Wells Fargo 2009 Annual Report Download - page 187

Download and view the complete annual report

Please find page 187 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

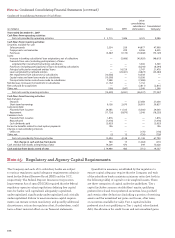

on marketable equity securities, subject to limitations by the

guidelines. Tier 2 capital is limited to the amount of Tier 1

capital (i.e., at least half of the total capital must be in the

form of Tier 1 capital). Tier 3 capital includes certain qualify-

ing unsecured subordinated debt.

We do not consolidate our wholly-owned trusts (the Trusts)

formed solely to issue trust preferred securities. The amount

of trust preferred securities and perpetual preferred purchase

securities issued by the Trusts that was includable in Tier 1

capital in accordance with FRB risk-based capital (RBC)

guidelines was $19.3 billion at December 31, 2009. The junior

subordinated debentures held by the Trusts were included in

the Company’s long-term debt. See Note 13 in this Report for

additional information on trust preferred securities.

Under the guidelines, capital is compared with the relative

risk related to the balance sheet. To derive the risk included in

the balance sheet, a risk weighting is applied to each balance

sheet asset and off-balance sheet item, primarily based on the

relative credit risk of the counterparty. For example, claims

guaranteed by the U.S. government or one of its agencies

are risk-weighted at 0% and certain real estate related loans

risk-weighted at 50%. Off-balance sheet items, such as loan

commitments and derivatives, are also applied a risk weight

after calculating balance sheet equivalent amounts. A credit

conversion factor is assigned to loan commitments based

on the likelihood of the off-balance sheet item becoming an

asset. For example, certain loan commitments are converted

at 50% and then risk-weighted at 100%. Derivatives are

converted to balance sheet equivalents based on notional

values, replacement costs and remaining contractual terms.

See Notes 6 and 15 in this Report for further discussion of

off-balance sheet items. For certain recourse obligations,

direct credit substitutes, residual interests in asset securitiza-

tion, and other securitized transactions that expose institutions

primarily to credit risk, the capital amounts and classification

under the guidelines are subject to qualitative judgments

by the regulators about components, risk weightings and

other factors.

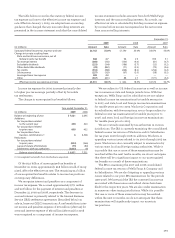

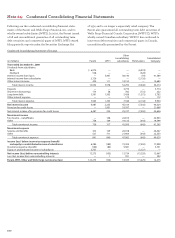

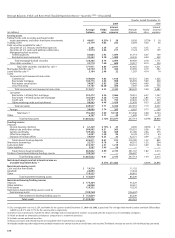

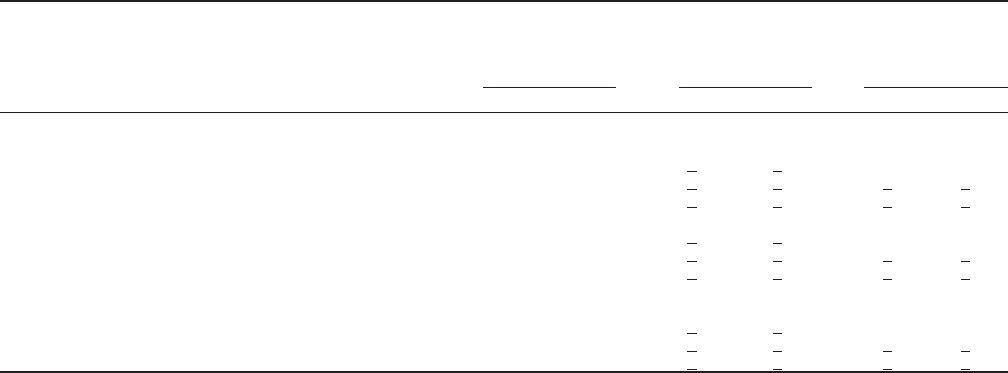

To be well capitalized

under the FDICIA

For capital prompt corrective

Actual adequacy purposes action provisions

(in billions) Amount Ratio Amount Ratio Amount Ratio

As of December 31, 2009:

Total capital (to risk-weighted assets)

Wells Fargo & Company $134.4 13.26% >$81.1 >8.00%

Wells Fargo Bank, N.A. 58.4 11.87 > 39.4 > 8.00 >$49.2 >10.00%

Wachovia Bank, N.A. 60.5 13.65 > 35.4 > 8.00 > 44.3 > 10.00

Tier 1 capital (to risk-weighted assets)

Wells Fargo & Company 93.8 9.25 > 40.5 >4.00

Wells Fargo Bank, N.A. 43.8 8.90 > 19.7 >4.00 > 29.5 > 6.00

Wachovia Bank, N.A. 39.7 8.97 > 17.7 > 4.00 > 26.6 > 6.00

Tier 1 capital (to average assets)

(Leverage ratio)

Wells Fargo & Company 93.8 7.87 > 47.7 >4.00(1)

Wells Fargo Bank, N.A. 43.8 7.50 > 23.3 > 4.00(1) > 29.2 > 5.00

Wachovia Bank, N.A. 39.7 8.23 > 19.3 >4.00(1) > 24.1 > 5.00

(1) The leverage ratio consists of Tier 1 capital divided by quarterly average total assets, excluding goodwill and certain other items. The minimum leverage ratio guideline

is 3% for banking organizations that do not anticipate significant growth and that have well-diversified risk, excellent asset quality, high liquidity, good earnings,

effective management and monitoring of market risk and, in general, are considered top-rated, strong banking organizations.

Management believes that, as of December 31, 2009, the

Company and each of the covered subsidiary banks met all

capital adequacy requirements to which they are subject.

The most recent notification from the OCC categorized

each of the covered subsidiary banks as well capitalized, under

the FDICIA prompt corrective action provisions applicable

to banks. To be categorized as well capitalized, the institution

must maintain a total RBC ratio as set forth in the table above

and not be subject to a capital directive order. There are no

conditions or events since that notification that management

believes have changed the RBC category of any of the covered

subsidiary banks.

Certain subsidiaries of the Company are approved seller/

servicers, and are therefore required to maintain minimum

levels of shareholders’ equity, as specified by various agencies,

including the United States Department of Housing and Urban

Development, GNMA, FHLMC and FNMA. At December 31,

2009, each seller/servicer met these requirements.

Certain broker-dealer subsidiaries of the Company are

subject to SEC Rule 15c3-1 (the Net Capital Rule), which

requires that we maintain minimum levels of net capital,

as defined. At December 31, 2009, each of these subsidiaries

met these requirements.