual status

at the end of the year. We establish an impairment reserve

when a loan is restructured in a TDR.

At December 31, 2008, total nonaccrual loans were

$6.8 billion (0.79% of total loans) up from $2.7 billion (0.70%)

at December 31, 2007. A significant portion of the $4.1 billion

increase in nonaccrual loans was in the real estate 1-4 family

first mortgage portfolio, including $742 million in Wells Fargo

Financial real estate and $424 million in Wells Fargo Home

Mortgage, and was due to the national rise in mortgage

default rates. Total NPAs were $9.0 billion (1.04% of total

loans) at December 31, 2008, compared with $3.9 billion

(1.01%) at December 31, 2007. Total NPAs at December 31,

2008, excluded $20.0 billion of PCI loans that were previously

reflected as nonperforming by Wachovia.

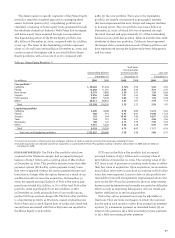

We expect NPAs to continue to grow, in part reflecting our

efforts to modify more real estate loans to reduce foreclosures

and keep customers in their homes. We remain focused on

proactively identifying problem credits, moving them to non-

performing status and recording the loss content in a timely

manner. We have increased and will continue to increase

staffing in our workout and collection organizations to ensure

these troubled borrowers receive the attention and help they

need. See the “Risk Management – Allowance for Credit

Losses” section in this Report for additional discussion.

The performance of any one loan can be affected by external

factors, such as economic or market conditions, or factors

affecting a particular borrower.

If interest due on the book balances of all nonaccrual loans

(including loans that were, but are no longer on nonaccrual

at year end) had been accrued under the original terms,

approximately $815 million of interest would have been

recorded as income in 2009, compared with $71 million

recorded as interest income.

At December 31, 2009, substantially all of our foreclosed

assets of $3.2 billion have been in the portfolio one year or less.

LOANS DAYS OR MORE PAST DUE AND STILL ACCRUING

Loans included in this category are 90 days or more past due

as to interest or principal and still accruing, because they are

(1) well-secured and in the process of collection or (2) real

estate 1-4 family first mortgage loans or consumer loans exempt

under regulatory rules from being classified as nonaccrual.

PCI loans are excluded from the disclosure of loans 90 days or

more past due and still accruing interest. Even though certain

of them are 90 days or more contractually past due, they are

considered to be accruing because the interest income on

these loans relates to the establishment of an accretable yield

under the accounting for PCI loans and not to contractual

interest payments.

Loans 90 days or more past due and still accruing totaled

$22.2 billion, $11.8 billion, $6.4 billion, $5.1 billion and $3.6 billion

at December 31, 2009, 2008, 2007, 2006 and 2005, respectively.

The total included $15.3 billion, $8.2 billion, $4.8 billion,

$3.9 billion and $2.9 billion for the same dates, respectively,

in advances pursuant to our servicing agreements to GNMA

mortgage pools and similar loans whose repayments are

insured by the FHA or guaranteed by the VA.

Table 27 reflects loans 90 days or more past due and still

accruing excluding the insured/guaranteed GNMA and

similar loans.

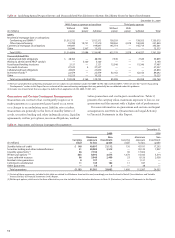

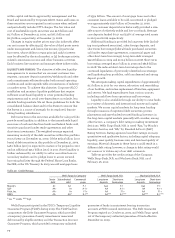

Table 27: Loans 90 Days or More Past Due and Still Accruing

(Excluding Insured/Guaranteed GNMA and Similar Loans)

December 31,

(in millions) 2009 2008 2007 2006 2005

Commercial and

commercial real estate:

Commercial $ 590 218 32 15 18

Real estate mortgage 1,183 88 10 3 13

Real estate construction 740 232 24 3 9

Total commercial

and commercial

real estate 2,513 538 66 21 40

Consumer:

Real estate

1-4 family

first mortgage (1) 1,623 883 286 154 103

Real estate

1-4 family junior

lien mortgage 515 457 201 63 50

Credit card 795 687 402 262 159

Other revolving credit

and installment 1,333 1,047 552 616 290

Total consumer 4,266 3,074 1,441 1,095 602

Foreign 73 34 52 44 41

Total $6,852 3,646 1,559 1,160 683

(1) Includes mortgage loans held for sale 90 days or more past due and still accruing.

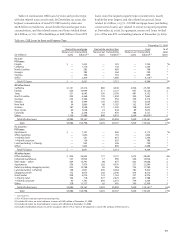

NET CHARGE-OFFS Table 28 presents net charge-offs for the

four quarters and full year of 2009.