Wells Fargo 2009 Annual Report Download - page 152

Download and view the complete annual report

Please find page 152 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

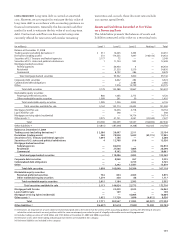

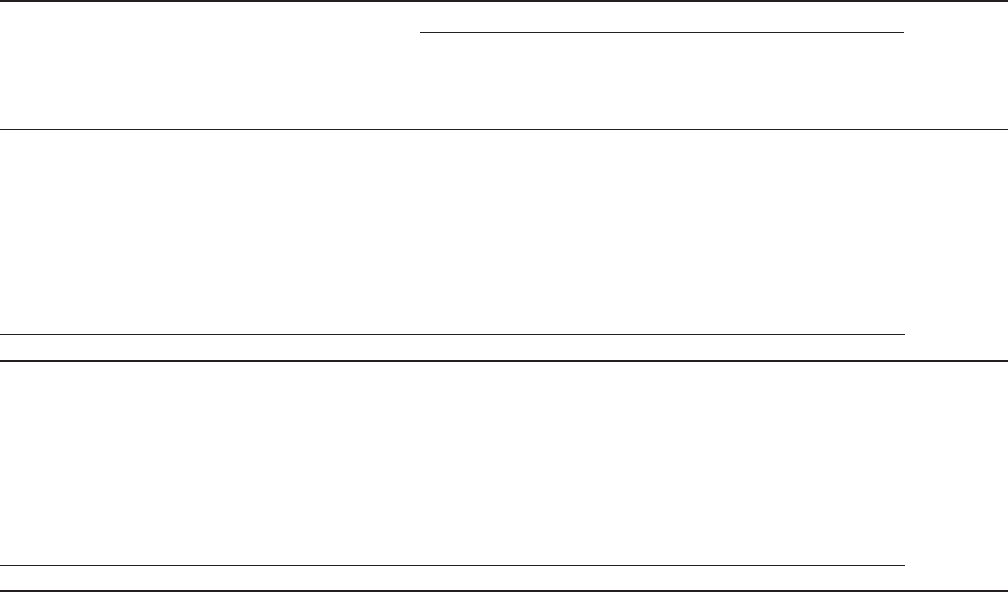

Notional amount

Protection Protection

sold – purchased Net

non- with protection Other

Fair value Protection investment identical sold protection Range of

(in millions) liability sold (A) grade underlyings (B) (A)-(B) purchased maturities

December 31, 2008

Credit default swaps on:

Corporate bonds $ 9,643 83,446 39,987 31,413 52,033 50,585 2009-2018

Structured products 4,940 7,451 5,824 5,061 2,390 6,559 2009-2056

Credit protection on:

Credit default swap index 2,611 35,943 6,364 4,606 31,337 31,410 2009-2017

Commercial mortgage-

backed securities index 2,231 7,291 2,938 1,521 5,770 3,919 2009-2052

Asset-backed securities index 1,331 1,526 1,116 235 1,291 803 2037-2046

Loan deliverable credit default swaps 106 611 592 281 330 1,033 2009-2014

Other 18 845 150 21 824 — 2009-2020

Total credit derivatives $20,880 137,113 56,971 43,138 93,975 94,309

December 31, 2009

Credit default swaps on:

Corporate bonds $ 2,419 55,511 23,815 44,159 11,352 12,634 2010-2018

Structured products 4,498 6,627 5,084 4,999 1,628 3,018 2014-2056

Credit protection on:

Default swap index 23 6,611 2,765 4,202 2,409 2,510 2010-2017

Commercial mortgage-

backed securities index 1,987 5,188 453 4,749 439 189 2049-2052

Asset-backed securities index 637 830 660 696 134 189 2037-2046

Loan deliverable credit default swaps 12 510 494 423 87 287 2010-2014

Other 1 1,416 809 32 1,384 100 2010-2020

Total credit derivatives $ 9,577 76,693 34,080 59,260 17,433 18,927

Note 15: Derivatives (continued)

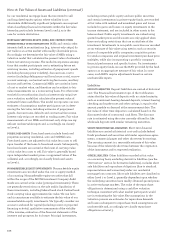

Protection sold represents the estimated maximum

exposure to loss that would be incurred under an assumed

hypothetical circumstance, despite what we believe is its

extremely remote possibility, where the value of our interests

and any associated collateral declines to zero, without any

consideration of recovery or offset from any economic hedges.

Accordingly, this required disclosure is not an indication

of expected loss. The amounts under non-investment grade

represent the notional amounts of those credit derivatives

on which we have a higher performance risk, or higher risk

of being required to perform under the terms of the credit

derivative and is a function of the underlying assets. We

consider the risk of performance to be high if the underlying

assets under the credit derivative have an external rating that

is below investment grade or an internal credit default grade

that is equivalent thereto. We believe the net protection

sold, which is representative of the net notional amount of

protection sold and purchased with identical underlyings,

in combination with other protection purchased, is more rep-

resentative of our exposure to loss than either non-investment

grade or protection sold. Other protection purchased repre-

sents additional protection, which may offset the exposure

to loss for protection sold, that was not purchased with an

identical underlying of the protection sold.

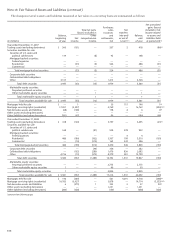

Credit-Risk Contingent Features

Certain of our derivative contracts contain provisions whereby

if the credit rating of our debt, based on certain major credit

rating agencies indicated in the relevant contracts, were to

fall below investment grade, the counterparty could demand

additional collateral or require termination or replacement of

derivative instruments in a net liability position. The aggregate

fair value of all derivative instruments with such credit-risk-

related contingent features that are in a net liability position

on December 31, 2009, was $7.5 billion for which we have

posted $7.1 billion collateral in the normal course of business.

If the credit-risk-related contingent features underlying

these agreements were triggered on December 31, 2009, we

would be required to post additional collateral of $1.0 billion

or potentially settle the contract in an amount equal to its

fair value.

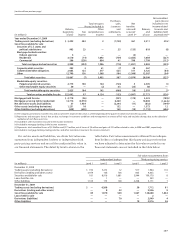

Counterparty Credit Risk

By using derivatives, we are exposed to counterparty

credit risk if counterparties to the derivative contracts do

not perform as expected. If a counterparty fails to perform,

our counterparty credit risk is equal to the amount reported

as a derivative asset on our balance sheet. The amounts

reported as a derivative asset are derivative contracts in a

gain position, and to the extent subject to master netting

arrangements, net of derivatives in a loss position with the

same counterparty and cash collateral received. We minimize

counterparty credit risk through credit approvals, limits,

monitoring procedures, executing master netting arrangements

and obtaining collateral, where appropriate. To the extent

the master netting arrangements and other criteria meet the

requirements outlined in the Derivatives and Hedging topic

of the Codification, derivatives balances and related cash

collateral amounts are shown net in the balance sheet.

Counterparty credit risk related to derivatives is considered

in determining fair value.