Wells Fargo 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Wells Fargo & Company is a $1.2 trillion diversified financial

services company providing banking, insurance, trust and

investments, mortgage banking, investment banking, retail

banking, brokerage and consumer finance through banking

stores, the internet and other distribution channels to individ-

uals, businesses and institutions in all 50 states, the District

of Columbia (D.C.) and in other countries. We ranked fourth

in assets and second in the market value of our common stock

among our peers at December 31, 2009. When we refer to

“Wells Fargo,” “the Company,” “we,” “our” or “us” in this

Report, we mean Wells Fargo & Company and Subsidiaries

(consolidated). When we refer to the “Parent,” we mean

Wells Fargo & Company. When we refer to “legacy

Wells Fargo,” we mean Wells Fargo excluding

Wachovia Corporation (Wachovia).

Our vision is to satisfy all our customers’ financial needs,

help them succeed financially, be recognized as the premier

financial services company in our markets and be one of

America’s great companies. Our primary strategy to achieve

this vision is to increase the number of products our customers

buy from us and to give them all of the financial products that

fulfill their needs. Our cross-sell strategy, diversified business

model and the breadth of our geographic reach facilitate growth

in both strong and weak economic cycles, as we can grow by

expanding the number of products our current customers have

with us, gain new customers in our extended markets, and

increase market share in many businesses. We continued to earn

more of our customers’ business in 2009 in both our retail and

commercial banking businesses and in our equally customer-

centric securities brokerage and investment banking businesses.

On December 31, 2008, Wells Fargo acquired Wachovia.

Because the acquisition was completed at the end of 2008,

Wachovia’s results are included in the income statement,

average balances and related financial information beginning

in 2009. Wachovia’s assets and liabilities are included, at

fair value, in the consolidated balance sheet beginning on

December 31, 2008, but not in 2008 averages.

On January 1, 2009, we adopted new FASB guidance on

noncontrolling interests on a retrospective basis for disclosure

and, accordingly, prior period information reflects the adoption.

The guidance requires that noncontrolling interests be reported

as a component of total equity. In addition, our consolidated

income statement must disclose amounts attributable to both

Wells Fargo interests and the noncontrolling interests.

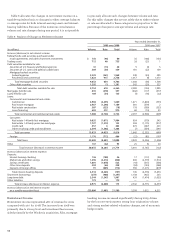

We generated record revenue and built capital at a record

rate in 2009 despite elevated credit costs. Wells Fargo net

income was a record $12.3 billion in 2009, with net income

applicable to common stock of $8.0 billion. Diluted earnings

per common share were $1.75. In fourth quarter 2009, we fully

repaid the U.S. Treasury’s $25 billion Troubled Asset Relief

Program (TARP) Capital Purchase Program (CPP) preferred

stock investment, including related preferred dividends, which

reduced 2009 diluted earnings per share by $0.76 per share.

Pre-tax pre-provision profit (PTPP) was $39.7 billion in 2009,

which covered more than 2.1 times annual net charge-offs.

PTPP is total revenue less noninterest expense. Management

believes that PTPP is a useful financial measure because it

enables investors and others to assess the Company’s ability

to generate capital to cover credit losses through a credit cycle.

Our cross-sell at legacy Wells Fargo set records for the

11th consecutive year with a record of 5.95 Wells Fargo products

for retail banking households. Our goal is eight products

per customer, which is approximately half of our estimate of

potential demand. One of every four of our legacy Wells Fargo

retail banking households has eight or more products and our

average middle-market commercial banking customer has

almost eight products. Wachovia retail bank households had

an average of 4.65 Wachovia products. We believe there is

potentially significant opportunity for growth as we increase

the Wachovia retail bank household cross-sell. For legacy

Wells Fargo, our average middle-market commercial banking

customer reached an average of 7.8 products and an average

of 6.4 products for Wholesale Banking customers. Business

banking cross-sell offers another potential opportunity for

growth, with a record cross-sell of 3.77 products at legacy

Wells Fargo.

Wells Fargo remained one of the largest providers of credit

to the U.S. economy. We continued to lend to credit-worthy

customers and, during 2009, made $711 billion in new loan

commitments to consumer, small business and commercial

customers, including $420 billion of residential mortgage

originations. We are an industry leader in loan modifications

for homeowners. As of December 31, 2009, nearly half a million

Wells Fargo mortgage customers were in active trial or had

completed loan modifications started in the prior 12 months.

We have helped reduce mortgage payments for 1.7 million

homeowners through refinancing.

Overview

This Annual Report, including the Financial Review and the Financial Statements and related Notes, has forward-looking statements,

which may include forecasts of our financial results and condition, expectations for our operations and business, and our assumptions

for those forecasts and expectations. Do not unduly rely on forward-looking statements. Actual results may differ materially from our

forward-looking statements due to several factors. Some of these factors are described in the Financial Review and in the Financial

Statements and related Notes. For a discussion of other factors, refer to the “Risk Factors” section in this Report. A Glossary of

Acronyms for terms used throughout this Report and a Codification Cross Reference for cross references from accounting standards

under the recently adopted Financial Accounting Standards Board (FASB) Accounting Standards Codification (Codification)

to pre-Codification accounting standards can be found at the end of this Report.

Financial Review