Wells Fargo 2009 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

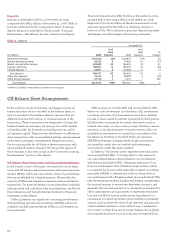

The Federal Reserve Board (FRB) announced regulatory

changes to debit card and ATM overdraft practices in fourth

quarter 2009. In third quarter 2009, we had also announced

policy changes that will help customers limit overdraft and

returned item fees. We currently estimate that the combina-

tion of these changes will reduce our 2010 fee revenue by

approximately $500 million (after tax). The actual impact

could vary due to a variety of factors including changes in

customer behavior. There is no assurance that the actual

impact on our 2010 fee revenue from pending changes to our

overdraft practices will not materially vary from our estimate.

We earn trust, investment and IRA (Individual Retirement

Account) fees from managing and administering assets, including

mutual funds, corporate trust, personal trust, employee benefit

trust and agency assets. At December 31, 2009, these assets

totaled $1.9 trillion, up 19% from $1.6 trillion (including

$510 billion from Wachovia) at December 31, 2008. Trust,

investment and IRA fees are primarily based on a tiered scale

relative to the market value of the assets under management

or administration. The fees increased to $3.6 billion in 2009

from $2.2 billion a year ago.

We receive commissions and other fees for providing services

to full-service and discount brokerage customers. These fees

increased to $6.1 billion in 2009 from $763 million a year ago,

primarily due to Wachovia. These fees include transactional

commissions, which are based on the number of transactions

executed at the customer’s direction, and asset-based fees,

which are based on the market value of the customer’s assets.

Client assets totaled $1.1 trillion at December 31, 2009, up from

$970 billion (including $859 billion from Wachovia) a year ago.

Commissions and other fees also include fees from investment

banking activities including equity and bond underwriting.

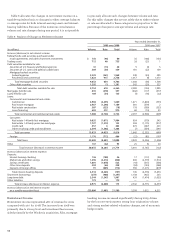

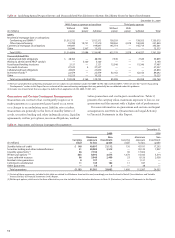

Table 7: Noninterest Income

Year ended December 31,

(in millions) 2009 2008 2007

Service charges on deposit accounts $ 5,741 3,190 3,050

Trust and investment fees:

Trust, investment and IRA fees 3,588 2,161 2,305

Commissions and all other fees 6,147 763 844

Total trust and investment fees 9,735 2,924 3,149

Card fees 3,683 2,336 2,136

Other fees:

Cash network fees 231 188 193

Charges and fees on loans 1,801 1,037 1,011

All other fees 1,772 872 1,088

Total other fees 3,804 2,097 2,292

Mortgage banking:

Servicing income, net 5,557 979 1,511

Net gains on mortgage

loan origination/sales activities 6,152 1,183 1,289

All other 319 363 333

Total mortgage banking 12,028 2,525 3,133

Insurance 2,126 1,830 1,530

Net gains from trading activities 2,674 275 544

Net gains (losses) on debt

securities available for sale (127) 1,037 209

Net gains (losses) from

equity investments 185 (757) 864

Operating leases 685 427 703

All other 1,828 850 936

Total $42,362 16,734 18,546

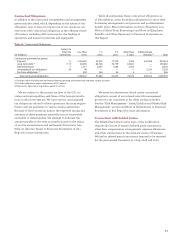

Card fees increased 58% to $3.7 billion in 2009 from

$2.3 billion in 2008, predominantly due to additional card fees

from the Wachovia portfolio. Recent legislative and regulatory

changes limit our ability to increase interest rates and assess

certain fees on card accounts. We currently estimate that

these changes will reduce our 2010 fee revenue by approxi-

mately $235 million (after tax) before accounting for potential

offsets in performance, the economy, revenue mitigation

impacts and other factors. The actual impact could vary due

to a variety of factors, and there is no assurance that the actual

impact on our 2010 fee revenue from these changes will not

materially vary from our estimate.

Mortgage banking noninterest income was $12.0 billion

in 2009, compared with $2.5 billion a year ago. In addition to

servicing fees, net servicing income includes both changes in

the fair value of mortgage servicing rights (MSRs) during the

period as well as changes in the value of derivatives (economic

hedges) used to hedge the MSRs. Net servicing income for

2009 included a $5.3 billion net MSRs valuation gain that was

recorded to earnings ($1.5 billion decrease in the fair value

of the MSRs offset by a $6.8 billion hedge gain) and for 2008

included a $242 million net MSRs valuation loss ($3.3 billion

decrease in the fair value of MSRs offset by a $3.1 billion

hedge gain). See the “Risk Management – Mortgage Banking

Interest Rate and Market Risk” section of this Report for a

detailed discussion of our MSRs risks and hedging approach.

Our portfolio of loans serviced for others was $1.88 trillion at

December 31, 2009, and $1.86 trillion (including $379 billion

acquired from Wachovia) at December 31, 2008. At December 31,

2009, the ratio of MSRs to related loans serviced for others

was 0.91%.

Net gains on mortgage loan origination/sales activities

of $6.2 billion for 2009 were up from $1.2 billion a year ago,

due to strong business performance during the year as the low

interest-rate environment produced higher levels of refinance

activity. Residential real estate originations were $420 billion

in 2009, compared with $230 billion a year ago. The 1-4 family

first mortgage unclosed pipeline was $57 billion at December 31,

2009, and $71 billion at December 31, 2008. For additional detail,

see the “Risk Management – Mortgage Banking Interest Rate

and Market Risk” section and Note 1 (Summary of Significant

Accounting Policies), Note 9 (Mortgage Banking Activities)

and Note 16 (Fair Values of Assets and Liabilities) to Financial

Statements in this Report.

Net gains on mortgage loan origination/sales activities

include the cost of any additions to the mortgage repurchase

reserve as well as adjustments of loans in the warehouse/

pipeline for changes in market conditions that affect their

value. Mortgage loans are repurchased based on standard

representations and warranties and early payment default

clauses in mortgage sale contracts. Additions to the mortgage

repurchase reserve that were charged against net gains on

mortgage loan origination/sales activities during 2009

totaled $927 million ($399 million for 2008), of which

$302 million ($165 million for 2008) was related to our

estimate of loss content associated with loan sales during

the year and $625 million ($234 million for 2008) was for

subsequent increases in estimated losses, primarily due to