Wells Fargo 2009 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

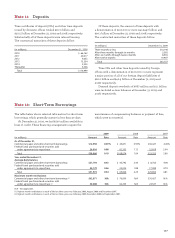

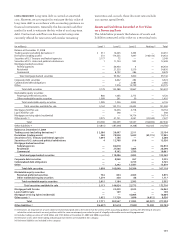

The total notional or contractual amounts and fair values for derivatives were:

December 31, 2009 December 31, 2008

Notional or Fair value Notional or Fair value

contractual Asset Liability contractual Asset Liability

(in millions) amount derivatives derivatives amount derivatives derivatives

Qualifying hedge contracts (1)

Interest rate contracts (2) $ 119,966 6,425 1,302 191,972 11,511 3,287

Foreign exchange contracts 30,212 1,553 811 38,386 1,138 1,198

Total derivatives designated as qualifying

hedging instruments 7,978 2,113 12,649 4,485

Derivatives not designated as hedging instruments

Free-standing derivatives (economic hedges) (1):

Interest rate contracts (3) 633,734 4,441 4,873 750,728 12,635 9,708

Equity contracts 300 — 2 ———

Foreign exchange contracts 7,019 233 29 4,208 150 325

Credit contracts – protection purchased 577 261 — 644 528 —

Other derivatives 4,583 — 40 4,458 108 71

Subtotal 4,935 4,944 13,421 10,104

Customer accommodation, trading

and other free-standing derivatives (4):

Interest rate contracts 2,734,664 54,687 53,905 3,752,656 142,739 141,508

Commodity contracts 92,182 5,400 5,182 86,360 6,117 6,068

Equity contracts 27,123 2,434 2,977 37,136 3,088 2,678

Foreign exchange contracts 172,018 3,084 2,737 273,437 7,562 7,419

Credit contracts – protection sold 76,693 979 9,577 137,113 349 20,880

Credit contracts – protection purchased 81,357 9,349 1,089 140,442 22,100 1,281

Other derivatives 8,717 638 389 1,490 28 150

Subtotal 76,571 75,856 181,983 179,984

Total derivatives not designated as hedging instruments 81,506 80,800 195,404 190,088

Total derivatives before netting 89,484 82,913 208,053 194,573

Netting (5) (65,926) (73,303) (168,690) (182,435)

Total $ 23,558 9,610 39,363 12,138

(1) Represents asset/liability management hedges, which are included in other assets or other liabilities.

(2) Notional amounts presented exclude $20.9 billion of basis swaps that are combined with receive fixed-rate/pay floating-rate swaps and designated as one

hedging instrument.

(3) Includes free-standing derivatives (economic hedges) used to hedge the risk of changes in the fair value of residential MSRs, MHFS, interest rate lock commitments

and other interests held.

(4) Customer accommodation, trading and other free-standing derivatives are included in trading assets or other liabilities.

(5) Represents netting of derivative asset and liability balances, and related cash collateral, with the same counterparty subject to master netting arrangements under

the accounting guidance covering the offsetting of amounts related to certain contracts. The amount of cash collateral netted against derivative assets and liabilities

was $5.3 billion and $14.1 billion, respectively, at December 31, 2009, and $17.7 billion and $22.2 billion, respectively, at December 31, 2008.

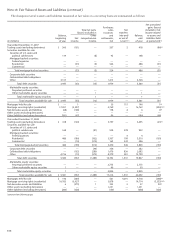

Fair Value Hedges

We use interest rate swaps to convert certain of our fixed-rate

long-term debt and CDs to floating rates to hedge our expo-

sure to interest rate risk. We also enter into cross-currency

swaps, cross-currency interest rate swaps and forward

contracts to hedge our exposure to foreign currency risk

and interest rate risk associated with the issuance of non-U.S.

dollar denominated long-term debt and repurchase agree-

ments. Consistent with our asset/liability management

strategy of converting fixed-rate debt to floating rates, we

believe interest expense should reflect only the current con-

tractual interest cash flows on the liabilities and the related

swaps. In addition, we use interest rate swaps and forward

contracts to hedge against changes in fair value of certain

debt securities that are classified as securities available for

sale, due to changes in interest rates, foreign currency rates,

or both. For fair value hedges of long-term debt, CDs, repur-

chase agreements and debt securities, all parts of each

derivative’s gain or loss due to the hedged risk are included

in the assessment of hedge effectiveness, except for foreign-

currency denominated securities available for sale, short-term

borrowings and long-term debt hedged with forward deriva-

tives for which the time value component of the derivative gain

or loss is excluded from the assessment of hedge effectiveness.

For fair value hedging relationships, we use statistical

regression analysis to assess hedge effectiveness, both at

inception of the hedging relationship and on an ongoing

basis. The regression analysis involves regressing the

periodic change in fair value of the hedging instrument

against the periodic changes in fair value of the asset or

liability being hedged due to changes in the hedged risk(s).

The assessment includes an evaluation of the quantitative

measures of the regression results used to validate the

conclusion of high effectiveness.