Wells Fargo 2009 Annual Report Download - page 133

Download and view the complete annual report

Please find page 133 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

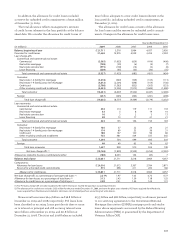

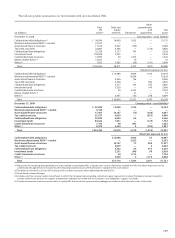

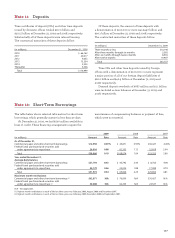

The table below summarizes the weighted-average

credit rating equivalents of the conduit’s assets.

These ratings are based on internal rating criteria.

December 31, 2009 December 31, 2008(1)

Funded Total Funded Total

asset committed asset committed

composition exposure composition exposure

Commercial and middle market loans 42.3% 35.6 27.6 32.6

Auto loans 26.8 29.2 27.6 22.0

Equipment loans 18.5 16.8 14.4 11.4

Leases 4.2 3.2 12.6 11.7

Trade receivables 3.3 10.3 8.8 10.9

Credit cards 1.7 2.7 7.0 7.9

Other 3.2 2.2 2.0 3.5

Total 100.0% 100.0 100.0 100.0

(1) Certain December 31, 2008, percentages have been revised to conform with the December 31, 2009, classification of certain assets.

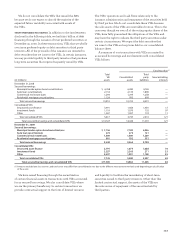

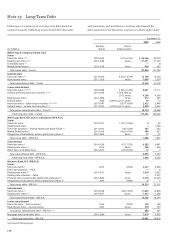

December 31, 2009 December 31, 2008

Funded Total Funded Total

asset committed asset committed

composition exposure composition exposure

AAA —% — 9.4 10.4

AA 12.8 18.7 8.3 11.7

A29.4 36.5 52.2 51.5

BBB/BB 57.8 44.8 30.1 26.4

Total 100.0% 100.0 100.0 100.0

The composition of the conduit’s assets follows:

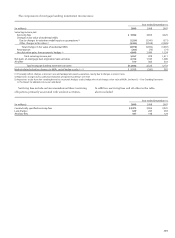

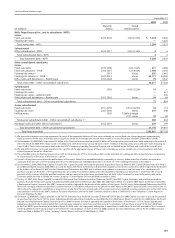

The timely repayment of the commercial paper is further

supported by asset-specific liquidity facilities in the form of

liquidity asset purchase agreements that we provide. Each

facility is equal to 102% of the conduit’s funding commitment

to a client. The aggregate amount of liquidity must be equal

to or greater than all the commercial paper issued by the

conduit. At the discretion of the administrator, we may be

required to purchase assets from the conduit at par value plus

accrued interest or discount on the related commercial paper,

including situations where the conduit is unable to issue

commercial paper. Par value may be different from fair value.

We receive fees in connection with our role as administrator

and liquidity provider. We may also receive fees related to the

structuring of the conduit’s transactions.

The weighted average life of the commercial paper was

22.5 days at December 31, 2009, and the average yield on

the commercial paper was 0.24%. The ability of the conduit

to issue commercial paper is a function of general market

conditions and the credit rating of the liquidity provider.

At December 31, 2009, we did not hold any of the commercial

paper issued by the conduit.

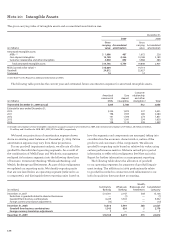

The conduit has issued a subordinated note to a third

party investor. The subordinated note is designed to absorb

the expected variability associated with the credit risk in the

conduit’s assets as well as assets that may be or were funded

by us as a result of a purchase under the provisions of a spe-

cific liquidity asset purchase agreement. Actual credit losses

incurred on the conduit’s assets or assets purchased under

the liquidity facilities are absorbed first by the subordinated

note prior to any allocation to us as the liquidity provider.

We increased the face amount of our subordinated note to

$60 million in March 2009. In fourth quarter 2009, the subor-

dinated note absorbed $16 million of losses. At December 31,

2009, the available balance of the subordinated note was

$44 million. The subordinated note matures in 2017.

At least quarterly, or more often if circumstances dictate,

we assess whether we are the primary beneficiary of the

conduit based on our expectation of the variability associated

with our liquidity facilities and administrative fee arrangement.

Such circumstances may include changes to the terms of the

conduit’s assets, internal credit grades, outstanding amounts

under each facility or the purchase of the conduit’s commercial

paper. We assess variability using a quantitative expected

loss model. The key inputs to the model include internally

generated risk ratings that are mapped to third party rating

agency loss-given-default assumptions. We do not consolidate

the conduit because our expected loss model indicates that

the holder of the subordinated note absorbs the majority

of the variability of the conduit’s assets.

ASSET-BASED FINANCE STRUCTURES We engage in various

forms of structured finance arrangements with VIEs that

are collateralized by various asset classes including energy

contracts, auto and other transportation leases, intellec -

tual property, equipment and general corporate credit. We

typically provide senior financing, and may act as an inter-

est rate swap or commodity derivative counterparty when

necessary. In most cases, we are not the primary beneficiary

of these structures because we do not retain a majority

of the variability in these transactions.