Wells Fargo 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Wells Fargo annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

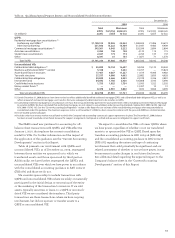

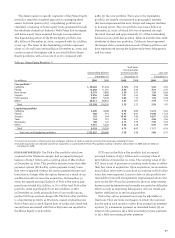

Deposits

Deposits totaled $824.0 billion at December 31, 2009,

compared with $781.4 billion at December 31, 2008. Table 14

provides additional detail. Comparative detail of average

deposit balances is provided in Table 5 under “Earnings

Performance – Net Interest Income” earlier in this Report.

Total core deposits were $780.7 billion at December 31, 2009,

up $35.3 billion from $745.4 billion at December 31, 2008.

High-rate CDs of $109 billion at Wachovia matured in 2009

and were replaced by $62 billion in checking, savings or

lower-cost CDs. We continued to gain new deposit customers

and deepen our relationships with existing customers.

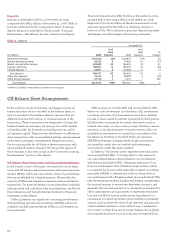

Off-Balance Sheet Arrangements

In the ordinary course of business, we engage in financial

transactions that are not recorded in the balance sheet, or

may be recorded in the balance sheet in amounts that are

different from the full contract or notional amount of the

transaction. These transactions are designed to (1) meet the

financial needs of customers, (2) manage our credit, market

or liquidity risks, (3) diversify our funding sources, and/or

(4) optimize capital. These are described below as off-balance

sheet transactions with unconsolidated entities, and guarantees

and certain contingent arrangements. Beginning in 2010,

the accounting rules for off-balance sheet transactions with

unconsolidated entities changed. We discuss the impact of

those changes in this section and in the “Current Accounting

Developments” section in this Report.

Off-Balance Sheet Transactions with Unconsolidated Entities

In the normal course of business, we enter into various types

of on- and off-balance sheet transactions with special purpose

entities (SPEs), which are corporations, trusts or partnerships

that are established for a limited purpose. Historically, the

majority of SPEs were formed in connection with securitization

transactions. For more information on securitizations, including

sales proceeds and cash flows from securitizations, see Note 8

(Securitizations and Variable Interest Entities) to Financial

Statements in this Report.

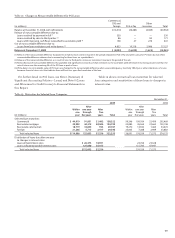

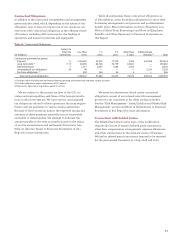

Table 15 presents our significant continuing involvement

with qualifying special purpose entities (QSPEs) and uncon-

solidated variable interest entities (VIEs) as of December 31,

2009 and 2008.

Table 15 does not include SPEs and unconsolidated VIEs

where our only involvement is in the form of (1) investments

in trading securities, (2) investments in securities available

for sale or loans issued by entities sponsored by third parties,

(3) derivative counterparty for certain derivatives such as

interest rate swaps or cross currency swaps that have custom-

ary terms or (4) administrative or trustee services. Also not

included are investments accounted for in accordance with

the American Institute of Certified Public Accountants

(AICPA) Investment Company Audit Guide, investments

accounted for under the cost method and investments

accounted for under the equity method.

In Table 15, “Total entity assets” represents the total assets

of unconsolidated SPEs. “Carrying value” is the amount in

our consolidated balance sheet related to our involvement

with the unconsolidated SPEs. “Maximum exposure to loss”

from our involvement with off-balance sheet entities, which

is a required disclosure under generally accepted accounting

principles (GAAP), is determined as the carrying value of

our involvement with off-balance sheet (unconsolidated) VIEs

plus the remaining undrawn liquidity and lending commitments,

the notional amount of net written derivative contracts, and

generally the notional amount of, or stressed loss estimate for,

other commitments and guarantees. It represents estimated

loss that would be incurred under severe, hypothetical cir-

cumstances, for which we believe the possibility is extremely

remote, such as where the value of our interests and any asso-

ciated collateral declines to zero, without any consideration

of recovery or offset from any economic hedges. Accordingly,

this required disclosure is not an indication of expected loss.

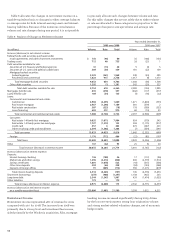

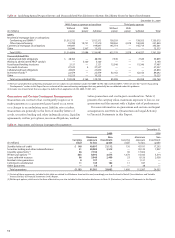

Table 14: Deposits

December 31,

% of % of

total total %

(in millions) 2009 deposits 2008 deposits Change

Noninterest-bearing $181,356 22% $150,837 19% 20

Interest-bearing checking 63,225 8 72,828 10 (13)

Market rate and other savings 402,448 49 306,255 39 31

Savings certificates 100,857 12 182,043 23 (45)

Foreign deposits (1) 32,851 4 33,469 4 (2)

Core deposits 780,737 95 745,432 95 5

Other time deposits 16,142 2 28,498 4 (43)

Other foreign deposits 27,139 3 7,472 1 263

Total deposits $824,018 100% $781,402 100% 5

(1) Reflects Eurodollar sweep balances included in core deposits.