Wells Fargo 2009 Annual Report Download - page 151

Download and view the complete annual report

Please find page 151 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

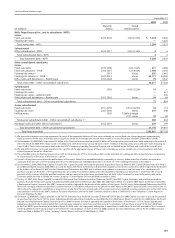

Year ended

(in millions) December 31, 2009

Gains (losses) recognized on free-standing

derivatives (economic hedges)

Interest rate contracts (1)

Recognized in noninterest income:

Mortgage banking $5,582

Other (15)

Foreign exchange contracts 133

Credit contracts (269)

Subtotal 5,431

Gains (losses) recognized on customer

accommodation, trading and other

free-standing derivatives

Interest rate contracts (2)

Recognized in noninterest income:

Mortgage banking 2,035

Other 1,139

Commodity contracts 29

Equity contracts (275)

Foreign exchange contracts 607

Credit contracts (621)

Other (187)

Subtotal 2,727

Net gains recognized related to derivatives

not designated as hedging instruments $8,158

(1) Predominantly mortgage banking noninterest income including gains (losses)

on the derivatives used as economic hedges of MSRs, interest rate lock

commitments, loans held for sale and mortgages held for sale.

(2) Predominantly mortgage banking noninterest income including gains (losses)

on interest rate lock commitments.

Interest rate lock commitments for residential mortgage

loans that we intend to sell are considered free-standing

derivatives. Our interest rate exposure on these derivative

loan commitments, as well as most new prime residential

MHFS for which we have elected the fair value option, is

hedged with free-standing derivatives (economic hedges)

such as forwards and options, Eurodollar futures and options,

and Treasury futures, forwards and options contracts. The

commitments, free-standing derivatives and residential MHFS

are carried at fair value with changes in fair value included in

mortgage banking noninterest income. For interest rate lock

commitments we include, at inception and during the life of

the loan commitment, the expected net future cash flows

related to the associated servicing of the loan as part of the

fair value measurement of derivative loan commitments.

Changes subsequent to inception are based on changes in

fair value of the underlying loan resulting from the exercise of

the commitment and changes in the probability that the loan

will not fund within the terms of the commitment (referred to

as a fall-out factor). The value of the underlying loan is affect-

ed primarily by changes in interest rates and the passage of

time. However, changes in investor demand, such as concerns

about credit risk, can also cause changes in the spread rela-

tionships between underlying loan value and the derivative

financial instruments that cannot be hedged. The aggregate

fair value of derivative loan commitments in the balance

sheet was a net liability of $312 million and a net asset of

$125 million at December 31, 2009, and 2008, respectively,

and is included in the caption “Interest rate contracts” under

“Customer accommodation, trading and other free standing

derivatives” in the table on page 147.

We also enter into various derivatives primarily to provide

derivative products to customers. To a lesser extent, we take

positions based on market expectations or to benefit from

price differentials between financial instruments and markets.

These derivatives are not linked to specific assets and liabili-

ties in the balance sheet or to forecasted transactions in an

accounting hedge relationship and, therefore, do not qualify

for hedge accounting. We also enter into free-standing deriva-

tives for risk management that do not otherwise qualify for

hedge accounting. They are carried at fair value with changes

in fair value recorded as part of other noninterest income.

Additionally, free-standing derivatives include embedded

derivatives that are required to be accounted for separate

from their host contract. We periodically issue hybrid long-

term notes and CDs where the performance of the hybrid

instrument notes is linked to an equity, commodity or cur-

rency index, or basket of such indices. These notes contain

explicit terms that affect some or all of the cash flows or the

value of the note in a manner similar to a derivative instru-

ment and therefore are considered to contain an “embedded”

derivative instrument. The indices on which the performance

of the hybrid instrument is calculated are not clearly and

closely related to the host debt instrument. In accordance

with accounting guidance for derivatives, the “embedded”

derivative is separated from the host contract and accounted

for as a free-standing derivative.

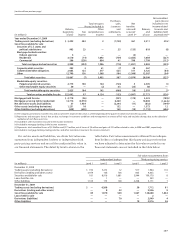

The following table shows the net gains (losses)

recognized in the income statement related to derivatives

not designated as hedging instruments under the Derivatives

and Hedging topic of the Codification.

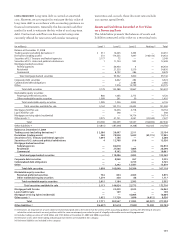

Credit Derivatives

We use credit derivatives to manage exposure to credit

risk related to lending and investing activity and to assist

customers with their risk management objectives. This may

include protection sold to offset purchased protection in

structured product transactions, as well as liquidity agree-

ments written to special purpose vehicles. The maximum

exposure of sold credit derivatives is managed through

posted collateral, purchased credit derivatives and similar

products in order to achieve our desired credit risk profile.

This credit risk management provides an ability to recover a

significant portion of any amounts that would be paid under

the sold credit derivatives. We would be required to perform

under the noted credit derivatives in the event of default by

the referenced obligors. Events of default include events

such as bankruptcy, capital restructuring or lack of principal

and/or interest payment. In certain cases, other triggers may

exist, such as the credit downgrade of the referenced obligors

or the inability of the special purpose vehicle for which we

have provided liquidity to obtain funding.

The following table provides details of sold and purchased

credit derivatives. In 2009, we exited the legacy Wachovia

market making activity of credit correlation trading resulting

in a significant reduction in our credit derivative and

counterparty credit exposures from December 31, 2008.