Wells Fargo 2009 Annual Report Download - page 153

Download and view the complete annual report

Please find page 153 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

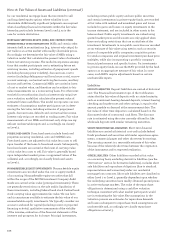

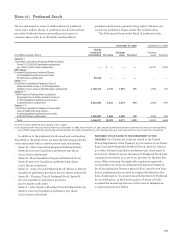

Note 16: Fair Values of Assets and Liabilities

We use fair value measurements to record fair value

adjustments to certain assets and liabilities and to determine

fair value disclosures. Trading assets, securities available for

sale, derivatives, prime residential mortgages held for sale

(MHFS), certain commercial loans held for sale (LHFS),

residential MSRs, principal investments and securities sold

but not yet purchased (short sale liabilities) are recorded at

fair value on a recurring basis. Additionally, from time to

time, we may be required to record at fair value other assets

on a nonrecurring basis, such as nonprime residential and

commercial MHFS, certain LHFS, loans held for investment

and certain other assets. These nonrecurring fair value

adjustments typically involve application of lower-of-cost-

or-market accounting or write-downs of individual assets.

We adopted new guidance on fair value measurements

effective January 1, 2009, which addresses measuring fair

value in situations where markets are inactive and transactions

are not orderly. In accordance with fair value accounting

provisions, transaction or quoted prices for assets or liabilities

in inactive markets may require adjustment due to the uncer-

tainty of whether the underlying transactions are orderly.

Prior to our adoption of the new provisions for measuring fair

value, we primarily used unadjusted independent vendor or

broker quoted prices to measure fair value for substantially all

securities available for sale. In connection with the change in

guidance for fair value measurement, we developed policies

and procedures to determine when the level and volume of

activity for our assets and liabilities requiring fair value

measurements has significantly declined relative to normal

conditions. For such items that use price quotes, such as

certain security classes within securities available for sale,

the degree of market inactivity and distressed transactions

was analyzed to determine the appropriate adjustment to the

price quotes. The security classes where we considered the

market to be less orderly included non-agency residential

MBS, commercial MBS, CDOs, home equity asset-backed

securities, auto asset-backed securities and credit card-

backed securities. The methodology used to adjust the quotes

involved weighting the price quotes and results of internal

pricing techniques such as the net present value of future

expected cash flows (with observable inputs, where available)

discounted at a rate of return market participants require.

The significant inputs utilized in the internal pricing tech-

niques, which were estimated by type of underlying collateral,

included credit loss assumptions, estimated prepayment

speeds and appropriate discount rates. The more active and

orderly markets for particular security classes were determined

to be, the more weighting assigned to price quotes. The less

active and orderly markets were determined to be, the less

weighting assigned to price quotes. For the impact of the new

fair value measurement provisions, see Note 1 in this Report.

Under fair value option accounting guidance, we elected

to measure MHFS at fair value prospectively for new prime

residential MHFS originations, for which an active secondary

market and readily available market prices existed to reliably

support fair value pricing models used for these loans. We

also elected to remeasure at fair value certain of our other

interests held related to residential loan sales and securitiza-

tions. We believe the election for MHFS and other interests

held (which are now hedged with free-standing derivatives

(economic hedges) along with our MSRs) reduces certain

timing differences and better matches changes in the value

of these assets with changes in the value of derivatives used

as economic hedges for these assets.

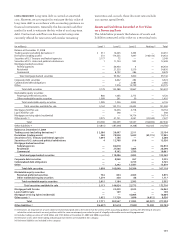

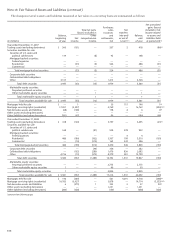

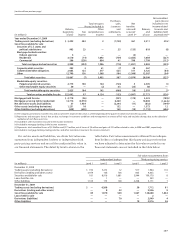

Fair Value Hierarchy

In accordance with the Fair Value Measurements and

Disclosures topic of the Codification, we group our assets

and liabilities measured at fair value in three levels, based

on the markets in which the assets and liabilities are traded

and the reliability of the assumptions used to determine

fair value. These levels are:

• Level 1 – Valuation is based upon quoted prices for

identical instruments traded in active markets.

• Level 2 – Valuation is based upon quoted prices for similar

instruments in active markets, quoted prices for identical

or similar instruments in markets that are not active, and

model-based valuation techniques for which all significant

assumptions are observable in the market.

• Level 3 – Valuation is generated from model-based tech-

niques that use significant assumptions not observable

in the market. These unobservable assumptions reflect

estimates of assumptions that market participants would

use in pricing the asset or liability. Valuation techniques

include use of option pricing models, discounted cash

flow models and similar techniques.

In the determination of the classification of financial

instruments in Level 2 or Level 3 of the fair value hierarchy,

we consider all available information, including observable

market data, indications of market liquidity and orderliness,

and our understanding of the valuation techniques and

significant inputs used. For securities in inactive markets, we

use a predetermined percentage to evaluate the impact of fair

value adjustments derived from weighting both external and

internal indications of value to determine if the instrument is

classified as Level 2 or Level 3. Based upon the specific facts

and circumstances of each instrument or instrument category,

judgments are made regarding the significance of the Level 3

inputs to the instruments’ fair value measurement in its

entirety. If Level 3 inputs are considered significant, the

instrument is classified as Level 3.