Wells Fargo 2009 Annual Report Download - page 104

Download and view the complete annual report

Please find page 104 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

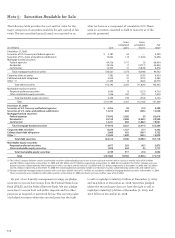

Note 1: Summary of Significant Accounting Policies (continued)

The securities portfolio is an integral part of our asset/

liability management process. We manage these investments

to provide liquidity, manage interest rate risk and maximize

portfolio yield within capital risk limits approved by man-

agement and the Board of Directors and monitored by the

Corporate Asset/Liability Management Committee (Corporate

ALCO). We recognize realized gains and losses on the sale

of these securities in noninterest income using the specific

identification method.

Unamortized premiums and discounts are recognized in

interest income over the contractual life of the security using

the interest method. As principal repayments are received on

securities (i.e., primarily mortgage-backed securities (MBS))

a pro-rata portion of the unamortized premium or discount

is recognized in interest income.

NONMARKETABLE EQUITY SECURITIES Nonmarketable equity

securities include venture capital equity securities that

are not publicly traded and securities acquired for various

purposes, such as to meet regulatory requirements (for

example, Federal Reserve Bank and Federal Home Loan Bank

stock). These securities are accounted for under the cost or

equity method or are carried at fair value and are included in

other assets. We review those assets accounted for under the

cost or equity method at least quarterly for possible OTTI.

Our review typically includes an analysis of the facts and

circumstances of each investment, the expectations for the

investment’s cash flows and capital needs, the viability of its

business model and our exit strategy. We reduce the asset

value when we consider declines in value to be other than

temporary. We recognize the estimated loss as a loss from

equity investments in noninterest income.

Nonmarketable equity securities held by investment

company subsidiaries that fall within the scope of the American

Institute of Certified Public Accountants (AICPA) Investment

Company Audit Guide are carried at fair value (principal

investments). An investment company is a separate legal entity

that pools shareholders’ funds and has a business purpose of

investing in multiple substantive investments for current

income, capital appreciation, or both, with investment plans

that include exit strategies. Principal investments, including

certain public equity and non-public securities and certain

investments in private equity funds, are recorded at fair value

with realized and unrealized gains and losses included in gains

and losses on equity investments in the income statement,

and are included in other assets in the balance sheet. Public

equity investments are valued using quoted market prices and

discounts are only applied when there are trading restrictions

that are an attribute of the investment.

Private direct investments are valued using metrics such

as security prices of comparable public companies, acquisi-

tion prices for similar companies and original investment

purchase price multiples, while also incorporating a portfolio

company’s financial performance and specific factors. For cer-

tain fund investments, where the best estimates of fair value

were primarily determined based upon fund sponsor data,

we use the NAV provided by the fund sponsor as a practical

expedient to measure fair value. In some cases, such NAVs

require adjustments based on certain unobservable inputs.

In situations where a portion of an investment in a non-public

security or fund is sold, we recognize a realized gain or loss

on the portion sold and an unrealized gain or loss on the

portion retained.

Securities Purchased and Sold Agreements

Securities purchased under resale agreements and securities

sold under repurchase agreements are generally accounted

for as collateralized financing transactions and are recorded

at the acquisition or sale price plus accrued interest. It is

our policy to take possession of securities purchased under

resale agreements, which are primarily U.S. Government and

Government agency securities. We monitor the market value

of securities purchased and sold, and obtain collateral from or

return it to counterparties when appropriate.

Mortgages Held for Sale

Mortgages held for sale (MHFS) include commercial and

residential mortgages originated for sale and securitization

in the secondary market, which is our principal market, or

for sale as whole loans. We elected the fair value option for

our new prime residential MHFS portfolio (see Note 16 in

this Report). Nonprime residential and commercial MHFS

continue to be held at the lower of cost or market value, and

are valued on an aggregate portfolio basis.

Gains and losses on nonprime loan sales (sales proceeds

minus carrying value) are recorded in noninterest income.

Direct loan origination costs and fees are deferred at origina-

tion of the loans and are recognized in mortgage banking

noninterest income upon sale of the loan.

Our lines of business are authorized to originate held-

for-investment loans that meet or exceed established loan

product profitability criteria, including minimum positive net

interest margin spreads in excess of funding costs. When a

determination is made at the time of commitment to originate

loans as held for investment, it is our intent to hold these

loans to maturity or for the “foreseeable future,” subject to

periodic review under our corporate asset/liability manage-

ment process. In determining the “foreseeable future” for

these loans, management considers (1) the current economic

environment and market conditions, (2) our business strategy

and current business plans, (3) the nature and type of the loan

receivable, including its expected life, and (4) our current

financial condition and liquidity demands. Consistent with

our core banking business of managing the spread between

the yield on our assets and the cost of our funds, loans are

periodically reevaluated to determine if our minimum net

interest margin spreads continue to meet our profitability

objectives. If subsequent changes in interest rates significantly

impact the ongoing profitability of certain loan products, we

may subsequently change our intent to hold these loans and

we would take actions to sell such loans in response to the

Corporate ALCO directives to reposition our balance sheet

because of the changes in interest rates. Such Corporate

ALCO directives identify both the type of loans (for example

3/1, 5/1, 10/1 and relationship adjustable-rate mortgages

(ARMs), as well as specific fixed-rate loans) to be sold and