Wells Fargo 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

We saw signs of stability emerging in our credit portfolio,

as the rate of growth in credit losses slowed during 2009.

While losses remained elevated as expected, a more favorable

economic outlook and improved credit statistics in several

portfolios further increase our confidence that our credit cycle

is turning, provided economic conditions do not deteriorate.

In the commercial portfolios, we saw some signs that credit

quality may be improving, as the pace of commercial and

commercial real estate (CRE) nonaccrual growth slowed

toward the end of 2009, reflecting our historically strong

underwriting and the purchase accounting adjustments

taken on the Wachovia portfolio at the time of the merger.

We expect credit losses to remain elevated in the near term,

but, assuming no further economic deterioration, current

projections show credit losses peaking in the first half of 2010

in our consumer portfolios and later in 2010 in our commercial

and CRE portfolios. Based on the portfolio performance

data we saw in fourth quarter 2009, and assuming the same

economic outlook, we are tracking somewhat better than

these expectations.

We believe it is important to maintain a well controlled

operating environment as we complete the integration of the

Wachovia businesses and grow the combined company. We

manage our credit risk by setting what we believe are sound

credit policies for underwriting new business, while monitor-

ing and reviewing the performance of our loan portfolio. We

manage the interest rate and market risks inherent in our

asset and liability balances within established ranges, while

ensuring adequate liquidity and funding. We maintain strong

capital levels to facilitate future growth.

WACHOVIA MERGER On December 31, 2008, Wells Fargo

acquired Wachovia, one of the nation’s largest diversified

financial services companies. Wachovia’s assets and liabilities

were included in the December 31, 2008, consolidated balance

sheet at their respective fair values on the acquisition date.

Because the acquisition was completed on December 31, 2008,

Wachovia’s results of operations were not included in our

2008 income statement. Beginning in 2009, our consolidated

results and associated financial information, as well as our

consolidated average balances, include Wachovia. The

Wachovia acquisition was material to us, and the inclusion

of results from Wachovia’s businesses in our 2009 financial

statements is a material factor in the changes in our results

compared with prior year periods.

Because the transaction closed on the last day of the 2008

annual reporting period, certain fair value purchase accounting

adjustments were based on preliminary data as of an interim

period with estimates through year end. We have validated

and, where necessary, refined our December 31, 2008, fair

value estimates and other purchase accounting adjustments.

The impact of these refinements was recorded as an adjust-

ment to goodwill in 2009. Based on the purchase price of

$23.1 billion and the $12.2 billion fair value of net assets

acquired, inclusive of final refinements identified during

2009, the transaction resulted in goodwill of $10.9 billion.

The more significant fair value adjustments in our pur-

chase accounting for the Wachovia acquisition were to loans.

As of December 31, 2008, certain of the loans acquired from

Wachovia had evidence of credit deterioration since origina-

tion, and it was probable that we would not collect all contrac-

tually required principal and interest payments. Such loans

identified at the time of the acquisition were accounted for

using the measurement provisions for purchased credit-

impaired (PCI) loans, which are contained in the Receivables

topic (FASB Accounting Standards Codification (ASC) 310) of

the Codification. PCI loans were recorded at fair value at the

date of acquisition, and any related allowance for loan losses

was not permitted to be carried over.

PCI loans were written down to an amount estimated to

be collectible. Accordingly, such loans are not classified as

nonaccrual, even though they may be contractually past due,

because we expect to fully collect the new carrying values

of such loans (that is, the new cost basis arising out of our

purchase accounting). PCI loans are also not included in the

disclosure of loans 90 days or more past due and still accruing

interest even though a portion of them are 90 days or more

contractually past due.

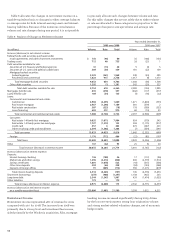

Table 2: Ratios and Per Common Share Data

Year ended December 31,

2009 2008 2007

Profitability ratios

Wells Fargo net income to

average assets (ROA) 0.97% 0.44 1.55

Net income to average assets 1.00 0.45 1.59

Wells Fargo net income applicable to

common stock to average Wells Fargo

common stockholders’ equity (ROE) 9.88 4.79 17.12

Net income to average total equity 10.75 5.02 17.46

Efficiency ratio (1) 55.3 54.0 57.6

Capital ratios

At year end:

Wells Fargo common stockholders’

equity to assets 8.34 5.21 8.28

Total equity to assets 9.20 7.81 8.33

Risk-based capital (2)

Tier 1 capital 9.25 7.84 7.59

Total capital 13.26 11.83 10.68

Tier 1 leverage (2)(3) 7.87 14.52 6.83

Tier 1 common equity (4) 6.46 3.13 6.56

Average balances:

Average Wells Fargo common

stockholders’ equity to average assets 6.41 8.18 9.04

Average total equity to average assets 9.34 8.89 9.09

Per common share data

Dividend payout (5) 27.9 185.4 49.0

Book value $20.03 16.15 14.45

Market price (6)

High 31.53 44.68 37.99

Low 7.80 19.89 29.29

Year end 26.99 29.48 30.19

(1) The efficiency ratio is noninterest expense divided by total revenue

(net interest income and noninterest income).

(2) See Note 25 (Regulatory and Agency Capital Requirements) to Financial

Statements in this Report for additional information.

(3) Due to the Wachovia acquisition that closed on December 31, 2008, the Tier 1

leverage ratio, which considers period-end Tier 1 capital and quarterly averages

in the computation of the ratio, does not reflect average assets of Wachovia for

the full period ended December 31, 2008.

(4) See the “Capital Management” section in this Report for additional information.

(5) Dividends declared per common share as a percentage of earnings per

common share.

(6) Based on daily prices reported on the New York Stock Exchange Composite

Transaction Reporting System.