Wells Fargo 2009 Annual Report Download - page 111

Download and view the complete annual report

Please find page 111 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

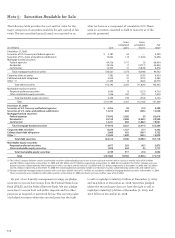

December 31,

2008 December 31,

(in millions) (final) Refinements 2008

Purchase price:

Value of common shares $ 14,621 — 14,621

Value of preferred shares 8,409 — 8,409

Other (value of share-based awards and direct acquisition costs) 62 —62

Total purchase price 23,092 — 23,092

Allocation of the purchase price:

Wachovia tangible stockholders’ equity, less prior purchase accounting

adjustments and other basis adjustments eliminated in purchase accounting 19,387 (7) 19,394

Adjustments to reflect assets acquired and liabilities assumed at fair value:

Loans and leases, net (18,033) (1,636) (16,397)

Premises and equipment, net (972) (516) (456)

Intangible assets 14,675 (65) 14,740

Other assets (2,972) 472 (3,444)

Deposits (4,577) (143) (4,434)

Accrued expenses and other liabilities (exit, termination and other liabilities) (4,466) (2,867) (1,599)

Long-term debt (227) (37) (190)

Deferred taxes 9,365 2,689 6,676

Fair value of net assets acquired 12,180 (2,110) 14,290

Goodwill resulting from the merger $ 10,912 2,110 8,802

On December 31, 2008, we acquired all outstanding shares

of Wachovia common stock in a stock-for-stock transaction.

Wachovia, based in Charlotte, North Carolina, was one of

the nation’s largest diversified financial services companies,

providing a broad range of retail banking and brokerage,

asset and wealth management, and corporate and investment

banking products and services to customers through 3,300

financial centers in 21 states from Connecticut to Florida and

west to Texas and California, and nationwide retail brokerage,

mortgage lending and auto finance businesses. In the merger,

we exchanged 0.1991 shares of our common stock for each

outstanding share of Wachovia common stock, issuing a total

of 422.7 million shares of our common stock with a December 31,

2008, value of $12.5 billion to Wachovia shareholders. Shares

of each outstanding series of Wachovia preferred stock were

converted into shares (or fractional shares) of a corresponding

series of our preferred stock having substantially the same

rights and preferences. Because the acquisition was completed

at the end of 2008, Wachovia’s results of operations for 2008

are not included in our income statement.

The assets and liabilities of Wachovia were recorded at

their respective acquisition date fair values, and identifiable

intangible assets were recorded at fair value. Because the

transaction closed on the last day of the annual reporting

period, certain fair value purchase accounting adjustments

were based on data as of an interim period with estimates

through year end. Accordingly, we have re-validated, and,

where necessary, have finalized our purchase accounting

adjustments. The impact of all finalized purchase accounting

adjustments were recorded to goodwill and increased good-

will by $2.1 billion in 2009. This acquisition was nontaxable

and, as a result, there is no tax basis in goodwill. Accordingly,

none of the goodwill associated with the Wachovia acquisition

is deductible for tax purposes. Additional exit reserves related

to costs associated with involuntary employee termination,

contract termination penalties and closing duplicate facilities

were recorded during 2009 as part of the further integration

of Wachovia’s employees, locations and operations.

The final allocation of purchase price at December 31,

2008, is presented in the following table.

Note 2: Business Combinations