Wells Fargo 2009 Annual Report Download - page 118

Download and view the complete annual report

Please find page 118 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

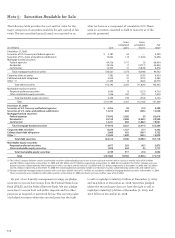

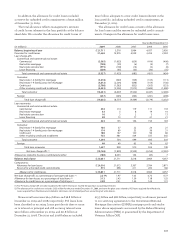

Year ended December 31,

(in millions) 2009 2008 2007

Gross realized gains $ 1,601 1,920 479

Gross realized losses (1,254) (1,891) (129)

Net realized gains $ 347 29 350

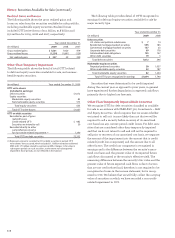

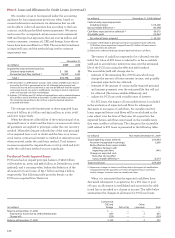

(in millions) Year ended December 31, 2009

OTTI write-downs

(included in earnings)

Debt securities $1,012

Equity securities:

Marketable equity securities 82

Nonmarketable equity securities 573

Total equity securities 655

Total OTTI write-downs $1,667

OTTI on debt securities

Recorded as part of gross

realized losses:

Credit-related OTTI $ 982

Securities we intend to sell 30

Recorded directly to other

comprehensive income

for non-credit-related impairment (1) 1,340

Total OTTI on debt securities $2,352

(1) Represents amounts recorded to OCI on debt securities in periods OTTI

write-downs have occurred, which included $1.1 billion related to residential

MBS and $179 million related to commercial MBS. Changes in fair value in

subsequent periods on such securities, to the extent not subsequently

impaired in those periods, are not reflected in this balance.

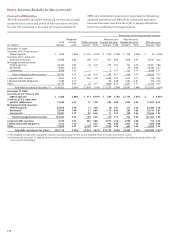

Year ended December 31,

(in millions) 2009 2008

Debt securities

U.S. states and political subdivisions $7 14

Residential mortgage-backed securities 595 183

Commercial mortgage-backed securities 137 23

Corporate debt securities 69 176

Collateralized debt obligations 125 147

Other debt securities 79 3

Total debt securities 1,012 546

Marketable equity securities

Perpetual preferred securities 50 1,057

Other marketable equity securities 32 187

Total marketable equity securities 82 1,244

Total OTTI losses recognized in earnings $1,094 1,790

Realized Gains and Losses

The following table shows the gross realized gains and

losses on sales from the securities available-for-sale portfolio,

including marketable equity securities. Realized losses

included OTTI write-downs of $1.1 billion, $1.8 billion and

$50 million for 2009, 2008 and 2007, respectively.

Other-Than-Temporary Impairment

The following table shows the detail of total OTTI related

to debt and equity securities available for sale, and nonmar-

ketable equity securities.

The following table provides detail of OTTI recognized in

earnings for debt and equity securities available for sale by

major security type.

Securities that were determined to be credit impaired

during the current year as opposed to prior years, in general

have experienced further degradation in expected cash flows

primarily due to higher loss forecasts.

Other-Than-Temporarily Impaired Debt Securities

We recognize OTTI for debt securities classified as available

for sale in accordance with FASB ASC 320, Investments – Debt

and Equity Securities, which requires that we assess whether

we intend to sell or it is more likely than not that we will be

required to sell a security before recovery of its amortized

cost basis less any current-period credit losses. For debt secu-

rities that are considered other-than-temporarily impaired

and that we do not intend to sell and will not be required to

sell prior to recovery of our amortized cost basis, we separate

the amount of the impairment into the amount that is credit

related (credit loss component) and the amount due to all

other factors. The credit loss component is recognized in

earnings and is the difference between the security’s amor-

tized cost basis and the present value of its expected future

cash flows discounted at the security’s effective yield. The

remaining difference between the security’s fair value and the

present value of future expected cash flows is due to factors

that are not credit related and, therefore, is not required to be

recognized as losses in the income statement, but is recog-

nized in OCI. We believe that we will fully collect the carrying

value of securities on which we have recorded a non-credit-

related impairment in OCI.

Note 5: Securities Available for Sale (continued)