Wells Fargo 2009 Annual Report Download - page 37

Download and view the complete annual report

Please find page 37 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Our core deposits grew 5% from December 31, 2008, even

though $109 billion in higher-priced Wachovia certificates

of deposit (CDs) matured. Average core deposits funded

93% of total average loans in 2009, up from 82% in 2008.

Checking and savings deposits grew 21% to $679.9 billion

at December 31, 2009, from $563.4 billion a year ago as we

continued to gain new customers and deepen our relation-

ships with existing customers.

As we have stated in the past, to consistently grow over

the long term, successful companies must invest in their core

businesses and maintain strong balance sheets. In 2009, we

opened 70 retail banking stores for a retail network total of

6,629 stores. We converted 19 Wachovia Banking stores in

Colorado to the Wells Fargo platform, as part of the Wachovia

integration, with the conversion of our remaining overlapping

markets scheduled to occur in 2010.

The Wachovia integration remains on track and on

schedule, with business and revenue synergies exceeding our

expectations at the time the merger was announced. Cross-sell

revenues are being realized. We are on track to realize annual

run-rate savings of $5 billion upon completion of the Wachovia

integration in 2011, with over 50% of this annual run rate

already achieved in 2009. We currently expect cumulative

merger integration costs of approximately $5 billion, down

from our $7.9 billion estimate at the time of merger. The

revised estimate reflects lower owned real estate write-downs

and lower employee-related expenses than anticipated at the

time of the merger. In 2009, we spent a total of $1.9 billion in

merger expenses, $1.0 billion through goodwill under purchase

accounting and $895 million expensed through earnings.

We continued taking actions to further strengthen our bal-

ance sheet, including building credit reserves by $3.5 billion

during the year to $25.0 billion at December 31, 2009, reduc-

ing previously identified non-strategic and liquidating loan

portfolios by $18.9 billion to $104.9 billion, and reducing the

value of our debt and equity investment portfolios through

$1.7 billion of other-than-temporary impairment (OTTI) write-

downs. We significantly built capital in 2009 and in the last 15

months since announcing our merger with Wachovia, driven

by record retained earnings and other sources of internal

capital generation, as well as three common stock offerings

totaling over $33 billion, including the $12.2 billion offering in

fourth quarter 2009, which allowed us to repay in full the U.S.

Treasury’s TARP preferred stock investment. We substantially

increased the size of the Company with the Wachovia merger,

and experienced cyclically elevated credit costs; however, our

capital ratios at December 31, 2009, were higher than they

were prior to the Wachovia acquisition, even after redeeming

the TARP preferred stock in full and purchasing Prudential

Financial Inc.’s noncontrolling interest in our retail securities

brokerage joint venture. Tier 1 common equity increased to

$65.5 billion, 6.46% of risk-weighted assets. The Tier 1 capital

ratio increased to 9.25% and Tier 1 leverage ratio declined to

7.87%. See the “Capital Management” section in this Report

for more information regarding Tier 1 common equity.

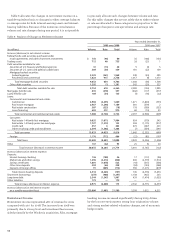

Table 1: Six-Year Summary of Selected Financial Data

% Change Five-year

(in millions, except 2009/ compound

per share amounts) 2009 2008 2007 2006 2005 2004 2008 growth rate

Income statement

Net interest income $ 46,324 25,143 20,974 19,951 18,504 17,150 84% 22

Noninterest income 42,362 16,734 18,546 15,817 14,591 12,930 153 27

Revenue 88,686 41,877 39,520 35,768 33,095 30,080 112 24

Provision for credit losses 21,668 15,979 4,939 2,204 2,383 1,717 36 66

Noninterest expense 49,020 22,598 22,746 20,767 18,943 17,504 117 23

Net income before

noncontrolling interests 12,667 2,698 8,265 8,567 7,892 7,104 369 12

Less: Net income from

noncontrolling interests 392 43 208 147 221 90 812 34

Wells Fargo net income 12,275 2,655 8,057 8,420 7,671 7,014 362 12

Earnings per common share 1.76 0.70 2.41 2.50 2.27 2.07 151 (3)

Diluted earnings

per common share 1.75 0.70 2.38 2.47 2.25 2.05 150 (3)

Dividends declared

per common share 0.49 1.30 1.18 1.08 1.00 0.93 (62) (12)

Balance sheet (at year end)

Securities available for sale $ 172,710 151,569 72,951 42,629 41,834 33,717 14% 39

Loans 782,770 864,830 382,195 319,116 310,837 287,586 (9) 22

Allowance for loan losses 24,516 21,013 5,307 3,764 3,871 3,762 17 45

Goodwill 24,812 22,627 13,106 11,275 10,787 10,681 10 18

Assets 1,243,646 1,309,639 575,442 481,996 481,741 427,849 (5) 24

Core deposits (1) 780,737 745,432 311,731 288,068 253,341 229,703 528

Long-term debt 203,861 267,158 99,393 87,145 79,668 73,580 (24) 23

Wells Fargo

stockholders’ equity 111,786 99,084 47,628 45,814 40,660 37,866 13 24

Noncontrolling interests 2,573 3,232 286 254 239 247 (20) 60

Total equity 114,359 102,316 47,914 46,068 40,899 38,113 12 25

(1) Core deposits are noninterest-bearing deposits, interest-bearing checking, savings certificates, market rate and other savings, and certain foreign deposits

(Eurodollar sweep balances).