Wells Fargo 2009 Annual Report Download - page 136

Download and view the complete annual report

Please find page 136 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

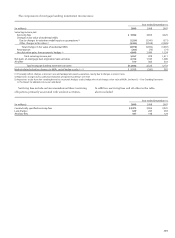

Mortgage banking activities, included in the Community

Banking and Wholesale Banking operating segments,

consist of residential and commercial mortgage originations

and servicing.

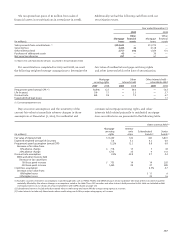

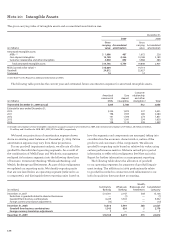

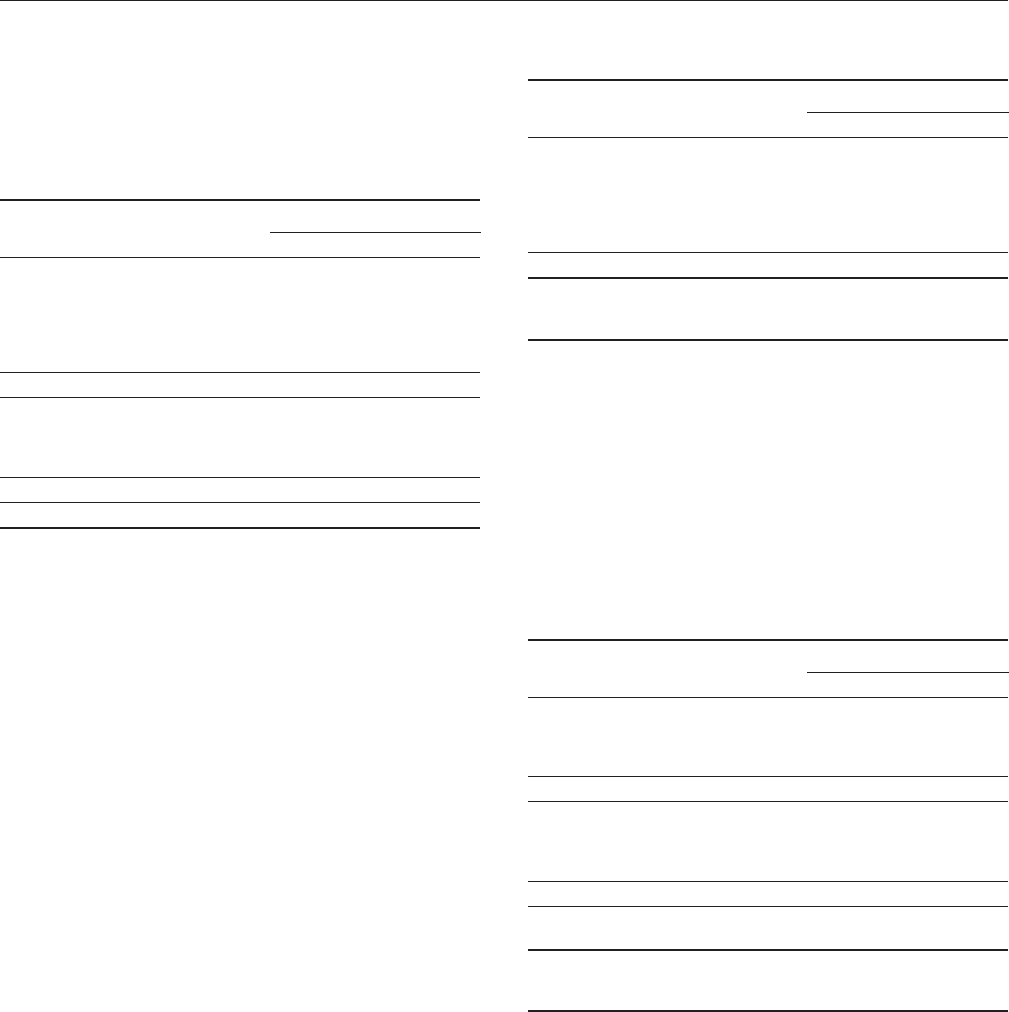

The changes in residential MSRs measured using the fair

value method were:

Note 9: Mortgage Banking Activities

Year ended December 31,

(in millions) 2009 2008 2007

Fair value, beginning of year $14,714 16,763 17,591

Purchases —191 803

Acquired from Wachovia (1) 34 479 —

Servicing from securitizations

or asset transfers 6,226 3,450 3,680

Sales —(269) (1,714)

Net additions 6,260 3,851 2,769

Changes in fair value:

Due to changes in valuation

model inputs or assumptions (2) (1,534) (3,341) (571)

Other changes in fair value (3) (3,436) (2,559) (3,026)

Total changes in fair value (4,970) (5,900) (3,597)

Fair value, end of year $16,004 14,714 16,763

(1) The 2009 amount reflects refinements to initial December 31, 2008,

Wachovia purchase accounting adjustments.

(2) Principally reflects changes in discount rates and prepayment speed

assumptions, mostly due to changes in interest rates.

(3) Represents changes due to collection/realization of expected cash flows

over time.

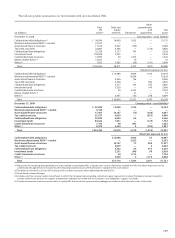

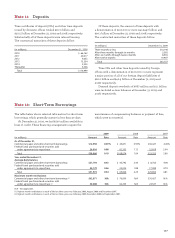

Year ended December 31,

(in millions) 2009 2008 2007

Balance, beginning of year $1,446 466 377

Purchases (1) 11 10 120

Acquired from Wachovia (2) (135) 1,021 —

Servicing from securitizations

or asset transfers (1) 61 24 40

Amortization (264) (75) (71)

Balance, end of year (3) $1,119 1,446 466

Fair value of amortized MSRs:

Beginning of year $1,555 573 457

End of year 1,261 1,555 573

(1) Based on December 31, 2009, assumptions, the weighted-average amortization

period for MSRs added during the twelve months of 2009 was approximately

18.1 years.

(2) The 2009 amount reflects refinements to initial December 31, 2008,

Wachovia purchase accounting adjustments.

(3) There was no valuation allowance recorded for the periods presented.

Commercial MSRs are evaluated for impairment purposes by the following

asset classes: agency and non-agency commercial mortgage-backed

securities (MBS), and loans.

The changes in amortized commercial MSRs were:

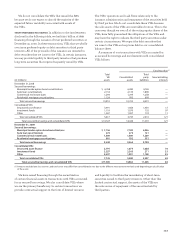

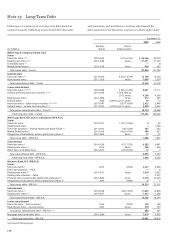

December 31,

(in billions) 2009 2008 2007

Residential mortgage servicing

Serviced for others $1,422 1,388 1,283

Owned loans serviced 364 378 174

Subservicing 10 15 17

Total residential servicing 1,796 1,781 1,474

Commercial mortgage servicing

Serviced for others 454 472 147

Owned loans serviced 105 103 37

Subservicing 10 11 6

Total commercial servicing 569 586 190

Total managed servicing

portfolio $2,365 2,367 1,664

Total serviced for others $1,876 1,860 1,430

Ratio of MSRs to related loans

serviced for others 0.91% 0.87 1.20

We present the components of our managed servicing

portfolio in the table below at unpaid principal balance for

loans serviced and subserviced for others and at book value

for owned loans serviced.