Wells Fargo 2009 Annual Report Download - page 143

Download and view the complete annual report

Please find page 143 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

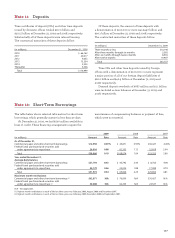

We participated in the Federal Deposit Insurance Corp -

oration’s (FDIC) Temporary Liquidity Guarantee Program

(TLGP). The TLGP had two components: the Debt Guarantee

Program, which provided a temporary guarantee of newly

issued senior unsecured debt issued by eligible entities; and

the Transaction Account Guarantee Program, which provided

a temporary unlimited guarantee of funds in noninterest-

bearing transaction accounts at FDIC-insured institutions.

The Debt Guarantee Program expired on October 31, 2009,

and we opted out of the temporary unlimited guarantee of

funds effective December 31, 2009.

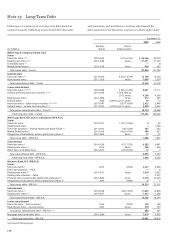

The aggregate annual maturities of long-term debt

obligations (based on final maturity dates) as of December 31,

2009, follow.

The interest rates on floating-rate notes are determined

periodically by formulas based on certain money market

rates, subject, on certain notes, to minimum or maximum

interest rates.

As part of our long-term and short-term borrowing

arrangements, we are subject to various financial and opera-

tional covenants. Some of the agreements under which debt

has been issued have provisions that may limit the merger

or sale of certain subsidiary banks and the issuance of capital

stock or convertible securities by certain subsidiary banks.

At December 31, 2009, we were in compliance with all

the covenants.

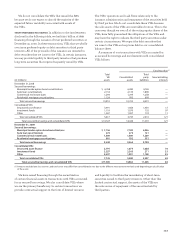

(in millions) Parent Company

2010 $ 21,292 40,495

2011 22,466 37,699

2012 15,460 27,027

2013 9,871 19,716

2014 7,575 11,063

Thereafter 42,689 67,861

Total $119,353 203,861

Note 14: Guarantees and Legal Actions

Guarantees

Guarantees are contracts that contingently require us

to make payments to a guaranteed party based on an event

or a change in an underlying asset, liability, rate or index.

Guarantees are generally in the form of standby letters of

credit, securities lending and other indemnifications, liquidity

agreements, written put options, recourse obligations,

residual value guarantees, and contingent consideration.

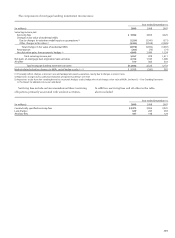

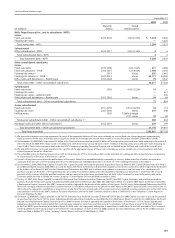

The following table shows carrying value, maximum exposure

to loss on our guarantees and the amount with a higher risk

of performance.

December 31,

2009 2008

Maximum Non- Maximum Non-

Carrying exposure investment Carrying exposure investment

(in millions) value to loss grade value to loss grade

Standby letters of credit $ 148 49,997 21,112 130 47,191 17,293

Securities lending and other indemnifications 51 20,002 2,512 — 30,120 1,907

Liquidity agreements (1) 66 7,744 — 30 17,602 —

Written put options (1)(2) 803 8,392 3,674 1,376 10,182 5,314

Loans sold with recourse 96 5,049 2,400 53 6,126 2,038

Residual value guarantees 8 197 — — 1,121 —

Contingent consideration 11 145 102 11 187 —

Other guarantees —55 2 —38—

Total guarantees $1,183 91,581 29,802 1,600 112,567 26,552

(1) Certain of these agreements included in this table are related to off-balance sheet entities and, accordingly, are also disclosed in Note 8 in this Report.

(2) Written put options, which are in the form of derivatives, are also included in the derivative disclosures in Note 15 in this Report.

“Maximum exposure to loss” and “Non-investment grade”

are required disclosures under GAAP. Non-investment

grade represents those guarantees on which we have a

higher risk of being required to perform under the terms of

the guarantee. If the underlying assets under the guarantee

are non-investment grade (that is, an external rating that is

below investment grade or an internal credit default grade

that is equivalent to a below investment grade external

rating), we consider the risk of performance to be high.

Internal credit default grades are determined based upon

the same credit policies that we use to evaluate the risk of

payment or performance when making loans and other

extensions of credit. These credit policies are more fully

described in Note 6 in this Report.

Maximum exposure to loss represents the estimated

loss that would be incurred under an assumed hypothetical

circumstance, despite what we believe is its extremely remote

possibility, where the value of our interests and any associated