Wells Fargo 2009 Annual Report Download - page 127

Download and view the complete annual report

Please find page 127 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

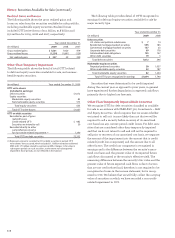

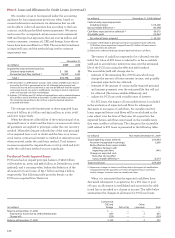

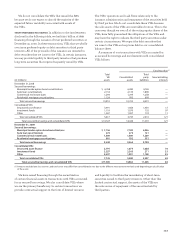

Transfers that

VIEs that we VIEs we account

do not that we for as secured

(in millions) QSPEs consolidate (1) consolidate borrowings Total

December 31, 2008

Cash $ — — 117 287 404

Trading account assets 1,261 5,241 71 141 6,714

Securities (2) 18,078 15,117 922 6,094 40,211

Mortgages held for sale 56 — — — 56

Loans (3) — 16,882 217 4,126 21,225

Mortgage servicing rights (4) 14,966 — — — 14,966

Other assets 345 5,022 2,416 55 7,838

Total assets 34,706 42,262 3,743 10,703 91,414

Short-term borrowings — — 307 1,440 1,747

Accrued expenses and other liabilities (4) 514 1,976 330 26 2,846

Long-term debt — — 1,773 7,125 8,898

Noncontrolling interests — — 121 — 121

Total liabilities and noncontrolling interests 514 1,976 2,531 8,591 13,612

Net assets $ 34,192 40,286 1,212 2,112 77,802

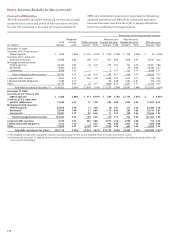

December 31, 2009

Cash $ — — 273 328 601

Trading account assets 1,309 4,788 77 35 6,209

Securities (2) 21,015 14,171 1,794 7,126 44,106

Loans (3) — 15,698 561 2,007 18,266

Mortgage servicing rights 16,233 — — — 16,233

Other assets 41 5,563 2,595 68 8,267

Total assets 38,598 40,220 5,300 9,564 93,682

Short-term borrowings — — 351 1,996 2,347

Accrued expenses and other liabilities 1,113 2,239 708 4,864 8,924

Long-term debt — — 1,448 1,938 3,386

Noncontrolling interests — — 68 — 68

Total liabilities and noncontrolling interests 1,113 2,239 2,575 8,798 14,725

Net assets $37,485 37,981 2,725 766 78,957

(1) Reverse repurchase agreements of $20 million are included in other assets at December 31, 2009. These instruments were included in loans at December 31, 2008,

in the amount of $349 million. The balance for securities at December 31, 2008, has been revised to reflect the removal of funds for which we had no contractual

support arrangements.

(2) Excludes certain debt securities related to loans serviced for the Federal National Mortgage Association (FNMA), Federal Home Loan Mortgage Corporation (FHLMC)

and Government National Mortgage Association (GNMA).

(3) Excludes related allowance for loan losses.

(4) Balances related to QSPEs involving mortgage servicing rights and accrued expenses and other liabilities have been revised to reflect additionally identified QSPEs.

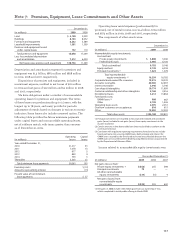

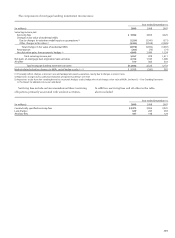

The classifications of assets and liabilities in our balance sheet associated with our transactions with QSPEs and VIEs follow:

Transactions with QSPEs

We use QSPEs to securitize consumer and CRE loans and

other types of financial assets, including student loans,

auto loans and municipal bonds. We typically retain the ser-

vicing rights from these sales and may continue to hold other

beneficial interests in QSPEs. We may also provide liquidity

to investors in the beneficial interests and credit enhance-

ments in the form of standby letters of credit. Through these

securitizations we may be exposed to liability under limited

amounts of recourse as well as standard representations and

warranties we make to purchasers and issuers. The amount

recorded for this liability is included in other commitments

and guarantees in the following table.

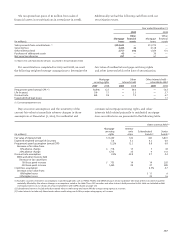

The following disclosures regarding our continuing

involvement with QSPEs and unconsolidated VIEs exclude

entities where our only involvement is in the form of:

(1) investments in trading securities, (2) investments in

securities or loans underwritten by third parties, (3) derivative

counterparty for certain derivatives such as interest rate

swaps or cross currency swaps that have customary terms,

and (4) administrative or trustee services. We determined

these forms of involvement are not significant due to the

temporary nature and size as well as our lack of involvement

in the design or operations of unconsolidated VIEs or

QSPEs. Also not included are investments accounted for

in accordance with the AICPA Investment Company Audit

Guide, investments accounted for under the cost method

and investments accounted for under the equity method.