Wells Fargo 2009 Annual Report Download - page 142

Download and view the complete annual report

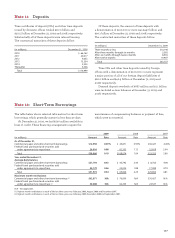

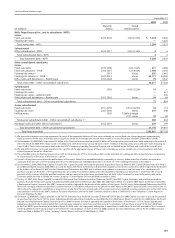

Please find page 142 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.(9)0On May 19, 2008, Wells Fargo Capital XIII issued 7.70% Fixed-to-Floating Rate Normal Preferred Purchase Securities (PPS) (the Second 2008 Capital Securities). The

proceeds were used to purchase Remarketable 7.50% Junior Subordinated Notes maturing in 2044 (the Second 2008 Notes) from the Parent. In connection with the

issuance of the Second 2008 Capital Securities, the Trust and the Parent entered into a forward stock purchase contract that obligates the Trust to purchase the Parent’s

Noncumulative Perpetual Preferred Stock, Series A (the Series A Preferred Stock) and obligates the Parent to make payments to the Trust of 0.20% per annum through

the stock purchase date, expected to be March 26, 2013 (the Series A Stock Purchase Date). Prior to the Series A Stock Purchase Date, the Trust is required to remarket

and sell the Second 2008 Notes to third party investors to generate cash proceeds to satisfy its obligation to purchase the Series A Preferred Stock. When it issued

the Second 2008 Notes, the Parent entered into a Replacement Capital Covenant (the Second 2008 Covenant) in which it agreed for the benefit of the holders of the

Covered Debt that, after the date it notifies the holders of the Covered Debt of the Second 2008 Covenant, it will not repay, redeem or repurchase, and that none of its

subsidiaries will purchase, (i) any part of the Second 2008 Notes prior to the Series A Stock Purchase Date or (ii) any part of the Second 2008 Capital Securities or the

Series A Preferred Stock prior to the date that is 10 years after the Series A Stock Purchase Date, unless the repayment, redemption or repurchase is made from the

net cash proceeds of the issuance of certain qualified securities and pursuant to the other terms and conditions set forth in the Second 2008 Covenant. For more

information, refer to the Second 2008 Covenant, which was filed as Exhibit 99.1 to the Company’s Current Report on Form 8-K filed May 19, 2008.

(10) On September 10, 2008, Wells Fargo Capital XV issued 9.75% Fixed-to-Floating Rate Normal PPS (the Third 2008 Capital Securities). The proceeds were used to purchase

Remarketable 9.25% Junior Subordinated Notes maturing in 2044 (the Third 2008 Notes) from the Parent. In connection with the issuance of the Third 2008 Capital

Securities, the Trust and the Parent entered into a forward stock purchase contract that obligates the Trust to purchase the Parent’s Noncumulative Perpetual Preferred

Stock, Series B (the Series B Preferred Stock) and obligates the Parent to make payments to the Trust of 0.50% per annum through the stock purchase date, expected to

be September 26, 2013 (the Series B Stock Purchase Date). Prior to the Series B Stock Purchase Date, the Trust is required to remarket and sell the Third 2008 Notes to

third party investors to generate cash proceeds to satisfy its obligation to purchase the Series B Preferred Stock. When it issued the Third 2008 Notes, the Parent entered

into a Replacement Capital Covenant (the Third 2008 Covenant) in which it agreed for the benefit of the holders of the Covered Debt that, after the date it notifies the

holders of the Covered Debt of the Third 2008 Covenant, it will not repay, redeem or repurchase, and that none of its subsidiaries will purchase, (i) any part of the Third

2008 Notes prior to the Series B Stock Purchase Date or (ii) any part of the Third 2008 Capital Securities or the Series B Preferred Stock prior to the date that is 10 years

after the Series B Stock Purchase Date, unless the repayment, redemption or repurchase is made from the net cash proceeds of the issuance of certain qualified securities

and pursuant to the other terms and conditions set forth in the Third 2008 Covenant. For more information, refer to the Third 2008 Covenant, which was filed as

Exhibit 99.1 to the Company’s Current Report on Form 8-K filed September 10, 2008.

(11) On February 15, 2007, Wachovia Capital Trust IV issued 6.375% Trust Preferred Securities (the First Wachovia Trust Securities) and used the proceeds to purchase from

Wachovia 6.375% Extendible Long-Term Subordinated Notes (the First Wachovia Notes). When it issued the First Wachovia Notes, Wachovia entered into a Replacement

Capital Covenant (the First Wachovia Covenant) in which it agreed for the benefit of the holders of Wachovia’s Floating-Rate Junior Subordinated Deferrable Interest

Debentures due January 15, 2027, (the Wachovia Covered Debt) that it will not repay, redeem or repurchase, and that none of its subsidiaries will purchase, any part of

the First Wachovia Notes or the First Wachovia Trust Securities on or after the scheduled maturity date of the First Wachovia Notes and prior to the date that is 20 years

prior to the final repayment date of the First Wachovia Notes, unless the repayment, redemption or repurchase is made from the net cash proceeds of the issuance of

certain qualified securities and pursuant to the other terms and conditions set forth in the First Wachovia Covenant. In connection with the Wachovia acquisition, the

Parent assumed all of Wachovia’s obligations under the First Wachovia Covenant. For more information, refer to the First Wachovia Covenant, which was filed as Exhibit

99.1 to Wachovia’s Current Report on Form 8-K filed February 15, 2007.

(12) On May 8, 2007, Wachovia Capital Trust IX issued 6.375% Trust Preferred Securities (the Second Wachovia Trust Securities) and used the proceeds to purchase from

Wachovia 6.375% Extendible Long-Term Subordinated Notes (the Second Wachovia Notes). When it issued the Second Wachovia Notes, Wachovia entered into a

Replacement Capital Covenant (the Second Wachovia Covenant) in which it agreed for the benefit of the holders of the Wachovia Covered Debt that it will not repay,

redeem or repurchase, and that none of its subsidiaries will purchase, any part of the Second Wachovia Notes or the Second Wachovia Trust Securities (i) on or after the

earlier of the date that is 30 years prior to the final repayment date of the Second Wachovia Notes and the scheduled maturity date of the Second Wachovia Notes and

(ii) prior to the later of the date that is 20 years prior to the final repayment date of the Second Wachovia Notes and June 15, 2057, unless the repayment, redemption

or repurchase is made from the net cash proceeds of the issuance of certain qualified securities and pursuant to the other terms and conditions set forth in the Second

Wachovia Covenant. In connection with the Wachovia acquisition, the Parent assumed all of Wachovia’s obligations under the Second Wachovia Covenant. For more

information, refer to the Second Wachovia Covenant, which was filed as Exhibit 99.1 to Wachovia’s Current Report on Form 8-K filed May 8, 2007.

(13) On November 21, 2007, Wachovia Capital Trust X issued 7.85% Trust Preferred Securities (the Third Wachovia Trust Securities) and used the proceeds to purchase from

Wachovia 7.85% Extendible Long-Term Subordinated Notes (the Third Wachovia Notes). When it issued the Third Wachovia Notes, Wachovia entered into a Replacement

Capital Covenant (the Third Wachovia Covenant) in which it agreed for the benefit of the holders of the Wachovia Covered Debt that it will not repay, redeem or

repurchase, and that none of its subsidiaries will purchase, any part of the Third Wachovia Notes or the Third Wachovia Trust Securities (i) on or after the earlier of the

date that is 30 years prior to the final repayment date of the Third Wachovia Notes and the scheduled maturity date of the Third Wachovia Notes and (ii) prior to the

later of the date that is 20 years prior to the final repayment date of the Third Wachovia Notes and December 15, 2057, unless the repayment, redemption or repurchase

is made from the net cash proceeds of the issuance of certain qualified securities and pursuant to the other terms and conditions set forth in the Third Wachovia

Covenant. In connection with the Wachovia acquisition, the Parent assumed all of Wachovia’s obligations under the Third Wachovia Covenant. For more information,

refer to the Third Wachovia Covenant, which was filed as Exhibit 99.1 to Wachovia’s Current Report on Form 8-K filed November 21, 2007.

(14) On February 1, 2006, Wachovia Capital Trust III issued 5.80% Fixed-to-Floating Rate Wachovia Income Trust Securities (the Fourth Wachovia Trust Securities) and used

the proceeds to purchase from Wachovia Remarketable Junior Subordinated Notes due 2042 (the Fourth Wachovia Notes). In connection with the issuance of the

Fourth Wachovia Trust Securities, the Trust and Wachovia entered into a forward stock purchase contract that obligates the Trust to purchase Wachovia’s Noncumulative

Perpetual Class A Preferred Stock, Series I (the Series I Preferred Stock) and obligates Wachovia to make payments to the Trust of 0.60% per annum through the stock

purchase date, expected to be March 15, 2011 (the Series I Stock Purchase Date). Prior to the Series I Stock Purchase Date, the Trust is required to remarket and sell the

Fourth Wachovia Notes to third party investors to generate cash proceeds to satisfy its obligation to purchase the Series I Preferred Stock. When it issued the Fourth

Wachovia Notes, Wachovia entered into a Declaration of Covenant (the Fourth Wachovia Covenant) in which it agreed for the benefit of the holders of the Wachovia

Covered Debt that it will repurchase the Fourth Wachovia Trust Securities or redeem or repurchase shares of the Series I Preferred Stock only if and to the extent that

the total redemption or repurchase price is equal to or less than the net cash proceeds of the issuance of certain qualified securities as described in the Fourth Wachovia

Covenant. In connection with the Wachovia acquisition, the Parent assumed all of Wachovia’s obligations under the Fourth Wachovia Covenant. For more information,

refer to the Fourth Wachovia Covenant, which was filed as Exhibit 99.1 to Wachovia’s Current Report on Form 8-K filed February 1, 2006.

(15) Represents junior subordinated debentures held by unconsolidated wholly-owned trusts formed for the sole purpose of issuing trust preferred securities.

(16) At December 31, 2009, bank notes of $3.8 billion had floating rates of interest ranging from 0.0006% to 7.6%, and $593 million of the notes had fixed rates of interest

ranging from 1.00% to 5.00%.

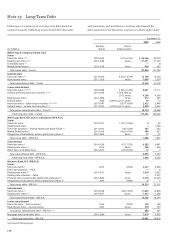

Note 13: Long-Term Debt (continued)