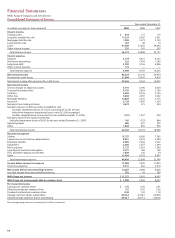

Wells Fargo 2009 Annual Report Download - page 83

Download and view the complete annual report

Please find page 83 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

An investment in the Company involves risk, including

the possibility that the value of the investment could fall

substantially and that dividends or other distributions on the

investment could be reduced or eliminated. We discuss below

and elsewhere in this Report, as well as in other documents we

file with the SEC, risk factors that could adversely affect our

financial results and condition and the value of, and return on,

an investment in the Company. We refer you to the Financial

Review section and Financial Statements (and related Notes)

in this Report for more information about credit, interest

rate, market and litigation risks and to the “Regulation and

Supervision” section of our 2009 Form 10-K for more

information about legislative and regulatory risks. Any factor

described below or elsewhere in this Report or in our 2009

Form 10-K could by itself, or together with other factors,

adversely affect our financial results and condition. Refer to

our quarterly reports on Form 10-Q filed with the SEC in 2010

for material changes to the discussion of risk factors. There

are factors not discussed below or elsewhere in this Report

that could adversely affect our financial results and condition.

RISKS RELATING TO CURRENT ECONOMIC AND MARKET CONDITIONS

Our financial results and condition may be adversely affected

if home prices continue to fall or unemployment continues to

increase. Significant declines in home prices over the last two

years and recent increases in unemployment have resulted in

higher loan charge-offs and increases in our allowance for credit

losses and related provision expense. The economic environment

and related conditions will directly affect credit performance.

For example, if home prices continue to fall or unemployment

continues to rise we would expect to incur higher than normal

charge-offs and provision expense from increases in our allowance

for credit losses. These conditions may adversely affect not only

consumer loan performance but also commercial and CRE loans,

especially those business borrowers that rely on the health of

industries or properties that may experience deteriorating

economic conditions.

Current financial and credit market conditions may persist or

worsen, making it more difficult to access capital markets on

favorable terms. Financial and credit markets may continue to

experience unprecedented disruption and volatility. These condi-

tions may continue or even worsen, affecting our ability to access

capital markets on favorable terms. We may raise additional capital

through the issuance of common stock, which could dilute existing

stockholders, or further reduce or even eliminate our common stock

dividend to preserve capital or in order to raise additional capital.

Bank regulators may require higher capital levels, limiting our

ability to pay common stock dividends or repurchase our common

stock. On December 23, 2009, we repaid the U.S. Treasury’s

investment in us under the TARP CPP program. While we are no

longer a participant in the TARP CPP program, federal banking

regulators continue to monitor the capital position of banks and

bank holding companies. Although not currently anticipated, our

regulators may require us to raise additional capital or otherwise

restrict how we utilize our capital, including common stock

dividends and stock repurchases. Issuing additional common

stock may dilute existing stockholders.

In addition, the U.S. Treasury continues to hold a warrant to

purchase approximately 110.3 million shares of our common

stock at $34.01 per share. If the warrant is exercised, the

ownership of existing stockholders may be diluted.

Compensation restrictions could adversely affect our ability to

recruit and retain key employees. Following repayment of the

U.S. Treasury’s TARP CPP investment in December 2009, we are

no longer subject to the compensation restrictions applicable to

participants in the TARP CPP program. However, legislators and

regulators may impose compensation restrictions on financial

institutions, which could adversely affect our ability to compete

for executive talent.

We may be required to repurchase mortgage loans or reimburse

investors as a result of breaches in contractual representations

and warranties. We sell mortgage loans to various parties,

including GSEs, under contractual provisions that include

various representations and warranties which typically cover

ownership of the loan, compliance with loan criteria set forth in

the applicable agreement, validity of the lien securing the loan,

absence of delinquent taxes or liens against the property

securing the loan, and similar matters. We may be required to

repurchase the mortgage loans with identified defects, indemnify

the investor or insurer, or reimburse the investor for credit loss

incurred on the loan (collectively, “repurchase obligations”) in

the event of a material breach of such contractual representations

or warranties. In addition, we may negotiate global settlements in

order to resolve repurchase obligations in lieu of repurchasing

loans. If economic conditions and the housing market do not

recover or future investor repurchase demand and our success at

appealing repurchase requests differ from past experience, we

could continue to have increased repurchase obligations and

increased loss severity on repurchases, requiring material addi-

tions to the repurchase reserve.

For more information, refer to the “Risk Management – Reserve

for Mortgage Loan Repurchase Losses” section in this Report.

Legislative and regulatory proposals may restrict or limit our

ability to engage in our current businesses or in businesses that

we desire to enter into. Many legislative and regulatory proposals

directed at the financial services industry are being proposed or

are pending in the U.S. Congress to address perceived weaknesses

in the financial system and regulatory oversight thereof that may

have contributed to the financial disruption over the last two

years and to provide additional protection for consumers and

investors. These proposals, if adopted, may restrict our ability to

compete in our current businesses or restrict our ability to enter

into new businesses that we otherwise may desire to enter into.

In addition, the proposals may limit our revenues in businesses,

impose fees or taxes on us, restrict compensation we may pay to

key employees, restrict acquisition opportunities, and/or intensify

the regulatory supervision of us and the financial services industry.

These proposals, if adopted, may have a material adverse effect

on our business operations, income, and/or competitive position.

Risk Factors