Wells Fargo 2009 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

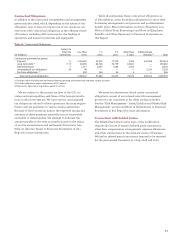

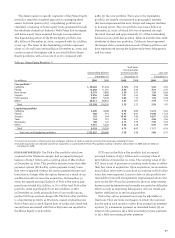

Total NPAs were $27.6 billion (3.53% of total loans) at

December 31, 2009, and included $24.4 billion of nonaccrual

loans and $3.2 billion of foreclosed assets, real estate, and

other nonaccrual investments. Nonaccrual loans increased

$17.6 billion from December 31, 2008. The rate of nonaccrual

growth in 2009 was somewhat increased by the effect of pur-

chase accounting applicable to substantially all of Wachovia’s

nonaccrual loans as PCI loans at year-end 2008. This pur-

chase accounting resulted in reclassifying all but $97 million

of Wachovia’s nonaccruing loans to accruing status, virtually

eliminating all nonaccrual loans as of our merger date, and

limiting comparability of this metric and related credit ratios

with prior periods and our peers. Typically, changes to nonac-

crual loans period-over-period represent inflows for loans that

reach a specified past due status, offset by reductions for

loans that are charged off, sold, transferred to foreclosed

properties, or are no longer classified as nonaccrual because

they return to accrual status. During 2009, because of pur-

chase accounting, the rate of growth in nonaccrual loans was

higher than it would have been without PCI loan accounting.

The impact of purchase accounting on our credit data should

diminish over time. In addition, we have also increased loan

modifications and restructurings to assist homeowners and

other borrowers in the current difficult economic cycle.

This increase is expected to result in elevated nonaccrual loan

levels for longer periods because consumer nonaccrual loans

that have been modified remain in nonaccrual status until a

borrower has made six consecutive contractual payments,

inclusive of consecutive payments made prior to the modifica-

tion. For a consumer accruing loan that has been modified, if

the borrower has demonstrated performance under the previ-

ous terms and shows the capacity to continue to perform under

the restructured terms, the loan will remain in accruing status.

Otherwise, the loan will be placed in a nonaccrual status until

the borrower has made six consecutive contractual payments.

As explained in more detail below, we believe the loss

exposure expected in our NPAs is mitigated by three factors.

First, 96% of our nonaccrual loans are secured. Second, losses

have already been recognized on 36% of total nonaccrual

loans. Third, there is a segment of nonaccrual loans for which

specific impairment reserves have been established in the

allowance, while the remaining NPAs are covered by general

reserves. We are seeing signs of stability in our credit portfolio,

as growth in credit losses slowed during 2009. While losses

are expected to remain elevated, a more favorable economic

outlook and improved credit statistics in several portfolios

further increase our confidence that our credit cycle is turning,

provided economic conditions do not deteriorate further.

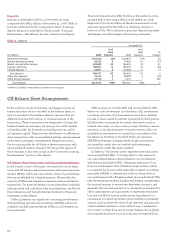

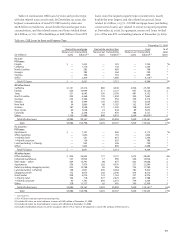

Table 25: Nonaccrual Loans and Other Nonperforming Assets

December 31,

(in millions) 2009 2008 2007 2006 2005

Nonaccrual loans:

Commercial and commercial real estate:

Commercial $ 4,397 1,253 432 331 286

Real estate mortgage 3,984 594 128 105 165

Real estate construction 3,025 989 293 78 31

Lease financing 171 92 45 29 45

Total commercial and commercial real estate 11,577 2,928 898 543 527

Consumer:

Real estate 1-4 family first mortgage 10,100 2,648 1,272 688 471

Real estate 1-4 family junior lien mortgage 2,263 894 280 212 144

Other revolving credit and installment 332 273 184 180 171

Total consumer 12,695 3,815 1,736 1,080 786

Foreign 146 57 45 43 25

Total nonaccrual loans (1)(2)(3) 24,418 6,800 2,679 1,666 1,338

As a percentage of total loans 3.12% 0.79 0.70 0.52 0.43

Foreclosed assets:

GNMA loans (4) $ 960 667 535 322 —

Other 2,199 1,526 649 423 191

Real estate and other nonaccrual investments (5) 62 16552

Total nonaccrual loans and other nonperforming assets $27,639 9,009 3,868 2,416 1,531

As a percentage of total loans 3.53% 1.04 1.01 0.76 0.49

(1) Includes nonaccrual mortgages held for sale and loans held for sale in their respective loan categories.

(2) Excludes loans acquired from Wachovia that are accounted for as PCI loans.

(3) Includes $9.5 billion and $3.6 billion at December 31, 2009, and December 31, 2008, respectively, of loans classified as impaired. See Note 6 (Loans and Allowance for

Credit Losses) to Financial Statements in this Report for further information on impaired loans.

(4) Consistent with regulatory reporting requirements, foreclosed real estate securing Government National Mortgage Association (GNMA) loans is classified as nonperforming.

Both principal and interest for GNMA loans secured by the foreclosed real estate are collectible because the GNMA loans are insured by the Federal Housing Administration

(FHA) or guaranteed by the Department of Veterans Affairs (VA).

(5) Includes real estate investments (contingent interest loans accounted for as investments) that would be classified as nonaccrual if these assets were recorded as loans,

and nonaccrual debt securities.