Wells Fargo 2009 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

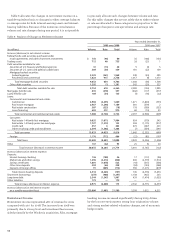

Key merger achievements included the conversion of

Wachovia offices to the commercial banking model, revenue

synergies through our government banking and global finan-

cial institutions and trade services businesses and enhance-

ment of our investment banking business across the franchise

by combining the best of the two companies’ advisory,

financing and securities distribution capabilities.

Wealth, Brokerage and Retirement provides a full range of

financial advisory services to clients. Wealth Management

provides affluent and high-net-worth clients with a complete

range of wealth management solutions including financial

planning, private banking, credit, investment management,

trust and estate services, business succession planning and

charitable services along with bank-based brokerage services

through Wells Fargo Advisors and Wells Fargo Investments,

LLC. Family Wealth provides family-office services to ultra-

high-net-worth clients and is one of the largest multi-family

financial office practices in the United States. Retail Brokerage’s

financial advisors serve customers’ advisory, brokerage

and financial needs as part of one of the largest full-service

brokerage firms in the United States. Retirement provides

retirement services for individual investors and is a national

leader in 401(k) and pension record keeping. The addition of

Wachovia in first quarter 2009 added the following businesses

to this operating segment: Wells Fargo Advisors (retail

brokerage), wealth management, including its family wealth

business, and retirement and reinsurance business.

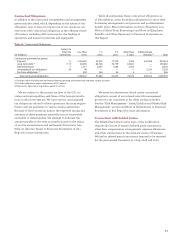

Wealth, Brokerage and Retirement earned net income of

$1.0 billion in 2009. Revenue of $11.5 billion included a mix

of brokerage commissions, asset-based fees and net interest

income. The equity market recovery helped drive growth in

fee income. Deposit balances grew 33% during the year. Net

interest income growth was dampened by the exceptionally

low short-term interest rate environment. Expenses increased

from the prior year due to the addition of Wachovia and the

loss reserve for the ARS legal settlement. Expense growth was

mitigated by the realization of merger synergies during the

year. The wealth, brokerage and retirement businesses have

solidified partnerships throughout Wells Fargo, working with

Community Banking and Wholesale Banking to provide

financial solutions for clients.

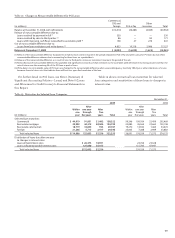

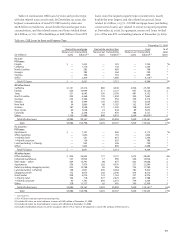

Earnings Performance – Comparison of with

Wells Fargo net income in 2008 was $2.7 billion ($0.70 per

common share), compared with $8.1 billion ($2.38 per common

share) in 2007. Results for 2008 included the impact of our

$8.1 billion (pre tax) credit reserve build, $2.0 billion (pre tax)

of OTTI and $124 million (pre tax) of merger-related expenses.

Results for 2007 included the impact of our $1.4 billion

(pre tax) credit reserve build and $203 million (pre tax) of

Visa litigation expenses. Despite the challenging environment

in 2008, we achieved both top line revenue growth and

positive operating leverage (revenue growth of 6%; expense

decline of 1%).

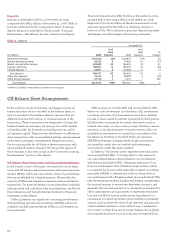

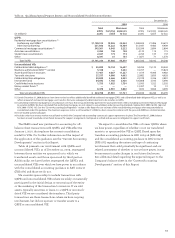

Revenue, the sum of net interest income and noninterest

income, grew 6% to $41.9 billion in 2008 from $39.5 billion in

2007. The breadth and depth of our business model resulted

in very strong and balanced growth in loans, deposits and

fee-based products. We achieved positive operating leverage

(revenue growth of 6%; expense decline of 1%), the best

among large bank peers. Wells Fargo net income for 2008 of

$2.7 billion included an $8.1 billion (pre tax) credit reserve

build, $2.0 billion (pre tax) of OTTI and $124 million (pre tax)

of merger-related expenses. Diluted earnings per share of

$0.70 for 2008 included credit reserve build ($1.51 per share)

and OTTI ($0.37 per share). Industry-leading annual results

included the highest growth in pre-tax pre-provision earnings

(up 15%), highest net interest margin (4.83%), return on average

common stockholders’ equity (ROE), return on average total

assets (ROA) and highest total shareholder return among

large bank peers (up 2%).

Net interest income on a taxable-equivalent basis was

$25.4 billion in 2008, up from $21.1 billion in 2007, reflecting

strong loan growth, disciplined deposit pricing and lower

market funding costs. Average earning assets grew 17% from

2007. Our net interest margin was 4.83% for 2008, up from

4.74% in 2007, primarily due to the benefit of lower funding

costs as market rates declined.

Noninterest income decreased 10% to $16.7 billion in 2008

from $18.5 billion in 2007. Card fees were up 9% from 2007,

due to continued growth in new accounts and higher credit

and debit card transaction volume. Insurance revenue was up

20%, due to customer growth, higher crop insurance revenue

and the fourth quarter 2007 acquisition of ABD Insurance.

However, trust and investment fees decreased 7% and other

fees decreased 9%, due to depressed market conditions.

Operating lease income decreased 39% from 2007, due to

continued softening in the auto market, reflecting tightened

credit standards. Noninterest income included $280 million in

net gains on debt and equity securities, including $2.0 billion

of OTTI write-downs.

Noninterest expense was $22.6 billion in 2008, down 1%

from $22.7 billion in 2007. We continued to invest in new

stores and additional sales and service-related team members.

Operating lease expense decreased 31% to $389 million in

2008 from $561 million in 2007, as we stopped originating

new indirect auto leases in third quarter 2008. Insurance

expense increased to $725 million in 2008 from $416 million

in 2007 due to the fourth quarter 2007 acquisition of ABD

Insurance, additional insurance reserves at our captive

mortgage reinsurance operation as well as higher

commissions on increased sales volume.